FEDERAL DIRECT PLUS LOAN REQUEST FORM School of the Saic

What is the Federal Direct PLUS Loan Request Form School of the SAIC

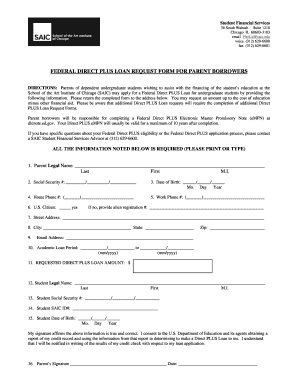

The Federal Direct PLUS Loan Request Form School of the SAIC is a crucial document for parents or graduate students seeking federal financial aid to cover educational expenses at the School of the Art Institute of Chicago (SAIC). This form allows eligible borrowers to apply for a Direct PLUS Loan, which helps pay for tuition, room and board, and other associated costs. The loan is federally funded, meaning it comes with specific terms and conditions set by the U.S. Department of Education.

Steps to Complete the Federal Direct PLUS Loan Request Form School of the SAIC

Completing the Federal Direct PLUS Loan Request Form involves several key steps to ensure accuracy and compliance. First, gather necessary personal and financial information, including Social Security numbers and income details. Next, access the form through the SAIC financial aid office or the official federal student aid website. Fill out the required sections, ensuring all information is correct. Review the completed form for any errors before submitting it. Finally, submit the form electronically or via mail as directed by the institution.

Legal Use of the Federal Direct PLUS Loan Request Form School of the SAIC

The Federal Direct PLUS Loan Request Form is legally binding when completed correctly and submitted to the appropriate educational institution. To ensure its legal standing, the form must comply with federal regulations governing student loans. This includes obtaining necessary signatures and adhering to deadlines. Electronic submissions are valid as long as they meet the requirements outlined by the ESIGN Act and other relevant legislation.

Key Elements of the Federal Direct PLUS Loan Request Form School of the SAIC

Key elements of the Federal Direct PLUS Loan Request Form include borrower information, loan amount requested, and certification of eligibility. The form also requires details about the student for whom the loan is being taken, including their enrollment status and school information. Additionally, borrowers must provide consent for a credit check, which is essential for the approval process. Understanding these elements can streamline the application process and increase the likelihood of receiving the loan.

How to Obtain the Federal Direct PLUS Loan Request Form School of the SAIC

To obtain the Federal Direct PLUS Loan Request Form, students and parents can visit the financial aid section of the School of the Art Institute of Chicago's website. The form is typically available for download in PDF format or can be filled out online through the federal student aid portal. It is advisable to check for any specific instructions or updates from the SAIC financial aid office to ensure compliance with current procedures.

Eligibility Criteria for the Federal Direct PLUS Loan Request Form School of the SAIC

Eligibility for the Federal Direct PLUS Loan requires that the borrower be a parent of a dependent undergraduate student or a graduate student enrolled at the School of the Art Institute of Chicago. Additionally, the borrower must meet certain credit criteria, which may include a credit check. It is important to note that applicants must also be U.S. citizens or eligible non-citizens and must complete the Free Application for Federal Student Aid (FAFSA) to qualify for federal financial aid.

Quick guide on how to complete federal direct plus loan request form school of the saic

Complete FEDERAL DIRECT PLUS LOAN REQUEST FORM School Of The Saic effortlessly on any gadget

Web-based document management has gained popularity among businesses and individuals. It offers an excellent environmentally friendly substitute to traditional printed and signed paperwork, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the features required to create, modify, and eSign your documents promptly without delays. Handle FEDERAL DIRECT PLUS LOAN REQUEST FORM School Of The Saic on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The easiest method to alter and eSign FEDERAL DIRECT PLUS LOAN REQUEST FORM School Of The Saic with minimal effort

- Obtain FEDERAL DIRECT PLUS LOAN REQUEST FORM School Of The Saic and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure confidential information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to store your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the stress of lost or misplaced files, tedious form searches, or errors that require printing new copies. airSlate SignNow manages all your document-related needs in just a few clicks from any device you choose. Modify and eSign FEDERAL DIRECT PLUS LOAN REQUEST FORM School Of The Saic and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the federal direct plus loan request form school of the saic

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FEDERAL DIRECT PLUS LOAN REQUEST FORM School Of The Saic?

The FEDERAL DIRECT PLUS LOAN REQUEST FORM School Of The Saic is designed for parents of dependent students to apply for federal loans to help cover educational expenses. This form is essential for those seeking additional financial assistance in conjunction with other types of aid. Completing this form accurately is crucial for securing the necessary funding.

-

How do I complete the FEDERAL DIRECT PLUS LOAN REQUEST FORM School Of The Saic?

To complete the FEDERAL DIRECT PLUS LOAN REQUEST FORM School Of The Saic, you need to gather personal, financial, and student information before proceeding. The form typically requires your Social Security number, income details, and the student’s enrollment information. Once you have all the necessary information, you can fill out the form online or through paper submission.

-

Are there any fees associated with the FEDERAL DIRECT PLUS LOAN REQUEST FORM School Of The Saic?

No fees are directly associated with submitting the FEDERAL DIRECT PLUS LOAN REQUEST FORM School Of The Saic. However, keep in mind that interest will accrue on the loans themselves, which can affect the total amount due. It's important to review the terms outlined by the Department of Education before proceeding.

-

What are the benefits of using the FEDERAL DIRECT PLUS LOAN REQUEST FORM School Of The Saic?

The benefits of the FEDERAL DIRECT PLUS LOAN REQUEST FORM School Of The Saic include access to federal funds specifically designated for educational purposes. This loan type allows for lower interest rates and flexible repayment options compared to private loans. It's an excellent resource for families looking to bridge the gap in funding college expenses.

-

Can I eSign the FEDERAL DIRECT PLUS LOAN REQUEST FORM School Of The Saic?

Yes, you can eSign the FEDERAL DIRECT PLUS LOAN REQUEST FORM School Of The Saic using airSlate SignNow's easy-to-use platform. This feature allows for secure and efficient electronic signatures, making the application process more convenient. Be sure to follow the steps carefully to ensure your signature is valid.

-

What information do I need before filling out the FEDERAL DIRECT PLUS LOAN REQUEST FORM School Of The Saic?

Before filling out the FEDERAL DIRECT PLUS LOAN REQUEST FORM School Of The Saic, prepare your family's financial information, including income tax returns and Social Security numbers. You will also need details about the student’s school and course of study. Having all this information on hand will streamline the application process.

-

How long does it take to process the FEDERAL DIRECT PLUS LOAN REQUEST FORM School Of The Saic?

The processing time for the FEDERAL DIRECT PLUS LOAN REQUEST FORM School Of The Saic can vary, but typically it takes a few weeks to receive confirmation after submitting your application. Ensure all information is accurately completed to avoid delays. It's advisable to apply early to ensure funding is available when needed.

Get more for FEDERAL DIRECT PLUS LOAN REQUEST FORM School Of The Saic

- Get 397767108 form

- A seussified christmas carol full length 1st ed form

- Job application for township of edison edison new jersey edisonnj form

- P3 network vessel sharing agreement www2 fmc form

- Bapplicationb for residential hydro service lakeland power lakelandpower on form

- Special needs reg bakercountyfl form

- Florida form 2 2015 2019

- Motheramp39s birth certificate worksheet mylearningpointe form

Find out other FEDERAL DIRECT PLUS LOAN REQUEST FORM School Of The Saic

- How Do I Electronic signature Idaho Assignment of License

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice