Vt Tax Form E2a

What is the Vt Tax Form E2a

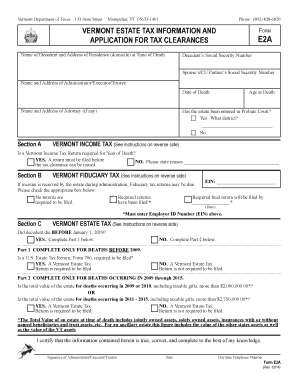

The Vt Tax Form E2a is a specific tax form used in Vermont for various tax-related purposes. It is primarily utilized by individuals and businesses to report income, deductions, and credits. This form is essential for ensuring compliance with state tax regulations and facilitates the accurate calculation of tax liabilities. Understanding its purpose is crucial for taxpayers in Vermont to fulfill their obligations effectively.

How to use the Vt Tax Form E2a

Using the Vt Tax Form E2a involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and previous tax returns. Next, carefully fill out the form, ensuring that all information is accurate and complete. It is important to follow the instructions provided with the form to avoid errors. Once completed, the form can be submitted electronically or by mail, depending on the taxpayer's preference.

Steps to complete the Vt Tax Form E2a

Completing the Vt Tax Form E2a requires attention to detail. Here are the key steps:

- Gather all relevant financial documents, such as W-2s, 1099s, and receipts.

- Review the instructions for the form to understand each section's requirements.

- Fill out personal information, including name, address, and Social Security number.

- Report income accurately, ensuring all sources are included.

- Claim deductions and credits based on eligibility.

- Double-check the information entered for accuracy.

- Submit the form by the specified deadline.

Legal use of the Vt Tax Form E2a

The Vt Tax Form E2a is legally binding when completed and submitted according to state regulations. It is important to ensure that all information provided is truthful and accurate, as discrepancies can lead to penalties or audits. By using a reliable eSignature solution, taxpayers can enhance the legal validity of their submissions, ensuring compliance with applicable laws and regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Vt Tax Form E2a are crucial for taxpayers to observe. Typically, the form must be submitted by April 15 of each year, aligning with federal tax deadlines. However, it is advisable to check for any updates or changes to these dates, as state regulations may vary. Filing on time helps avoid penalties and ensures that taxpayers remain in good standing with the Vermont Department of Taxes.

Required Documents

To complete the Vt Tax Form E2a, several documents are required. These include:

- W-2 forms from employers

- 1099 forms for other income sources

- Receipts for deductible expenses

- Previous year’s tax return for reference

- Any additional documentation supporting claims made on the form

Who Issues the Form

The Vt Tax Form E2a is issued by the Vermont Department of Taxes. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. It provides the necessary forms and instructions to assist individuals and businesses in meeting their tax obligations. For any questions regarding the form or its use, taxpayers can contact the department directly for guidance.

Quick guide on how to complete vt tax form e2a

Complete Vt Tax Form E2a effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, alter, and eSign your documents swiftly without delays. Handle Vt Tax Form E2a on any platform using airSlate SignNow Android or iOS applications and simplify any document-centered task today.

How to alter and eSign Vt Tax Form E2a with ease

- Find Vt Tax Form E2a and then click Get Form to begin.

- Use the tools we provide to fill out your form.

- Mark essential sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign Vt Tax Form E2a and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vt tax form e2a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the vt tax form e2a?

The vt tax form e2a is a document used for the Vermont income tax filing process. Specifically, it is designed for certain types of income and deductions. Understanding this form is essential for accurate tax compliance in Vermont.

-

How can airSlate SignNow help with the vt tax form e2a?

airSlate SignNow streamlines the process of completing and sending the vt tax form e2a. With our intuitive eSigning features, you can easily fill out, sign, and share the form electronically. This reduces the hassle of paper documents and enhances your e-filing experience.

-

Is airSlate SignNow affordable for small businesses needing the vt tax form e2a?

Yes, airSlate SignNow offers competitive pricing plans suitable for small businesses that need to handle the vt tax form e2a. Our cost-effective solution accommodates various budgets without compromising on quality or features. By using SignNow, businesses can save time and money during the tax filing process.

-

What features are included for managing the vt tax form e2a?

With airSlate SignNow, you have access to features like document templates, customizable workflows, and secure eSigning, specifically for the vt tax form e2a. These features are designed to simplify the filing process and ensure all necessary information is captured accurately. Plus, our user-friendly interface ensures a smooth experience.

-

Can I integrate airSlate SignNow with other software for the vt tax form e2a?

Absolutely! airSlate SignNow seamlessly integrates with various software applications, enhancing your workflow for the vt tax form e2a. Whether using accounting software, CRM systems, or cloud storage, our integrations simplify document management and sharing.

-

What are the benefits of using airSlate SignNow for the vt tax form e2a?

Using airSlate SignNow for the vt tax form e2a offers numerous benefits, including increased efficiency, reduced paper usage, and enhanced security for sensitive tax information. Our platform ensures that your documents are legally binding and securely stored. Additionally, you'll save time with easy access to your forms anytime, anywhere.

-

Is it easy to get support for questions about the vt tax form e2a?

Yes, airSlate SignNow provides excellent customer support for any inquiries regarding the vt tax form e2a. Our dedicated support team is available to assist users via live chat, email, or phone. Whether you have technical questions or need guidance on using our platform, we're here to help.

Get more for Vt Tax Form E2a

- Wps medicare snf pps mds 3 form

- West michigan regional purchase agreement wmlar form

- Visit mckinleyparkcenter mckinleyparkcenter form

- Domestic violence risk and needs assessment dvrna scoring manual form

- Prairie view aampm university application packet pvamu form

- Declaration by medical doctor dentist form

- Name date period lesson 7 homework practice compute with scientific notation evaluate each expression form

- Ff sre 006 convenio de renuncia para adquisicin de bienes inmuebles fuera de zona restringida 4 form

Find out other Vt Tax Form E2a

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online