Ftb 2518 Llc Form

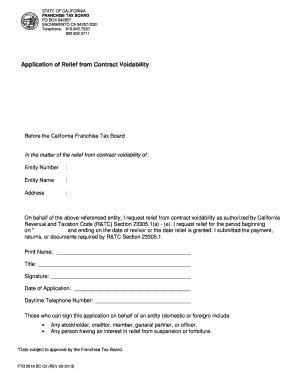

What is the FTB 2518 BC?

The FTB 2518 BC is a form used by individuals and businesses in California to apply for relief from certain tax obligations. This form is particularly relevant for those seeking to address issues related to tax liabilities, such as penalties or interest associated with late payments or filings. Understanding the purpose of this form is crucial for ensuring compliance with state tax regulations and for effectively managing tax responsibilities.

How to Use the FTB 2518 BC

Using the FTB 2518 BC involves several key steps. First, gather all necessary information related to your tax situation, including any relevant financial documents. Next, accurately complete the form, ensuring that all required fields are filled out correctly. Pay special attention to any instructions provided on the form, as these will guide you in providing the necessary details for your application. Once completed, you can submit the form either online or via mail, depending on your preference and the options available.

Steps to Complete the FTB 2518 BC

Completing the FTB 2518 BC requires careful attention to detail. Follow these steps for a smooth process:

- Review the eligibility criteria to ensure you qualify for relief.

- Collect supporting documents that substantiate your request.

- Fill out the form accurately, providing all requested information.

- Double-check your entries for accuracy and completeness.

- Submit the form through the preferred method, ensuring you keep a copy for your records.

Legal Use of the FTB 2518 BC

The legal use of the FTB 2518 BC is governed by California tax regulations. To ensure that your application is valid, it is essential to comply with all relevant laws and guidelines. This includes providing truthful information and adhering to deadlines for submission. Failure to comply with these legal requirements may result in rejection of your application or additional penalties.

Eligibility Criteria

To qualify for relief using the FTB 2518 BC, applicants must meet specific eligibility criteria set forth by the California Franchise Tax Board. Generally, this includes being a taxpayer who has incurred penalties or interest due to circumstances beyond their control, such as natural disasters or serious illness. It is important to review the detailed criteria outlined by the FTB to determine if you meet the necessary conditions for submitting this form.

Form Submission Methods

The FTB 2518 BC can be submitted through various methods, allowing flexibility for applicants. You may choose to file the form online through the California Franchise Tax Board's website, which often provides a faster processing time. Alternatively, you can mail a completed paper form to the appropriate address specified on the form. In-person submissions may also be possible at designated tax offices, depending on current policies and availability.

Quick guide on how to complete ftb 2518 llc

Effortlessly Prepare Ftb 2518 Llc on Any Device

Managing documents online has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents promptly and without delays. Manage Ftb 2518 Llc on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

Editing and eSigning Ftb 2518 Llc with Ease

- Locate Ftb 2518 Llc and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or conceal sensitive information using the tools airSlate SignNow provides for that purpose.

- Create your electronic signature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form searches, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign Ftb 2518 Llc to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ftb 2518 llc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ftb 2518 bc form used for?

The ftb 2518 bc form is utilized by businesses in California to report the sale of property or interest in it. Completing this form accurately is vital for compliance and ensures that all tax obligations are met. By using airSlate SignNow, you can easily eSign and submit the ftb 2518 bc, streamlining your tax documentation process.

-

How can airSlate SignNow help with the ftb 2518 bc form?

airSlate SignNow simplifies the process of completing the ftb 2518 bc form by providing templates and eSigning features. This enhances efficiency and reduces the risk of errors in filling out the form as your team can sign off on documents electronically. With this solution, the workflow for your ftb 2518 bc form can be completed seamlessly.

-

Is there a cost associated with using airSlate SignNow for the ftb 2518 bc?

Yes, while airSlate SignNow offers various pricing options, it's a cost-effective solution for managing your ftb 2518 bc needs. The value of avoiding potential penalties through accurate filings and streamlined processes makes the investment worthwhile for businesses. You can choose a plan that fits your volume of document management needs.

-

What features does airSlate SignNow offer for the ftb 2518 bc form?

airSlate SignNow provides numerous features for handling the ftb 2518 bc form, including customizable templates, eSigning, document tracking, and secure cloud storage. These tools ensure that your documents are not only legal and compliant but also accessible from anywhere. These features enhance your ability to manage the ftb 2518 bc process efficiently.

-

Can I integrate airSlate SignNow with other tools for the ftb 2518 bc form?

Absolutely! airSlate SignNow offers integrations with popular applications such as Google Drive, Salesforce, and Microsoft Office, which can help you manage the ftb 2518 bc form more effectively. These integrations enable you to import and export documents seamlessly, enhancing your overall productivity during tax season.

-

What benefits does airSlate SignNow provide for filing the ftb 2518 bc?

The benefits of using airSlate SignNow for filing the ftb 2518 bc include increased efficiency, reduced paperwork, and enhanced security. By utilizing eSigning and cloud capabilities, you can ensure that your documents are signed and stored securely, while also saving time on manual processes. This ultimately leads to more accurate and timely submissions of your ftb 2518 bc.

-

How secure is my information when using airSlate SignNow for the ftb 2518 bc?

When you use airSlate SignNow for your ftb 2518 bc form, your information is protected through industry-standard encryption and secure storage practices. This ensures that sensitive financial information remains confidential and secure throughout the signing process. Trust in airSlate SignNow's commitment to data security and compliance.

Get more for Ftb 2518 Llc

Find out other Ftb 2518 Llc

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe