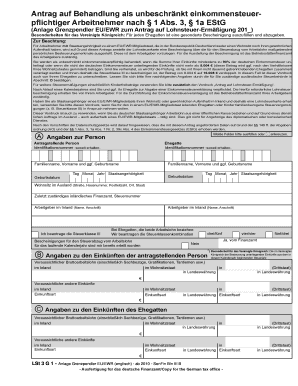

Anlage Grenzpendler Eu Ewr Form

What is the LST 315?

The LST 315 is a specific form used in the context of cross-border taxation for individuals who work in one country while residing in another. This form is essential for reporting income and determining tax obligations, particularly for those who may be subject to dual taxation. It serves as a declaration to tax authorities, detailing the income earned and ensuring compliance with relevant tax laws.

How to Use the LST 315

Using the LST 315 involves accurately filling out the required sections to report your income and tax situation. Begin by gathering all necessary documentation, including proof of income and residency. Complete the form by entering your personal information, income details, and any deductions or credits you may be eligible for. Ensure that all information is correct to avoid delays or issues with processing.

Steps to Complete the LST 315

Completing the LST 315 requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents, including pay stubs and tax statements.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Report your income, specifying the amounts earned in each relevant jurisdiction.

- Include any applicable deductions or credits to reduce your taxable income.

- Review the completed form for accuracy before submission.

Legal Use of the LST 315

The LST 315 is legally recognized for tax reporting purposes. To ensure its validity, it must be completed in accordance with the applicable tax laws and regulations. This includes adhering to deadlines and providing accurate information. Failure to comply with these legal requirements may result in penalties or complications with tax authorities.

Required Documents for the LST 315

When preparing to submit the LST 315, it is crucial to have the following documents ready:

- Proof of income, such as pay stubs or tax returns from your employer.

- Documentation of residency, which may include utility bills or lease agreements.

- Any previous tax forms that may be relevant to your current tax situation.

Filing Deadlines for the LST 315

Timely submission of the LST 315 is essential to avoid penalties. The specific deadlines may vary depending on your residency and employment status. Generally, it is advisable to file the form by the end of the tax year to ensure compliance. Always check for any updates or changes to filing deadlines that may apply to your situation.

Quick guide on how to complete anlage grenzpendler eu ewr 30090456

Effortlessly Prepare Anlage Grenzpendler Eu Ewr on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to access the proper format and securely keep it online. airSlate SignNow provides all the necessary tools for you to create, modify, and electronically sign your documents swiftly without delays. Handle Anlage Grenzpendler Eu Ewr on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to Modify and Electronically Sign Anlage Grenzpendler Eu Ewr with Ease

- Find Anlage Grenzpendler Eu Ewr and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or obscure confidential information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose your preferred method to deliver your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate generating new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Anlage Grenzpendler Eu Ewr and ensure outstanding communication at any phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the anlage grenzpendler eu ewr 30090456

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is lst 315 and how does it relate to airSlate SignNow?

lst 315 is a form of advanced electronic signature solution offered by airSlate SignNow, designed to streamline document signing processes. With lst 315, businesses can ensure compliance while sending and eSigning documents efficiently and securely. This solution can signNowly enhance workflow and productivity.

-

How much does airSlate SignNow cost for lst 315 integration?

The pricing for airSlate SignNow varies based on the features and the level of lst 315 integration you choose. Typically, plans range from basic to advanced tiers, allowing businesses to select a solution that fits their budget and needs. A trial period may also be available to evaluate the lst 315 features before committing.

-

What features does airSlate SignNow offer with lst 315?

AirSlate SignNow with lst 315 includes a user-friendly interface, customizable templates, and robust security measures for document signing. Additional features like automatic reminders and tracking enhance document management. These features make it easier to get documents signed quickly while ensuring compliance.

-

Can I integrate lst 315 with other tools and applications?

Yes, airSlate SignNow supports integration with various tools and applications, enhancing the functionality of lst 315. Popular integrations include CRM systems, cloud storage, and productivity software, which can help streamline your workflow further. This flexibility makes it easy to incorporate lst 315 into existing processes.

-

What are the benefits of using lst 315 for document signing?

Using lst 315 with airSlate SignNow offers numerous benefits, including increased efficiency, reduced turnaround times, and enhanced document security. Businesses can eliminate paper-based processes, making document handling faster and more cost-effective. Additionally, lst 315 ensures compliance with industry standards.

-

Is lst 315 suitable for small businesses?

Yes, lst 315 is ideal for small businesses looking for an efficient eSignature solution. AirSlate SignNow provides a cost-effective platform that scales with your business needs. Small businesses can leverage lst 315 to enhance their document signing processes without having to invest in costly systems.

-

How secure is my data with lst 315 on airSlate SignNow?

Data security is a top priority for airSlate SignNow, especially with lst 315. The platform employs industry-standard encryption protocols to protect sensitive information and ensure compliance with regulations. You can trust that your documents are secure during the signing process with lst 315.

Get more for Anlage Grenzpendler Eu Ewr

Find out other Anlage Grenzpendler Eu Ewr

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online