Individual Residential Tax Service Order Form CoreLogic

What is the Individual Residential Tax Service Order Form CoreLogic

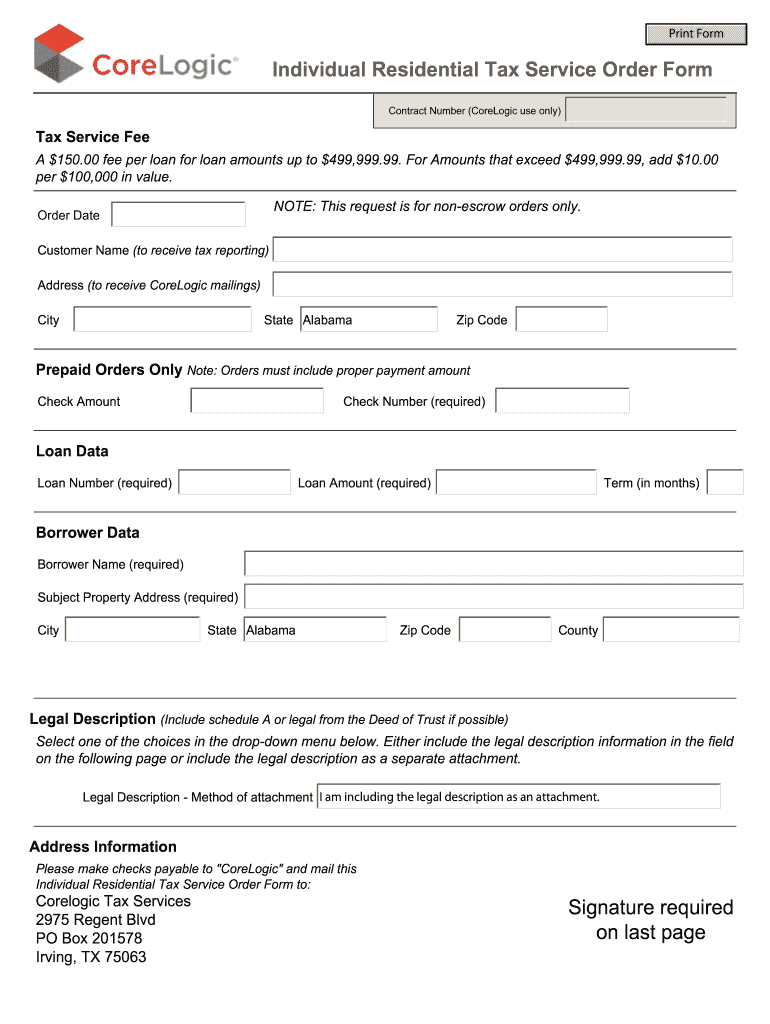

The Individual Residential Tax Service Order Form CoreLogic is a document designed for individuals seeking to obtain residential tax data and related services from CoreLogic. This form is essential for homeowners and real estate professionals who need accurate tax assessments and property information. It facilitates the collection of necessary details to process tax-related requests efficiently.

How to use the Individual Residential Tax Service Order Form CoreLogic

Using the Individual Residential Tax Service Order Form CoreLogic involves several straightforward steps. First, gather all necessary information, including property details and personal identification. Next, complete the form by providing accurate data in each required field. After filling out the form, review it for any errors or omissions. Finally, submit the form through the designated method, ensuring that all supporting documents are included as needed.

Steps to complete the Individual Residential Tax Service Order Form CoreLogic

Completing the Individual Residential Tax Service Order Form CoreLogic requires attention to detail. Follow these steps for a successful submission:

- Obtain the form from the official source.

- Fill in your personal information, including name, address, and contact details.

- Provide specific property information, such as the property address and tax identification number.

- Indicate the type of service requested, ensuring clarity on your needs.

- Review the form for accuracy and completeness.

- Submit the form online or via mail, as instructed.

Legal use of the Individual Residential Tax Service Order Form CoreLogic

The Individual Residential Tax Service Order Form CoreLogic is legally binding when completed correctly. To ensure its validity, it must comply with relevant eSignature laws, including the ESIGN Act and UETA. This means that electronic signatures obtained through a reliable platform, like signNow, are recognized as legally enforceable. Proper execution of the form protects both the requester and CoreLogic in any legal context.

Key elements of the Individual Residential Tax Service Order Form CoreLogic

Several key elements must be included in the Individual Residential Tax Service Order Form CoreLogic to ensure its effectiveness:

- Personal Information: Full name, address, and contact details of the requester.

- Property Details: Address and tax identification number of the property in question.

- Service Requested: Clear indication of the specific tax service or information needed.

- Signature: A legally binding signature, either electronic or handwritten, confirming the request.

Form Submission Methods

The Individual Residential Tax Service Order Form CoreLogic can be submitted through various methods, ensuring flexibility for users. The primary submission options include:

- Online Submission: Complete and submit the form electronically via the designated platform.

- Mail: Print the completed form and send it to the specified address.

- In-Person: Deliver the form directly to a CoreLogic office, if applicable.

Quick guide on how to complete individual residential tax service order form corelogic

Prepare Individual Residential Tax Service Order Form CoreLogic seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents swiftly without delays. Manage Individual Residential Tax Service Order Form CoreLogic on any device with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to edit and eSign Individual Residential Tax Service Order Form CoreLogic effortlessly

- Locate Individual Residential Tax Service Order Form CoreLogic and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all information and click the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Individual Residential Tax Service Order Form CoreLogic and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the individual residential tax service order form corelogic

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Individual Residential Tax Service Order Form CoreLogic?

The Individual Residential Tax Service Order Form CoreLogic is a convenient document designed to help you request residential tax services efficiently. It streamlines the process of obtaining accurate tax data and assessments. By utilizing this form, customers can ensure they receive prompt responses related to property tax inquiries.

-

How do I submit the Individual Residential Tax Service Order Form CoreLogic?

Submitting the Individual Residential Tax Service Order Form CoreLogic is straightforward. Simply fill in the required details and eSign the document using airSlate SignNow's platform. This ensures a secure, paperless submission that speeds up processing times for your tax service requests.

-

What are the key features of the Individual Residential Tax Service Order Form CoreLogic?

Key features of the Individual Residential Tax Service Order Form CoreLogic include easy-to-understand sections for property details and customizable options for specific tax services. Additionally, the form integrates seamlessly with airSlate SignNow's eSigning capabilities, making it simple to complete and send. Users can also track the status of their requests in real-time.

-

Is the Individual Residential Tax Service Order Form CoreLogic available for all states?

Yes, the Individual Residential Tax Service Order Form CoreLogic is designed to be applicable across all states. However, certain local requirements may vary, so it's essential to ensure that the information provided aligns with your state regulations. This adaptability makes it a versatile tool for property owners nationwide.

-

How much does the Individual Residential Tax Service Order Form CoreLogic cost?

The Individual Residential Tax Service Order Form CoreLogic is part of airSlate SignNow's cost-effective service offerings. Pricing may vary depending on specific integrations and features you choose to include. It’s advisable to review the pricing plans on our website for detailed information on your options and potential savings.

-

What benefits do I gain from using the Individual Residential Tax Service Order Form CoreLogic?

Using the Individual Residential Tax Service Order Form CoreLogic signNowly simplifies the process of managing property tax inquiries. It saves time with a streamlined workflow, reduces errors through an easy-to-follow format, and enhances communication regarding your requests. This leads to a more efficient experience with tax service providers.

-

Can I integrate the Individual Residential Tax Service Order Form CoreLogic with other tools?

Yes, the Individual Residential Tax Service Order Form CoreLogic can be easily integrated with various third-party tools and platforms. airSlate SignNow offers a range of integration options to ensure that your workflow remains smooth and cohesive. This allows you to enhance functionality and improve overall productivity.

Get more for Individual Residential Tax Service Order Form CoreLogic

Find out other Individual Residential Tax Service Order Form CoreLogic

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple

- Can I eSignature New York Bulk Sale Agreement

- How Do I Electronic signature Tennessee Web Hosting Agreement

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile

- How To Electronic signature Colorado Stock Transfer Form Template