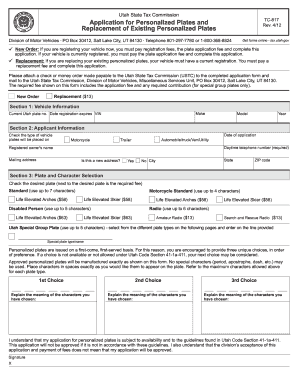

Tc 817 Form

What is the TC 817?

The TC 817 is a form used primarily in the context of tax documentation. It serves as a declaration for specific tax-related purposes, often required by individuals or businesses to report certain financial information to the Internal Revenue Service (IRS). Understanding the TC 817 is crucial for compliance with federal tax regulations, ensuring that all necessary information is accurately reported.

How to Use the TC 817

Using the TC 817 involves a few key steps to ensure proper completion and submission. First, gather all relevant financial documents that pertain to the information required on the form. Next, carefully fill out each section of the TC 817, ensuring accuracy in reporting income, deductions, and any other pertinent details. Once completed, review the form for any errors before submission to avoid complications with the IRS.

Steps to Complete the TC 817

Completing the TC 817 requires attention to detail. Follow these steps for a smooth process:

- Collect necessary documentation, including previous tax returns and financial statements.

- Fill in personal information, such as your name, address, and Social Security number.

- Report all income sources, including wages, self-employment income, and any other earnings.

- Detail any deductions or credits you are eligible for, ensuring you have supporting documents.

- Review the completed form for accuracy and completeness.

- Submit the TC 817 to the appropriate IRS office or online platform as required.

Legal Use of the TC 817

The TC 817 is legally binding when filled out correctly and submitted in accordance with IRS guidelines. It is essential to ensure that all information provided is truthful and accurate, as any discrepancies can lead to penalties or audits. Compliance with tax laws is crucial to avoid legal issues, making it important to understand the legal implications of submitting the TC 817.

Required Documents

When preparing to complete the TC 817, several documents are typically required. These may include:

- Previous tax returns for reference.

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses.

- Any other financial statements relevant to the reporting period.

Filing Deadlines / Important Dates

Timely submission of the TC 817 is essential to avoid penalties. Generally, the form must be filed by the tax deadline, which is typically April 15 for most taxpayers. However, specific deadlines may vary based on individual circumstances, such as extensions or specific tax situations. It is advisable to check the IRS website for the most current deadlines related to the TC 817.

Quick guide on how to complete tc 817 70768

Complete Tc 817 effortlessly on any device

Web-based document management has gained signNow traction among organizations and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, enabling you to locate the right form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Tc 817 on any platform with airSlate SignNow’s Android or iOS applications and streamline any document-related procedure today.

The easiest method to modify and eSign Tc 817 without hassle

- Locate Tc 817 and click Get Form to initiate.

- Employ the tools we provide to finalize your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign feature, which takes merely seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form retrieval, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Tc 817 and guarantee clear communication at every stage of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tc 817 70768

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is tc 817 and how does it relate to airSlate SignNow?

tc 817 refers to a specific compliance standard that can impact how businesses manage electronic signatures. With airSlate SignNow, users can ensure their eSignatures abide by tc 817 requirements, providing a secure and legally-binding way to execute documents.

-

How much does airSlate SignNow cost for tc 817 compliance?

airSlate SignNow offers various pricing tiers that accommodate businesses needing tc 817 compliance. Pricing may vary based on the number of users and features required, so it’s best to review our pricing page for detailed options that suit your needs.

-

What features does airSlate SignNow provide for tc 817 compliance?

airSlate SignNow provides comprehensive features tailored for tc 817 compliance, including robust encryption, audit trails, and customizable templates. These features ensure your documents remain secure and adhere to necessary standards while benefiting from an efficient eSigning process.

-

Can airSlate SignNow integrate with other tools for tc 817 compliance?

Yes, airSlate SignNow integrates seamlessly with other business tools and platforms that help achieve tc 817 compliance. Whether it’s CRM systems or document management software, these integrations enhance the overall workflow while ensuring adherence to compliance standards.

-

How does airSlate SignNow enhance the eSigning experience while ensuring tc 817 compliance?

With airSlate SignNow, users benefit from a streamlined eSigning process that is efficient and compliant with tc 817. The platform is user-friendly, allowing signers to complete documents quickly, while maintaining security and compliance throughout the process.

-

What are the benefits of using airSlate SignNow for documents needing tc 817 compliance?

Using airSlate SignNow for documents that require tc 817 compliance offers several benefits, including increased efficiency, cost savings, and improved tracking. Businesses can experience faster turnaround times for signature requests while ensuring all signatures are legally binding and in line with compliance regulations.

-

Is airSlate SignNow suitable for businesses of all sizes needing tc 817 compliance?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, ensuring that even small companies can meet tc 817 compliance requirements affordably and efficiently. The scalability of the platform makes it easy to adapt as your business grows.

Get more for Tc 817

Find out other Tc 817

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer