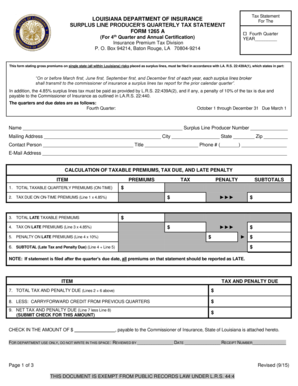

LOUISIANA DEPARTMENT of INSURANCE SURPLUS LINE PRODUCERS QUARTERLY TAX STATEMENT FORM 1265 a for 4th Quarter and Annual Certific

What is the Louisiana Department of Insurance Surplus Line Producers Quarterly Tax Statement Form 1265 A?

The Louisiana Department of Insurance Surplus Line Producers Quarterly Tax Statement Form 1265 A is a crucial document for surplus line producers in Louisiana. This form is used to report and certify insurance premium taxes for the fourth quarter and for annual certification. It ensures compliance with state regulations regarding surplus lines insurance and helps maintain transparency in the insurance market. Proper completion of this form is essential for producers to fulfill their tax obligations and avoid penalties.

Steps to Complete the Louisiana Department of Insurance Surplus Line Producers Quarterly Tax Statement Form 1265 A

Completing the Louisiana Department of Insurance Surplus Line Producers Quarterly Tax Statement Form 1265 A involves several key steps:

- Gather Required Information: Collect all necessary data, including premium amounts, policy details, and any relevant financial records.

- Fill Out the Form: Carefully enter the gathered information into the form, ensuring accuracy in all entries.

- Review for Errors: Double-check all sections of the form for any mistakes or omissions before finalizing.

- Sign and Date: Ensure that the form is signed and dated appropriately to validate the submission.

- Submit the Form: Choose your preferred method of submission, whether online, by mail, or in person.

How to Obtain the Louisiana Department of Insurance Surplus Line Producers Quarterly Tax Statement Form 1265 A

The Louisiana Department of Insurance Surplus Line Producers Quarterly Tax Statement Form 1265 A can be obtained through several channels:

- Official Website: Visit the Louisiana Department of Insurance website to download the form directly.

- Local Insurance Offices: Request a physical copy from local insurance offices or regulatory bodies.

- Professional Associations: Some industry associations may provide access to the form for their members.

Legal Use of the Louisiana Department of Insurance Surplus Line Producers Quarterly Tax Statement Form 1265 A

This form serves a legal purpose in the context of tax compliance for surplus line producers. It is recognized as a valid document for reporting insurance premiums and must be filled out accurately to ensure legal standing. The form's completion and submission demonstrate adherence to state laws governing surplus lines insurance, which is essential for maintaining good standing with the Louisiana Department of Insurance.

Filing Deadlines for the Louisiana Department of Insurance Surplus Line Producers Quarterly Tax Statement Form 1265 A

Filing deadlines for the Louisiana Department of Insurance Surplus Line Producers Quarterly Tax Statement Form 1265 A are critical for compliance. Producers must submit the form by the designated deadlines to avoid penalties. Typically, the fourth quarter form is due shortly after the end of the quarter, aligning with annual tax reporting requirements. It is advisable to check the Louisiana Department of Insurance’s official communications for specific dates each year.

Penalties for Non-Compliance with the Louisiana Department of Insurance Surplus Line Producers Quarterly Tax Statement Form 1265 A

Failing to comply with the filing requirements for the Louisiana Department of Insurance Surplus Line Producers Quarterly Tax Statement Form 1265 A can result in significant penalties. These may include fines, interest on unpaid taxes, and potential disciplinary actions against the surplus line producer. It is essential for producers to adhere to all filing deadlines and ensure accurate reporting to avoid these consequences.

Quick guide on how to complete louisiana department of insurance surplus line producers quarterly tax statement form 1265 a for 4th quarter and annual

Effortlessly Prepare LOUISIANA DEPARTMENT OF INSURANCE SURPLUS LINE PRODUCERS QUARTERLY TAX STATEMENT FORM 1265 A For 4th Quarter And Annual Certific on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed papers, as you can easily locate the correct template and securely keep it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle LOUISIANA DEPARTMENT OF INSURANCE SURPLUS LINE PRODUCERS QUARTERLY TAX STATEMENT FORM 1265 A For 4th Quarter And Annual Certific on any platform with airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

How to Modify and Electronically Sign LOUISIANA DEPARTMENT OF INSURANCE SURPLUS LINE PRODUCERS QUARTERLY TAX STATEMENT FORM 1265 A For 4th Quarter And Annual Certific with Ease

- Obtain LOUISIANA DEPARTMENT OF INSURANCE SURPLUS LINE PRODUCERS QUARTERLY TAX STATEMENT FORM 1265 A For 4th Quarter And Annual Certific and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to save your changes.

- Choose how you want to send your form: via email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign LOUISIANA DEPARTMENT OF INSURANCE SURPLUS LINE PRODUCERS QUARTERLY TAX STATEMENT FORM 1265 A For 4th Quarter And Annual Certific to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the louisiana department of insurance surplus line producers quarterly tax statement form 1265 a for 4th quarter and annual

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the LOUISIANA DEPARTMENT OF INSURANCE SURPLUS LINE PRODUCERS QUARTERLY TAX STATEMENT FORM 1265 A?

The LOUISIANA DEPARTMENT OF INSURANCE SURPLUS LINE PRODUCERS QUARTERLY TAX STATEMENT FORM 1265 A is a critical document that surplus line producers in Louisiana must complete quarterly for reporting insurance premium taxes. This form facilitates compliance with state regulations and assists in the annual certification process.

-

How can airSlate SignNow help with the LOUISIANA DEPARTMENT OF INSURANCE SURPLUS LINE PRODUCERS QUARTERLY TAX STATEMENT FORM 1265 A?

airSlate SignNow simplifies the eSignature process for the LOUISIANA DEPARTMENT OF INSURANCE SURPLUS LINE PRODUCERS QUARTERLY TAX STATEMENT FORM 1265 A, allowing producers to easily complete and submit their forms electronically. Our platform reduces errors and speeds up the submission process, ensuring compliance with regulatory timelines.

-

What features does airSlate SignNow offer for tax document handling?

With airSlate SignNow, you will enjoy features such as customizable templates, secure eSignatures, and document status tracking for forms like the LOUISIANA DEPARTMENT OF INSURANCE SURPLUS LINE PRODUCERS QUARTERLY TAX STATEMENT FORM 1265 A. These features enhance efficiency and provide full visibility into the document workflow.

-

Are there any costs associated with using airSlate SignNow for the LOUISIANA DEPARTMENT OF INSURANCE SURPLUS LINE PRODUCERS QUARTERLY TAX STATEMENT FORM 1265 A?

Yes, airSlate SignNow offers flexible pricing plans tailored to accommodate various business needs when handling documents like the LOUISIANA DEPARTMENT OF INSURANCE SURPLUS LINE PRODUCERS QUARTERLY TAX STATEMENT FORM 1265 A. By investing in our service, businesses can save time and reduce paper-related costs.

-

Is airSlate SignNow compliant with Louisiana insurance regulations?

Absolutely! airSlate SignNow is designed with compliance in mind, ensuring that all processes related to the LOUISIANA DEPARTMENT OF INSURANCE SURPLUS LINE PRODUCERS QUARTERLY TAX STATEMENT FORM 1265 A meet the Louisiana insurance regulations. Our platform maintains high standards for data security and regulatory compliance.

-

Can I integrate airSlate SignNow with other software I use?

Yes, airSlate SignNow offers seamless integrations with various CRM and document management systems, making it easy to incorporate the LOUISIANA DEPARTMENT OF INSURANCE SURPLUS LINE PRODUCERS QUARTERLY TAX STATEMENT FORM 1265 A into your existing workflows. This flexibility allows for enhanced productivity and efficiency.

-

What are the benefits of using airSlate SignNow for insurance tax documents?

Using airSlate SignNow for documents like the LOUISIANA DEPARTMENT OF INSURANCE SURPLUS LINE PRODUCERS QUARTERLY TAX STATEMENT FORM 1265 A streamlines the eSignature process, reduces turnaround times, and minimizes mistakes. This results in a smoother experience and helps maintain compliance with insurance tax obligations.

Get more for LOUISIANA DEPARTMENT OF INSURANCE SURPLUS LINE PRODUCERS QUARTERLY TAX STATEMENT FORM 1265 A For 4th Quarter And Annual Certific

- 12 902 d 2018 2019 form

- Nj order cause 2012 2019 form

- Case information statement cis lp case information statement cis lp

- Case information statement cis lp new jersey courts judiciary state nj

- Child support guideline worksheet form

- Stipulated judgement form oregon 2017 2019

- Et 4926 2017 2019 form

- Probate court milwaukee county city of milwaukee form

Find out other LOUISIANA DEPARTMENT OF INSURANCE SURPLUS LINE PRODUCERS QUARTERLY TAX STATEMENT FORM 1265 A For 4th Quarter And Annual Certific

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself