DR 1059 Colorado Form

What is the DR 1059 Colorado

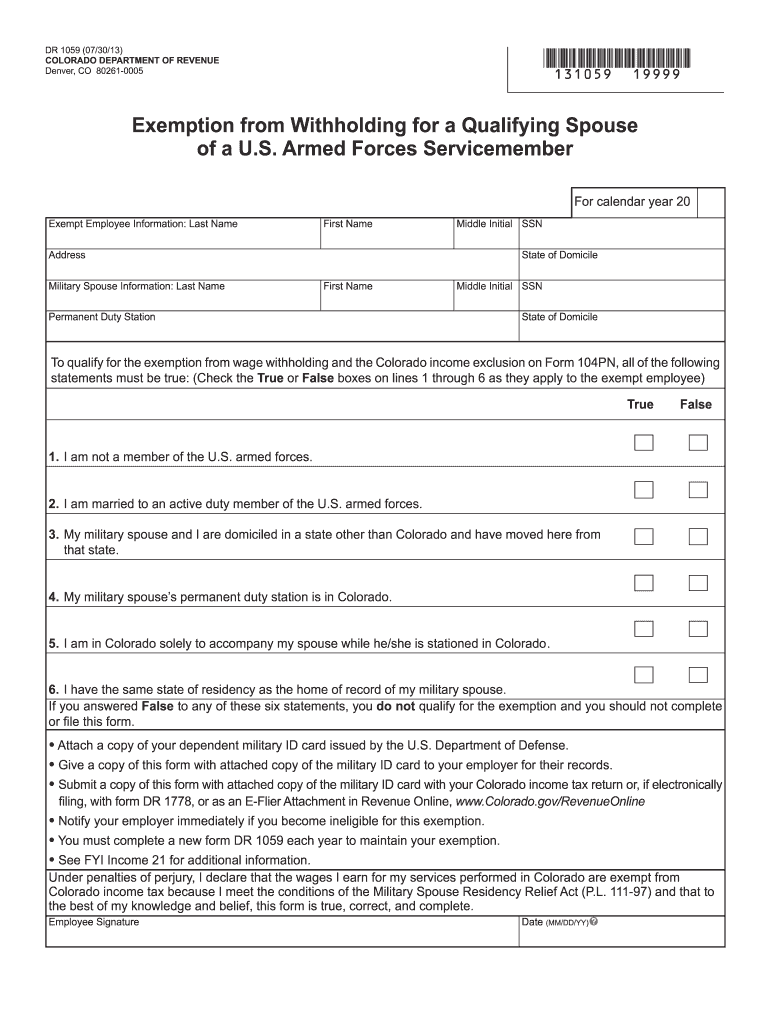

The DR 1059 Colorado form is a document used primarily for tax purposes within the state of Colorado. It serves as a request for a specific tax exemption or adjustment, enabling individuals or businesses to claim certain benefits under Colorado tax law. Understanding the purpose and implications of this form is crucial for ensuring compliance with state regulations and maximizing potential tax savings.

How to use the DR 1059 Colorado

Using the DR 1059 Colorado form involves several steps to ensure accurate completion and submission. First, gather all necessary information, including personal identification details and relevant tax data. Next, fill out the form carefully, ensuring that all fields are completed correctly. After completing the form, review it for any errors or omissions before submission. It is advisable to keep a copy of the submitted form for your records.

Steps to complete the DR 1059 Colorado

Completing the DR 1059 Colorado form requires attention to detail. Follow these steps:

- Obtain the latest version of the DR 1059 form from the Colorado Department of Revenue website.

- Fill in your name, address, and taxpayer identification number accurately.

- Provide details regarding the specific tax exemption or adjustment you are requesting.

- Sign and date the form to validate your request.

- Submit the form as instructed, either electronically or via mail.

Legal use of the DR 1059 Colorado

The DR 1059 Colorado form is legally binding when completed and submitted according to state laws. To ensure its legal standing, it must be filled out accurately and submitted within the designated time frames. Compliance with Colorado tax regulations is essential to avoid potential penalties or issues with tax authorities.

Key elements of the DR 1059 Colorado

Key elements of the DR 1059 Colorado form include:

- Taxpayer Information: Essential details about the individual or business submitting the form.

- Request Details: Specific information regarding the exemption or adjustment being requested.

- Signature: A signature is required to authenticate the submission.

- Date: The date of submission is crucial for tracking and compliance purposes.

Form Submission Methods

The DR 1059 Colorado form can be submitted through various methods. Taxpayers may choose to file the form electronically via the Colorado Department of Revenue's online portal, which is a convenient option for many. Alternatively, the form can be printed and mailed to the appropriate tax office. In-person submissions may also be possible at designated locations, depending on local regulations.

Quick guide on how to complete dr 1059 colorado

Effortlessly Prepare DR 1059 Colorado on Any Device

Digital document management has become increasingly favored by businesses and individuals. It serves as an excellent environmentally friendly substitute for traditional printed and signed papers, allowing you to find the appropriate template and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without hold-ups. Manage DR 1059 Colorado on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

How to Modify and Electronically Sign DR 1059 Colorado with Ease

- Locate DR 1059 Colorado and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive data with features that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form navigation, or errors that require printing new document versions. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Adjust and electronically sign DR 1059 Colorado to guarantee excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dr 1059 colorado

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is DR 1059 in the context of airSlate SignNow?

DR 1059 refers to a specific document management feature within airSlate SignNow that enhances the electronic signing process. This feature simplifies how users manage and track their documents, making it a vital tool for businesses looking to streamline their workflows.

-

How does airSlate SignNow pricing work for DR 1059 users?

airSlate SignNow offers flexible pricing plans tailored for businesses of all sizes. Users of DR 1059 can choose from monthly or annual subscriptions, ensuring they only pay for the features they need while benefiting from cost-effective solutions.

-

What are the key features of DR 1059?

DR 1059 includes a comprehensive set of features such as customizable templates, real-time tracking, and automated reminders. These tools allow users to manage their documents efficiently and enhance collaboration within their teams.

-

What benefits does DR 1059 provide to businesses?

With DR 1059, businesses can achieve greater productivity by reducing the time spent on document workflows. The feature also minimizes errors, ensuring a seamless experience that ultimately leads to higher customer satisfaction.

-

Can DR 1059 be integrated with other applications?

Yes, DR 1059 seamlessly integrates with various applications, including CRM and project management tools. This integration enhances workflow efficiency and allows users to leverage their existing systems while using airSlate SignNow.

-

Is there a mobile app for using DR 1059?

Absolutely! DR 1059 is accessible through the airSlate SignNow mobile app, allowing users to manage their document signing on the go. Whether in the office or away, users can execute documents easily and efficiently.

-

How secure is the document handling in DR 1059?

Security is a top priority for airSlate SignNow, and DR 1059 is no exception. It features robust encryption and compliance with industry standards, ensuring your documents are safe from unauthorized access.

Get more for DR 1059 Colorado

- Aw2 16 prescribed by secretary of state sections 141063 142007 texas election code 209 2011 form

- Fpca carrier envelope form

- Worksheet annual form

- Ecs agreement form

- Mwra closure form

- Ma reinstatement form

- Judicial branch employment application new hampshire judicial courts state nh form

- Certificate of divorce civil union cu dissolution legal separation or annulment courts state nh form

Find out other DR 1059 Colorado

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors