Foreign Use the SA106 Supplementary Pages to Declare Foreign Income and Gains and Claim for Foreign Tax Credit Relief When Compl 2016-2026

Understanding the Self Assessment Foreign Form

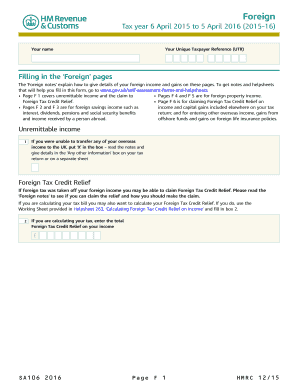

The self assessment foreign form, specifically the HMRC SA106 form, is essential for individuals who need to declare foreign income and gains while filing their tax returns in the United Kingdom. This form allows taxpayers to report income earned outside the UK and claim any foreign tax credits that may apply. It is particularly relevant for U.S. citizens or residents who have financial interests abroad and need to ensure compliance with both U.S. and UK tax obligations.

Steps to Complete the Self Assessment Foreign Form

Completing the self assessment foreign form involves several key steps:

- Gather all necessary documentation related to foreign income, such as bank statements, investment records, and tax documents from foreign authorities.

- Access the HMRC SA106 form, which can be downloaded or filled out online, ensuring you have the latest version for the relevant tax year.

- Carefully fill in the required sections, including details about your foreign income and any taxes paid abroad.

- Calculate any tax credits you are eligible for, which can help reduce your overall tax liability in the UK.

- Review the completed form for accuracy and ensure all supporting documents are attached.

- Submit the form by the specified deadline, either electronically or by mail, depending on your preference.

Required Documents for the Self Assessment Foreign Form

To successfully complete the self assessment foreign form, you will need to provide several documents, including:

- Proof of foreign income, such as pay stubs or bank statements.

- Documentation of foreign taxes paid, which may include tax returns or statements from foreign tax authorities.

- Any relevant forms or certificates that support your claims for foreign tax credits.

Filing Deadlines for the Self Assessment Foreign Form

It is crucial to be aware of the filing deadlines associated with the self assessment foreign form. Typically, the deadline for submitting your tax return, including the SA106 form, is January 31st following the end of the tax year on April 5th. For example, for the tax year ending April 5, 2023, the deadline would be January 31, 2024. Missing this deadline can result in penalties and interest charges, so timely submission is essential.

Legal Use of the Self Assessment Foreign Form

The self assessment foreign form is legally binding when completed accurately and submitted on time. Compliance with the relevant tax laws ensures that you are fulfilling your obligations as a taxpayer. It is important to retain copies of the submitted form and any supporting documents for your records, as these may be required in the event of an audit or review by tax authorities.

Examples of Taxpayer Scenarios for the Self Assessment Foreign Form

Different taxpayer scenarios may affect how the self assessment foreign form is completed:

- Self-employed individuals earning income from foreign clients must report this income and may be eligible for deductions related to business expenses.

- Retirees receiving pensions from foreign sources need to declare this income and may need to consider tax treaties between the U.S. and the UK.

- Students studying abroad who earn income while working part-time must also report their earnings on the form.

Quick guide on how to complete foreign use the sa106 supplementary pages to declare foreign income and gains and claim for foreign tax credit relief when

Easily Prepare Foreign Use The SA106 Supplementary Pages To Declare Foreign Income And Gains And Claim For Foreign Tax Credit Relief When Compl on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, enabling you to find the right form and securely store it online. airSlate SignNow equips you with all the tools you require to create, modify, and eSign your documents efficiently without delays. Manage Foreign Use The SA106 Supplementary Pages To Declare Foreign Income And Gains And Claim For Foreign Tax Credit Relief When Compl on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

Effortlessly Modify and eSign Foreign Use The SA106 Supplementary Pages To Declare Foreign Income And Gains And Claim For Foreign Tax Credit Relief When Compl

- Find Foreign Use The SA106 Supplementary Pages To Declare Foreign Income And Gains And Claim For Foreign Tax Credit Relief When Compl and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a regular wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiresome form searches, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Foreign Use The SA106 Supplementary Pages To Declare Foreign Income And Gains And Claim For Foreign Tax Credit Relief When Compl and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the foreign use the sa106 supplementary pages to declare foreign income and gains and claim for foreign tax credit relief when

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a self assessment foreign form?

A self assessment foreign form is a document used by individuals to report their foreign income and taxes to the tax authorities. This form helps ensure compliance with tax regulations, particularly for those earning money outside their home country. By utilizing an efficient tool like airSlate SignNow, you can easily prepare and eSign your self assessment foreign form.

-

How does airSlate SignNow simplify the self assessment foreign form process?

airSlate SignNow streamlines the process of completing a self assessment foreign form by enabling users to fill out, sign, and send documents digitally. With intuitive features and templates, you can efficiently manage your paperwork from anywhere. This user-friendly approach reduces time and errors associated with traditional methods.

-

Is there a cost associated with using airSlate SignNow for self assessment foreign forms?

airSlate SignNow offers flexible pricing plans, allowing users to choose options that best suit their needs. The cost-effective solution is designed to fit various budgets while providing comprehensive features for completing self assessment foreign forms. You can explore the pricing structure on our website to find the plan that's right for you.

-

What features are included with airSlate SignNow for handling self assessment foreign forms?

AirSlate SignNow includes a wide array of features for managing self assessment foreign forms, such as customized templates, easy document editing, and secure eSigning capabilities. The platform also supports team collaboration, making it simple to gather necessary approvals and signatures. This comprehensive tool enhances productivity and accuracy.

-

Can I integrate airSlate SignNow with other software to manage my self assessment foreign form?

Yes, airSlate SignNow offers integrations with various software applications, including CRM systems and cloud storage solutions. This capability enhances your workflow by allowing you to manage your self assessment foreign form alongside other important business tools. Streamlining your processes saves time and ensures better document management.

-

What are the benefits of using airSlate SignNow for my self assessment foreign form?

Using airSlate SignNow for your self assessment foreign form provides numerous benefits, including reduced paperwork, improved accuracy, and faster processing times. The digital solution allows users to track the status of their forms easily and ensures that documents remain secure. Enjoy peace of mind knowing that your tax form is handled efficiently.

-

Is my data safe when using airSlate SignNow for self assessment foreign forms?

Absolutely! airSlate SignNow prioritizes data security, employing advanced encryption protocols to protect your personal and financial information while managing your self assessment foreign form. With compliance to industry standards, your documents are safe from unauthorized access. Focus on your tasks while we take care of your data security.

Get more for Foreign Use The SA106 Supplementary Pages To Declare Foreign Income And Gains And Claim For Foreign Tax Credit Relief When Compl

Find out other Foreign Use The SA106 Supplementary Pages To Declare Foreign Income And Gains And Claim For Foreign Tax Credit Relief When Compl

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online