City of Carlsbad Nm Lodgers Tax Form

Understanding the Ruidoso Lodgers Tax Form

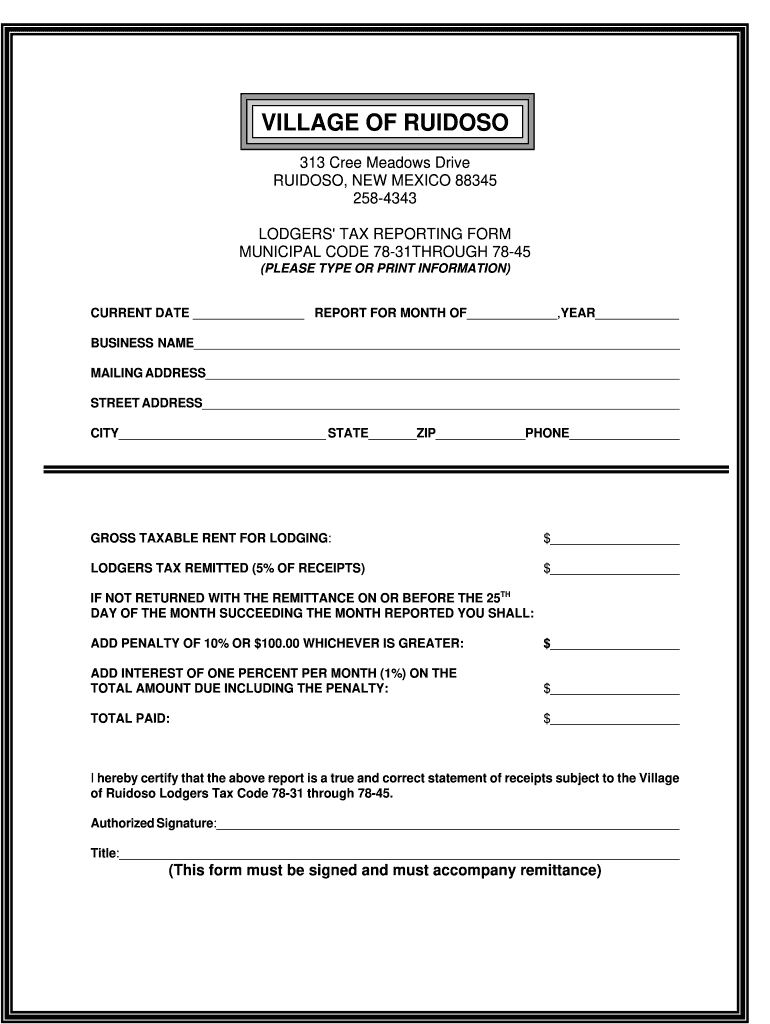

The Ruidoso Lodgers Tax Form is a crucial document for lodging operators in Ruidoso, New Mexico. This form is used to report and remit the lodging tax collected from guests staying at various accommodations. The tax is essential for funding local projects and services that benefit the community. It is important for lodging businesses to understand the specifics of this form to ensure compliance with local regulations.

Steps to Complete the Ruidoso Lodgers Tax Form

Completing the Ruidoso Lodgers Tax Form involves several key steps:

- Gather necessary information, including your business details and the total amount of lodging tax collected during the reporting period.

- Fill out the form accurately, ensuring all fields are completed, including the number of rooms rented and the applicable tax rate.

- Review the completed form for accuracy to avoid any discrepancies that could lead to penalties.

- Sign the form electronically using a secure eSignature solution to ensure it is legally binding.

Filing Deadlines and Important Dates

It is essential to be aware of the filing deadlines associated with the Ruidoso Lodgers Tax Form. Typically, the form must be submitted on a monthly basis, with specific due dates that vary by month. Missing these deadlines can result in penalties. Always check the local regulations for the most current deadlines to ensure timely submission.

Form Submission Methods

The Ruidoso Lodgers Tax Form can be submitted through various methods, including:

- Online submission via a secure portal, which allows for quick processing and confirmation.

- Mailing a physical copy of the form to the appropriate local government office.

- In-person submission at designated locations, which may provide immediate assistance if needed.

Legal Use of the Ruidoso Lodgers Tax Form

Using the Ruidoso Lodgers Tax Form legally requires adherence to local laws and regulations. The form must be filled out accurately and submitted on time to avoid legal repercussions. Additionally, businesses should maintain records of all transactions and filed forms for potential audits or reviews by local authorities.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Ruidoso Lodgers Tax Form can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial for lodging operators to understand their obligations to prevent any issues that could arise from non-compliance.

Quick guide on how to complete lodgers tax reporting form ruidoso nm

Your assistance manual on how to prepare your City Of Carlsbad Nm Lodgers Tax Form

If you're curious about how to develop and file your City Of Carlsbad Nm Lodgers Tax Form, here are a few concise guidelines to make tax filing considerably more straightforward.

To start, you need to set up your airSlate SignNow account to enhance the way you manage documents online. airSlate SignNow is a highly user-friendly and powerful document solution that enables you to edit, create, and finalize your income tax forms with ease. With its editor, you can toggle between text, check boxes, and eSignatures, and revisit the content to modify details as necessary. Simplify your tax administration with advanced PDF editing, eSigning, and easy sharing options.

Follow the instructions below to complete your City Of Carlsbad Nm Lodgers Tax Form within a few moments:

- Create your account and start editing PDFs within minutes.

- Explore our catalog to locate any IRS tax form; browse through variants and schedules.

- Click Get form to access your City Of Carlsbad Nm Lodgers Tax Form in our editor.

- Enter the necessary fillable fields with your information (text, numbers, check marks).

- Utilize the Sign Tool to add your legally-valid eSignature (if necessary).

- Review your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to electronically file your taxes with airSlate SignNow. Keep in mind that paper filing can lead to return errors and postpone refunds. Of course, before e-filing your taxes, visit the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

FAQs

-

What tax forms do I need to fill out for reporting bitcoin gains and loses?

IRS1040 and 1099 forms.“For instance, there is no long-term capital gains tax to pay if you are in the lower two tax brackets (less than $36,900 single income or less than $73,800 married income). The capital gains rate is only 15% for other tax brackets (less than $405,100 single income) with 20% for the final bracket.”Reference: Filing Bitcoin Taxes Capital Gains Losses 1040 Schedule DOther References:IRS Virtual Currency Guidance : Virtual Currency Is Treated as Property for U.S. Federal Tax Purposes; General Rules for Property Transactions ApplyHow do I report taxes?Filing Bitcoin Taxes Capital Gains Losses 1040 Schedule Dhttps://www.irs.gov/pub/irs-drop...

-

Do you have to fill out form 1099 (for tax reporting) if you send over $600 in bitcoin to company for a product?

Among the numerous tax forms, the IRS will be expecting you to fill out a 1099-MISC form in two cases:you made payments to freelancers or independent contractors for business-related services totaling at least $600 within the year;or you paid minimum $10 in royalties or broker payments in lieu of dividends or tax-exempt interest.However, if you made any payments for personal or household services, there is no need to submit a 1099-MISC form.This site has a lot of information about it - http://bit.ly/2Nkf48f

-

How do I fill out a 1120 tax report?

If you are not sophisticated with taxes, DON'T try this form. You can get yourself in a lot of trouble. Get a good CPA or EA. The time and effort it will take you to figure this thing out is not worth it. If you value your time at more than the minimum wage, you will save time and money by hiring a professional.

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do I fill out tax form 4972?

Here are the line by line instructions Page on irs.gov, if you still are having problems, I suggest you contact a US tax professional to complete the form for you.

Create this form in 5 minutes!

How to create an eSignature for the lodgers tax reporting form ruidoso nm

How to make an eSignature for your Lodgers Tax Reporting Form Ruidoso Nm online

How to make an electronic signature for the Lodgers Tax Reporting Form Ruidoso Nm in Chrome

How to create an electronic signature for putting it on the Lodgers Tax Reporting Form Ruidoso Nm in Gmail

How to make an eSignature for the Lodgers Tax Reporting Form Ruidoso Nm from your mobile device

How to create an electronic signature for the Lodgers Tax Reporting Form Ruidoso Nm on iOS devices

How to create an eSignature for the Lodgers Tax Reporting Form Ruidoso Nm on Android devices

People also ask

-

What features does airSlate SignNow offer for businesses in New Mexico Ruidoso?

airSlate SignNow provides a comprehensive suite of features designed to facilitate document management for businesses in New Mexico Ruidoso. These include electronic signatures, document templates, and real-time tracking of document status. This ensures that you can manage your important paperwork efficiently and securely.

-

How can airSlate SignNow benefit my business in New Mexico Ruidoso?

By using airSlate SignNow, businesses in New Mexico Ruidoso can streamline their document workflows, reducing turnaround time and increasing productivity. The platform is user-friendly and customizable, making it easy for teams to adapt it to their specific needs. This ultimately helps in enhancing customer satisfaction and fostering business growth.

-

What is the pricing structure for airSlate SignNow in New Mexico Ruidoso?

airSlate SignNow offers competitive pricing plans tailored to the needs of businesses in New Mexico Ruidoso. Customers can choose from different subscription tiers based on their document signing volume and required features. This flexibility ensures that businesses of all sizes can find a package that fits their budget.

-

Is there a free trial available for airSlate SignNow in New Mexico Ruidoso?

Yes, airSlate SignNow offers a free trial for prospective users in New Mexico Ruidoso. This allows businesses to explore the platform's capabilities and see how it can benefit their document management processes before committing financially. It's a great way to ensure the solution meets your specific needs.

-

What integrations does airSlate SignNow support for businesses in New Mexico Ruidoso?

airSlate SignNow seamlessly integrates with various business applications commonly used in New Mexico Ruidoso, including CRM systems and project management tools. This integration capability helps businesses continue using their existing software while automating their document workflows. It enhances efficiency and improves overall productivity.

-

How secure is airSlate SignNow for users in New Mexico Ruidoso?

Security is a top priority for airSlate SignNow, especially for users in New Mexico Ruidoso who handle sensitive documents. The platform employs advanced security measures, including encryption and secure cloud storage, to ensure that your data remains protected. You can confidently manage your document signing without compromising security.

-

Can I use airSlate SignNow on mobile devices in New Mexico Ruidoso?

Absolutely! airSlate SignNow is fully optimized for mobile devices, allowing users in New Mexico Ruidoso to manage and sign documents on the go. This mobile functionality provides great flexibility for businesses and ensures that important tasks can be accomplished anywhere, at any time.

Get more for City Of Carlsbad Nm Lodgers Tax Form

- Documentation of a two step tb tuberculosis skin test dccc form

- Spa intake form 63679030

- Nfl week 16 pick em sheet form

- Telex release request letter form

- Td ameritrade w9 form

- Medication dispensing form st joseph school stjoeelem

- Under the caption transfer of rights in the property and in sections 3 4 10 11 12 form

- Summer camp contract template form

Find out other City Of Carlsbad Nm Lodgers Tax Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation