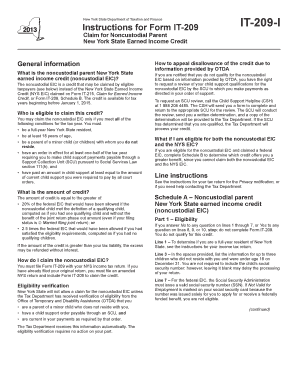

Nys It209 Form

What is the Nys It209 Form

The Nys IT-209 Form is a tax document used by residents of New York State to claim a credit for taxes paid to other jurisdictions. This form is essential for individuals who have earned income in multiple states and seek to avoid double taxation. By filing the IT-209, taxpayers can report their tax liability accurately and ensure they receive the appropriate credits for taxes paid outside of New York.

How to obtain the Nys It209 Form

The Nys IT-209 Form can be obtained from the New York State Department of Taxation and Finance website. It is available in a downloadable PDF format, allowing taxpayers to print and fill it out manually. Additionally, the form may be accessible through various tax preparation software that supports New York State tax filings. It is advisable to ensure you have the latest version of the form to comply with current tax regulations.

Steps to complete the Nys It209 Form

Completing the Nys IT-209 Form involves several key steps:

- Gather all necessary documentation, including W-2s and any tax returns from other states.

- Fill out your personal information, including your name, address, and Social Security number.

- Report your income earned in New York and other states as instructed on the form.

- Calculate the credit for taxes paid to other jurisdictions by following the provided guidelines.

- Review the completed form for accuracy before submitting it.

Legal use of the Nys It209 Form

The Nys IT-209 Form serves a legal purpose by allowing taxpayers to claim credits that help reduce their overall tax liability. It is important to ensure that all information provided on the form is accurate and truthful, as any discrepancies may lead to penalties or audits by the New York State Department of Taxation and Finance. Proper use of the form is essential for compliance with state tax laws.

Form Submission Methods

The Nys IT-209 Form can be submitted in several ways:

- Online: Taxpayers can file the form electronically through approved tax software that supports New York State forms.

- By Mail: The completed form can be mailed to the appropriate address provided in the form instructions.

- In-Person: Some taxpayers may choose to submit their forms in person at local tax offices, although this option may vary based on current regulations.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Nys IT-209 Form to avoid penalties. Typically, the form must be submitted by the same deadline as the New York State personal income tax return, which is usually April fifteenth. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should always check for any updates or changes to deadlines each tax year.

Quick guide on how to complete nys it209 form

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly and without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications, and enhance any document-based task today.

How to Edit and eSign [SKS] with Ease

- Locate [SKS] and then click Get Form to initiate the process.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign feature, which takes only seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that require new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign [SKS] and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Nys It209 Form

Create this form in 5 minutes!

How to create an eSignature for the nys it209 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Nys It209 Form?

The Nys It209 Form is a tax form used by residents of New York State to report certain types of income and calculate their state income tax liability. It is essential for individuals who need to file their state taxes accurately and efficiently. Understanding the Nys It209 Form is crucial for ensuring compliance with New York tax laws.

-

How can SignNow help with the Nys It209 Form?

SignNow provides a seamless way to eSign and send the Nys It209 Form securely and efficiently. With its user-friendly interface, you can quickly complete the form and gather necessary signatures, making the filing process straightforward. This can save you time and ensure that your paperwork is handled accurately.

-

Is there a cost associated with using SignNow for the Nys It209 Form?

Yes, SignNow offers various pricing plans tailored to different business needs, including options for individuals and enterprises. The cost is based on the features you require, such as document templates and team collaboration. Investing in SignNow can enhance your experience with the Nys It209 Form and improve your document management.

-

What features does SignNow offer for managing the Nys It209 Form?

SignNow provides a range of features designed to simplify the management of the Nys It209 Form, such as customizable templates, automated workflows, and robust security measures. The platform allows for easy sharing and tracking of documents, ensuring that all parties involved can access the Nys It209 Form efficiently and securely.

-

Can I integrate SignNow with other applications for the Nys It209 Form?

Absolutely! SignNow offers integrations with popular applications like Google Drive, Dropbox, and Microsoft Office, making it easy to manage the Nys It209 Form alongside your other documents. These integrations help streamline your workflow, allowing for better organization and faster access to your signed tax forms.

-

What are the benefits of using SignNow for the Nys It209 Form?

Using SignNow for the Nys It209 Form provides numerous benefits, including faster turnaround times for document signing, enhanced security for sensitive information, and easy document tracking. This can signNowly reduce the hassle of traditional paper forms and ensure you meet your filing deadlines efficiently.

-

Is SignNow easy to use for the Nys It209 Form?

Yes, SignNow is designed with user-friendliness in mind, making it easy for anyone to complete and eSign the Nys It209 Form. The intuitive interface requires no prior experience with eSigning tools, allowing you to focus on getting your taxes filed without unnecessary complications.

Get more for Nys It209 Form

- Application for a social insurance number information guide

- Notification to register change details of or cease form

- 2018 2020 form ssa ss 5 fs fill online printable fillable

- Application for 100 concession charitable organisations code 430 form e58 application for 100 concession charitable

- Statutory declaration register of lobbyists form

- Adult travel document application form pptc 190 canadaca

- Protected when completed form

- Httpsapi5ilovepdfcomv1download pinterest form

Find out other Nys It209 Form

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament