Standard Interrogatories to Be Served on Taxpayers for Form

What is the Standard Interrogatories To Be Served On Taxpayers For

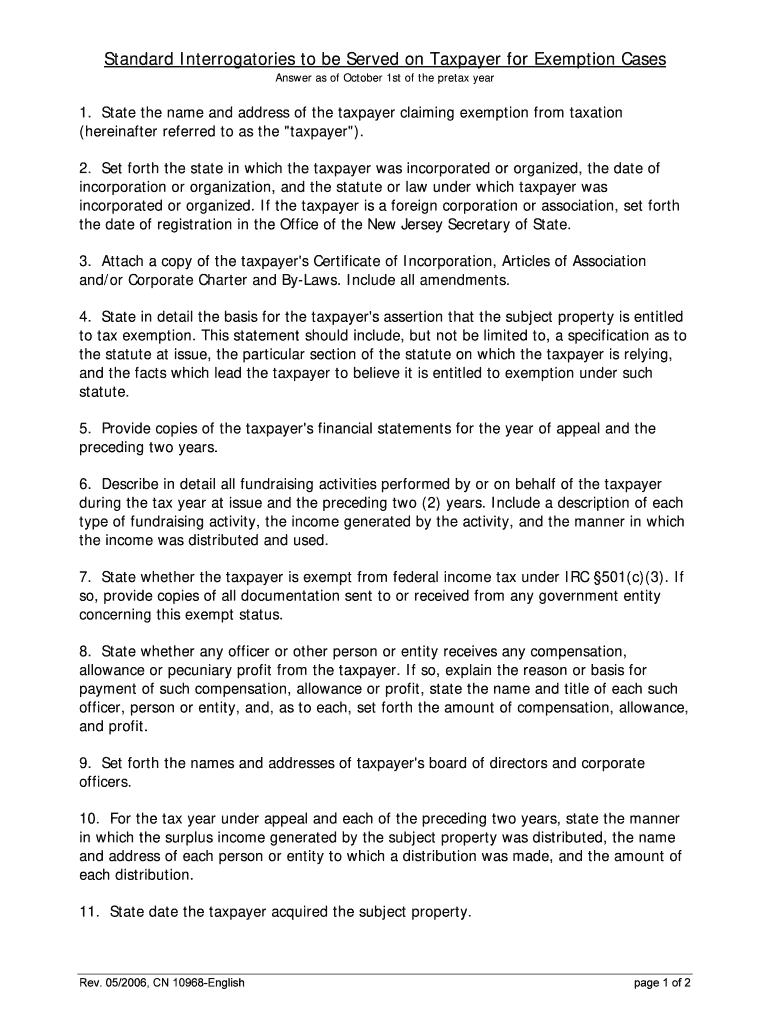

The Standard Interrogatories To Be Served On Taxpayers For is a legal document used primarily in tax-related cases. It serves as a set of questions that taxpayers must respond to, providing essential information to the taxing authority or court. This form is designed to gather relevant data regarding a taxpayer's financial situation, income sources, and other pertinent details. The information obtained through these interrogatories can be crucial for tax assessments, audits, and legal proceedings.

How to use the Standard Interrogatories To Be Served On Taxpayers For

Utilizing the Standard Interrogatories To Be Served On Taxpayers For involves several key steps. First, ensure that you have the correct form, which can typically be obtained from the relevant tax authority or legal resource. Next, carefully read each question to understand what information is required. It is important to provide accurate and complete responses, as any discrepancies may lead to further legal complications. Once completed, the form must be submitted to the appropriate authority, either electronically or by mail, depending on the specific requirements.

Steps to complete the Standard Interrogatories To Be Served On Taxpayers For

Completing the Standard Interrogatories To Be Served On Taxpayers For involves a systematic approach:

- Obtain the latest version of the form from a reliable source.

- Read the instructions carefully to understand the requirements.

- Gather all necessary financial documents and information.

- Answer each question truthfully and thoroughly.

- Review your responses for accuracy and completeness.

- Submit the form according to the specified submission method.

Legal use of the Standard Interrogatories To Be Served On Taxpayers For

The legal use of the Standard Interrogatories To Be Served On Taxpayers For is governed by specific regulations and laws. It is essential to ensure that the form is filled out in compliance with local and federal tax laws. The responses provided can be used as evidence in tax disputes or audits, making accuracy crucial. Failure to comply with the requirements may result in penalties or legal repercussions, emphasizing the importance of understanding the legal context in which the interrogatories are used.

Key elements of the Standard Interrogatories To Be Served On Taxpayers For

Key elements of the Standard Interrogatories To Be Served On Taxpayers For include:

- Identification of the taxpayer, including name and address.

- Detailed inquiries about income sources, deductions, and credits.

- Questions regarding financial accounts and assets.

- Requests for documentation to support the information provided.

- Deadlines for submission and any additional instructions.

Filing Deadlines / Important Dates

Filing deadlines for the Standard Interrogatories To Be Served On Taxpayers For can vary depending on the jurisdiction and the specific case. It is crucial to be aware of these deadlines to avoid penalties. Typically, the form must be submitted within a specified timeframe after it has been served. Failure to meet these deadlines may result in legal consequences, including the possibility of default judgments or adverse findings in tax disputes.

Quick guide on how to complete standard interrogatories to be served on taxpayers for

Complete Standard Interrogatories To Be Served On Taxpayers For effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without delays. Manage Standard Interrogatories To Be Served On Taxpayers For on any device with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The simplest way to modify and eSign Standard Interrogatories To Be Served On Taxpayers For effortlessly

- Locate Standard Interrogatories To Be Served On Taxpayers For and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the information and click the Done button to store your changes.

- Choose how you want to submit your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate creating new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device of your choice. Modify and eSign Standard Interrogatories To Be Served On Taxpayers For and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are Standard Interrogatories To Be Served On Taxpayers For?

Standard Interrogatories To Be Served On Taxpayers For are a set of standard legal questions designed to gather relevant information from taxpayers. These interrogatories help tax attorneys and accountants ensure compliance and facilitate the review process. Using airSlate SignNow simplifies sending and eSigning these documents securely and efficiently.

-

How does airSlate SignNow streamline the process for Standard Interrogatories To Be Served On Taxpayers For?

airSlate SignNow streamlines the process by allowing users to create, send, and eSign Standard Interrogatories To Be Served On Taxpayers For quickly. Our user-friendly interface enables seamless collaboration and tracking of document status, ensuring timely submissions. This efficiency can greatly enhance your productivity and compliance efforts.

-

What features does airSlate SignNow offer for handling Standard Interrogatories To Be Served On Taxpayers For?

airSlate SignNow provides features such as customizable templates, secure electronic signatures, and automated reminders for Standard Interrogatories To Be Served On Taxpayers For. These tools help ensure that your documents are completed accurately and on time. Additionally, integrations with various applications make it easy to embed these functionalities into your existing workflows.

-

Is there a free trial available for airSlate SignNow to test Standard Interrogatories To Be Served On Taxpayers For?

Yes, airSlate SignNow offers a free trial that allows you to explore its features for managing Standard Interrogatories To Be Served On Taxpayers For. This trial enables prospective customers to assess how the platform can enhance their document workflow. Sign up today to experience the benefits firsthand without any commitment.

-

What industries can benefit from using Standard Interrogatories To Be Served On Taxpayers For with airSlate SignNow?

Various industries, including legal, accounting, and tax consulting, can benefit from using Standard Interrogatories To Be Served On Taxpayers For with airSlate SignNow. Our platform is designed to meet the unique needs of professionals who require efficient document handling and secure communication. Implementing our solutions helps streamline inquiries and compliance processes across these sectors.

-

What are the pricing plans for using airSlate SignNow for Standard Interrogatories To Be Served On Taxpayers For?

airSlate SignNow offers flexible pricing plans tailored to different business needs for managing Standard Interrogatories To Be Served On Taxpayers For. Whether you are a small business or a large enterprise, there is an option that will fit your budget. Additionally, our plans include robust features to enhance your document management capabilities.

-

Can I integrate airSlate SignNow with other tools for handling Standard Interrogatories To Be Served On Taxpayers For?

Absolutely! airSlate SignNow integrates with a variety of tools such as CRM platforms, cloud storage services, and more, allowing you to manage Standard Interrogatories To Be Served On Taxpayers For seamlessly. These integrations help in maintaining a coherent document workflow and improve overall operational efficiency. Check our integration list for more details.

Get more for Standard Interrogatories To Be Served On Taxpayers For

- Appfolio property manager user guide form

- Aqua tots application form

- School bus pre trip inspection form

- Usit payment center dentonisd form

- Employment separation certificate symarco form

- Helpful aspects of therapy form h

- Pre authorized payment form the wynford group

- Cumulative standardized review spelling test grade 3 lessons 28 bb svusd form

Find out other Standard Interrogatories To Be Served On Taxpayers For

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form