The Maharashtra E Payment of Stamp Duty and Refund Rules PDF Form

Understanding the Maharashtra E Payment of Stamp Duty and Refund Rules PDF

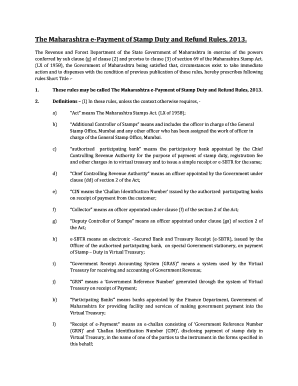

The Maharashtra E Payment of Stamp Duty and Refund Rules PDF outlines the legal framework governing the payment of stamp duty and the process for obtaining refunds. This document is essential for individuals and businesses engaging in transactions that require stamp duty payments in Maharashtra. It provides clarity on the obligations and rights of taxpayers, ensuring compliance with local regulations.

Steps to Complete the Maharashtra E Payment of Stamp Duty and Refund Rules PDF

Completing the Maharashtra E Payment of Stamp Duty and Refund Rules PDF involves several key steps:

- Review the document thoroughly to understand the requirements and guidelines.

- Gather necessary information, including personal identification and transaction details.

- Fill out the application form accurately, ensuring all required fields are completed.

- Attach any supporting documents as specified in the guidelines.

- Submit the completed form through the designated channels, whether online or by mail.

Required Documents for the Maharashtra E Payment of Stamp Duty and Refund Rules PDF

To successfully complete the stamp duty refund application, certain documents are typically required. These may include:

- Proof of payment of stamp duty.

- Identification documents, such as a driver's license or passport.

- Transaction documents related to the property or agreement.

- Any previous correspondence regarding the transaction or refund request.

Form Submission Methods for the Maharashtra E Payment of Stamp Duty and Refund Rules PDF

The submission of the Maharashtra E Payment of Stamp Duty and Refund Rules PDF can be done through various methods:

- Online submission via the official state portal, which often provides a streamlined process.

- Mailing the completed form and documents to the appropriate state office.

- In-person submission at designated government offices for those who prefer direct interaction.

Eligibility Criteria for the Maharashtra E Payment of Stamp Duty and Refund Rules PDF

Eligibility for submitting the stamp duty refund application generally includes:

- Individuals or entities that have paid stamp duty on eligible transactions.

- Compliance with all relevant state regulations and guidelines.

- Proper documentation to support the refund request.

Legal Use of the Maharashtra E Payment of Stamp Duty and Refund Rules PDF

The legal use of the Maharashtra E Payment of Stamp Duty and Refund Rules PDF ensures that all transactions comply with state laws. This document serves as a legally binding agreement when filled out correctly and submitted in accordance with the outlined procedures. Adhering to these rules protects the rights of taxpayers and facilitates the proper processing of refunds.

Quick guide on how to complete the maharashtra e payment of stamp duty and refund rules pdf

Complete The Maharashtra E Payment Of Stamp Duty And Refund Rules Pdf effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It offers a superb eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, amend, and eSign your documents swiftly without interruptions. Manage The Maharashtra E Payment Of Stamp Duty And Refund Rules Pdf on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The most effective way to modify and eSign The Maharashtra E Payment Of Stamp Duty And Refund Rules Pdf with ease

- Obtain The Maharashtra E Payment Of Stamp Duty And Refund Rules Pdf and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searching, or errors that require printing additional document copies. airSlate SignNow addresses all your document management needs in a few clicks from your preferred device. Modify and eSign The Maharashtra E Payment Of Stamp Duty And Refund Rules Pdf and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the the maharashtra e payment of stamp duty and refund rules pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is stamp duty on share purchase agreement in Mumbai?

Stamp duty on share purchase agreement in Mumbai is a tax levied by the government on the transfer of shares. It is essential to pay this duty for the agreement to be legally effective. The rate of stamp duty may vary based on the transaction value and the type of shares being transferred.

-

How is the stamp duty calculated for share purchase agreements in Mumbai?

The stamp duty for a share purchase agreement in Mumbai is typically calculated as a percentage of the agreement value. This percentage might be subject to changes by local authorities, so it’s advisable to check the latest rates. Accurate calculation ensures compliance and avoids penalties.

-

What are the consequences of not paying stamp duty on share purchase agreements in Mumbai?

Failing to pay stamp duty on share purchase agreements in Mumbai can lead to legal issues and invalidate the agreement. Additionally, the parties may face penalties and interest charges. It is crucial to comply to ensure the document is legally binding.

-

Does airSlate SignNow help with the process of calculating stamp duty?

While airSlate SignNow focuses on facilitating document signing, it does not provide direct calculations for stamp duty on share purchase agreements in Mumbai. However, users can easily integrate tools that offer tax calculation features. This helps streamline the documentation process.

-

What features does airSlate SignNow offer for share purchase agreements?

airSlate SignNow provides a seamless eSignature solution, allowing users to create, send, and sign share purchase agreements easily. Features include custom templates, real-time tracking, and secure cloud storage, enhancing the signing process. This simplifies compliance with requirements like stamp duty on share purchase agreement in Mumbai.

-

How does airSlate SignNow ensure the security of documents during the signing process?

airSlate SignNow employs advanced encryption protocols to ensure the security of documents being signed. This guarantees that sensitive information related to stamp duty on share purchase agreements in Mumbai is protected. Users can sign agreements with peace of mind knowing their data is secure.

-

Can I integrate airSlate SignNow with other software for managing stamp duty?

Yes, airSlate SignNow offers integrations with various accounting and document management software. This allows users to manage their stamp duty on share purchase agreements in Mumbai more effectively. Such integrations streamline processes and enhance overall efficiency.

Get more for The Maharashtra E Payment Of Stamp Duty And Refund Rules Pdf

Find out other The Maharashtra E Payment Of Stamp Duty And Refund Rules Pdf

- eSign North Dakota Award Nomination Form Free

- eSignature Mississippi Demand for Extension of Payment Date Secure

- Can I eSign Oklahoma Online Donation Form

- How Can I Electronic signature North Dakota Claim

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile