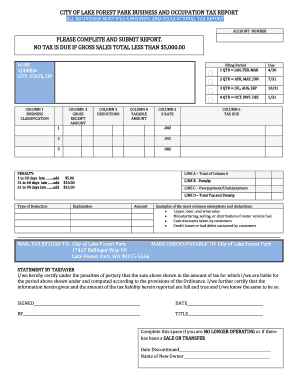

CITY of LAKE FOREST PARK BUSINESS and OCCUPATION TAX REPORT Form

What is the CITY OF LAKE FOREST PARK BUSINESS AND OCCUPATION TAX REPORT

The CITY OF LAKE FOREST PARK BUSINESS AND OCCUPATION TAX REPORT is a crucial document for businesses operating within Lake Forest Park, Washington. This report is designed to assess the business and occupation tax owed by companies based on their gross revenues. It serves as a means for the city to collect revenue that supports local services and infrastructure. Understanding this report is essential for compliance and effective financial management for business owners.

Steps to complete the CITY OF LAKE FOREST PARK BUSINESS AND OCCUPATION TAX REPORT

Completing the CITY OF LAKE FOREST PARK BUSINESS AND OCCUPATION TAX REPORT involves several key steps:

- Gather necessary financial records, including gross revenue figures for the reporting period.

- Access the official report form, either online or in printed format.

- Fill out the form accurately, ensuring all sections are completed based on your business activities.

- Review the completed form for accuracy and completeness.

- Submit the form by the specified deadline, either electronically or by mail.

Legal use of the CITY OF LAKE FOREST PARK BUSINESS AND OCCUPATION TAX REPORT

The CITY OF LAKE FOREST PARK BUSINESS AND OCCUPATION TAX REPORT is legally binding when completed and submitted in accordance with local regulations. It is important to ensure that all information provided is truthful and accurate, as discrepancies can lead to penalties or legal issues. Utilizing a reliable eSignature solution can enhance the legal validity of your submission, ensuring compliance with eSignature laws such as ESIGN and UETA.

Filing Deadlines / Important Dates

Filing deadlines for the CITY OF LAKE FOREST PARK BUSINESS AND OCCUPATION TAX REPORT are crucial for compliance. Typically, businesses must submit their reports annually, with specific due dates set by the city. It is advisable to check the city's official guidelines for the most current deadlines to avoid late fees or penalties.

Form Submission Methods (Online / Mail / In-Person)

The CITY OF LAKE FOREST PARK BUSINESS AND OCCUPATION TAX REPORT can be submitted through various methods to accommodate different preferences:

- Online Submission: Many businesses prefer to file electronically for convenience and speed.

- Mail Submission: Printed forms can be mailed to the designated city office.

- In-Person Submission: Businesses may also choose to deliver their forms directly to city offices during business hours.

Key elements of the CITY OF LAKE FOREST PARK BUSINESS AND OCCUPATION TAX REPORT

Understanding the key elements of the CITY OF LAKE FOREST PARK BUSINESS AND OCCUPATION TAX REPORT is essential for accurate completion. Key components typically include:

- Business Information: Name, address, and contact details of the business.

- Revenue Details: Total gross revenue figures for the reporting period.

- Tax Calculation: Breakdown of how the business and occupation tax is calculated based on revenue.

- Signature Section: Required signatures to validate the report.

Who Issues the Form

The CITY OF LAKE FOREST PARK BUSINESS AND OCCUPATION TAX REPORT is issued by the City of Lake Forest Park's finance department. This department is responsible for overseeing tax compliance and collecting revenue necessary for local governance and services. For any inquiries or assistance regarding the form, businesses may contact the finance department directly.

Quick guide on how to complete city of lake forest park business and occupation tax report

Complete CITY OF LAKE FOREST PARK BUSINESS AND OCCUPATION TAX REPORT seamlessly on any device

Digital document management has become increasingly popular among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage CITY OF LAKE FOREST PARK BUSINESS AND OCCUPATION TAX REPORT on any platform using airSlate SignNow's Android or iOS applications and simplify any document-based task today.

The simplest method to modify and electronically sign CITY OF LAKE FOREST PARK BUSINESS AND OCCUPATION TAX REPORT effortlessly

- Locate CITY OF LAKE FOREST PARK BUSINESS AND OCCUPATION TAX REPORT and click Get Form to start.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your electronic signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and electronically sign CITY OF LAKE FOREST PARK BUSINESS AND OCCUPATION TAX REPORT while ensuring excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the city of lake forest park business and occupation tax report

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CITY OF LAKE FOREST PARK BUSINESS AND OCCUPATION TAX REPORT?

The CITY OF LAKE FOREST PARK BUSINESS AND OCCUPATION TAX REPORT is a document that businesses operating in Lake Forest Park must complete to report their business and occupation taxes accurately. It provides local authorities with essential information about your business activities and revenue, ensuring compliance with local tax regulations.

-

How can airSlate SignNow assist with the CITY OF LAKE FOREST PARK BUSINESS AND OCCUPATION TAX REPORT?

With airSlate SignNow, you can easily create, send, and eSign the CITY OF LAKE FOREST PARK BUSINESS AND OCCUPATION TAX REPORT electronically. This streamlines the process, ensures accuracy, and allows you to maintain a digital record of your submissions, making tax compliance more manageable.

-

Is there a cost associated with using airSlate SignNow for the CITY OF LAKE FOREST PARK BUSINESS AND OCCUPATION TAX REPORT?

Yes, while airSlate SignNow offers a cost-effective solution for document management, there may be subscription fees involved depending on the features you need. However, investing in this service can ultimately save your business time and resources when preparing the CITY OF LAKE FOREST PARK BUSINESS AND OCCUPATION TAX REPORT.

-

What features does airSlate SignNow offer for completing the CITY OF LAKE FOREST PARK BUSINESS AND OCCUPATION TAX REPORT?

AirSlate SignNow provides features like customizable templates, electronic signatures, and secure storage for your CITY OF LAKE FOREST PARK BUSINESS AND OCCUPATION TAX REPORT. Additionally, its user-friendly interface makes it easy to navigate and fill out the necessary forms.

-

Can I integrate airSlate SignNow with other applications for the CITY OF LAKE FOREST PARK BUSINESS AND OCCUPATION TAX REPORT?

Yes, airSlate SignNow integrates seamlessly with various applications and software, allowing you to automate workflows and manage your CITY OF LAKE FOREST PARK BUSINESS AND OCCUPATION TAX REPORT alongside your existing tools. This integration enhances efficiency and ensures that your data is consistent across platforms.

-

What are the benefits of using airSlate SignNow for the CITY OF LAKE FOREST PARK BUSINESS AND OCCUPATION TAX REPORT?

Benefits of using airSlate SignNow include signNowly reduced paperwork, faster processing times, and improved accuracy when submitting the CITY OF LAKE FOREST PARK BUSINESS AND OCCUPATION TAX REPORT. You also gain the flexibility to access and manage your documents from anywhere.

-

How do I get started with airSlate SignNow for my CITY OF LAKE FOREST PARK BUSINESS AND OCCUPATION TAX REPORT?

To get started with airSlate SignNow, simply sign up for an account on their website. From there, you can explore templates for the CITY OF LAKE FOREST PARK BUSINESS AND OCCUPATION TAX REPORT and begin the process of creating and eSigning your documents.

Get more for CITY OF LAKE FOREST PARK BUSINESS AND OCCUPATION TAX REPORT

- Tax court of new jersey county equal complaint form tax court of new jersey county equal complaint form

- Tax court of new jersey county taxboard freeze act form county tax board freeze act form

- Tax court of new jersey dcm complaint form packet dcm complaint kit

- Tax court of new jersey trial information sheet

- Form c uniform interrogatories to be answered by defendant

- State the name and address of the owners of the subject property during the year of appeal and the form

- County tax board handbook njgov form

- Standard interrogatories to be served on taxpayers for form

Find out other CITY OF LAKE FOREST PARK BUSINESS AND OCCUPATION TAX REPORT

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free