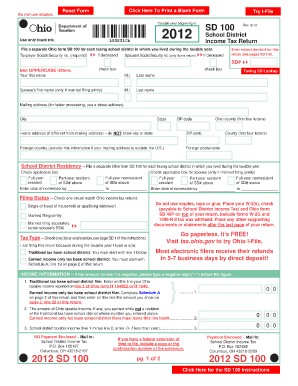

Ohio Sd100 Form

What is the Ohio Sd100 Form

The Ohio Sd100 Form is a state-specific document used primarily for reporting income and calculating tax liabilities for individuals and businesses within Ohio. This form is essential for taxpayers who need to declare their income, deductions, and credits accurately. It is designed to ensure compliance with Ohio tax laws and regulations.

How to use the Ohio Sd100 Form

Using the Ohio Sd100 Form involves several steps to ensure accurate completion and submission. First, gather all necessary financial information, including income statements, deductions, and any applicable credits. Next, fill out the form carefully, ensuring that all sections are completed accurately. Once the form is filled out, it can be submitted either electronically or via traditional mail, depending on the preferences of the taxpayer.

Steps to complete the Ohio Sd100 Form

Completing the Ohio Sd100 Form requires attention to detail. Follow these steps:

- Gather all relevant financial documents, such as W-2s, 1099s, and receipts for deductions.

- Begin filling out the form by entering personal information, including your name, address, and Social Security number.

- Report your total income from all sources in the designated section.

- List any deductions you are eligible for, ensuring you have supporting documentation.

- Calculate your total tax liability based on the information provided.

- Review the completed form for accuracy before submission.

Legal use of the Ohio Sd100 Form

The Ohio Sd100 Form is legally binding when completed and submitted according to state regulations. To ensure its validity, it must be filled out accurately and submitted by the appropriate deadlines. Compliance with all applicable tax laws is crucial to avoid penalties and ensure that the form is accepted by the Ohio Department of Taxation.

Filing Deadlines / Important Dates

Filing deadlines for the Ohio Sd100 Form are typically aligned with federal tax deadlines. Generally, the form must be submitted by April 15 of each year for the previous tax year. However, taxpayers should always verify specific deadlines, as extensions may apply in certain circumstances, such as natural disasters or other state-specific allowances.

Required Documents

To complete the Ohio Sd100 Form, several documents are necessary. These may include:

- W-2 forms from employers

- 1099 forms for additional income sources

- Receipts for deductible expenses

- Any relevant tax credits documentation

Form Submission Methods (Online / Mail / In-Person)

The Ohio Sd100 Form can be submitted through various methods. Taxpayers may choose to file online using the Ohio Department of Taxation's e-filing system, which is often the quickest option. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. Each method has its own processing times and requirements, so it's important to choose the one that best fits your needs.

Quick guide on how to complete ohio sd100 form

Effortlessly prepare Ohio Sd100 Form on any device

The management of online documents has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily locate the correct form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Manage Ohio Sd100 Form on any device using the airSlate SignNow apps available for Android or iOS, and streamline your document-related processes today.

The easiest way to edit and eSign Ohio Sd100 Form seamlessly

- Locate Ohio Sd100 Form and click on Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow has specifically designed for this purpose.

- Produce your eSignature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Ohio Sd100 Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ohio sd100 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ohio Sd100 Form?

The Ohio Sd100 Form is a tax document used by businesses in Ohio to report and remit various state taxes. Understanding this form is crucial for compliance with Ohio state tax regulations. With airSlate SignNow, you can easily fill out and eSign your Ohio Sd100 Form, ensuring accurate and timely submissions.

-

How can airSlate SignNow help with the Ohio Sd100 Form?

airSlate SignNow streamlines the process of completing and submitting the Ohio Sd100 Form. Our platform allows you to fill out the form digitally, add your signature, and send it directly to the appropriate state agency. This not only saves time but also reduces the risk of errors in your tax filings.

-

Is there a cost associated with using airSlate SignNow for the Ohio Sd100 Form?

airSlate SignNow offers a variety of pricing plans to accommodate different business needs when handling the Ohio Sd100 Form. You can choose a plan that suits your budget and workload. Please visit our pricing page for detailed information on costs and features.

-

What features does airSlate SignNow provide for the Ohio Sd100 Form?

With airSlate SignNow, you get a user-friendly interface, customizable templates, and the ability to store documents securely. Our platform supports electronic signatures and document tracking, making it easy to manage your Ohio Sd100 Form efficiently. These features help businesses stay organized and compliant.

-

Can I integrate airSlate SignNow with other applications for my Ohio Sd100 Form?

Yes, airSlate SignNow offers various integrations with popular business applications. This means you can connect tools you already use to enhance your workflow related to the Ohio Sd100 Form. Easy integration helps streamline the document management process further.

-

What benefits does using airSlate SignNow provide for the Ohio Sd100 Form?

Using airSlate SignNow for the Ohio Sd100 Form offers numerous benefits, including increased efficiency, reduced paper clutter, and enhanced accuracy. The platform’s ease of use allows users to complete their tax forms faster while ensuring compliance with state requirements. Additionally, tracking options keep you informed about the document status.

-

Is airSlate SignNow compliant with Ohio regulations for the Ohio Sd100 Form?

Absolutely, airSlate SignNow complies with all relevant Ohio regulations for electronic signatures and document submissions, including the Ohio Sd100 Form. Our solution is designed to meet legal requirements, ensuring that your eSigned documents will be valid and accepted by state authorities. Trust airSlate SignNow for reliable submissions.

Get more for Ohio Sd100 Form

- Parent acknowledgement form texas 2006 2019

- Google and georgia medical board aprn registration forms 2014 2018

- Guam nursing license renewal 2014 2019 form

- Home other form

- Iowa medicaid provider agreement general terms form

- Request to modify a child support order iowa department of secureapp dhs state ia form

- Iowa department of public health certificate of immunization form

- 470 0188 2016 2019 form

Find out other Ohio Sd100 Form

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word