Form 941 Rev January Employer's Quarterly Federal Tax Return Irs

What is the Form 941 Rev January Employer's Quarterly Federal Tax Return IRS

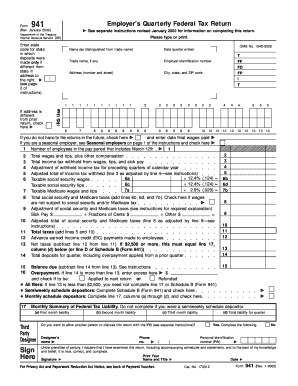

The Form 941 Rev January Employer's Quarterly Federal Tax Return is a crucial document used by employers in the United States to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form is essential for employers to accurately report their tax liabilities and ensure compliance with federal tax regulations. The IRS requires this form to be filed quarterly, reflecting the employment tax obligations for each quarter of the year. Understanding this form is vital for maintaining proper tax records and fulfilling legal responsibilities as an employer.

Steps to complete the Form 941 Rev January Employer's Quarterly Federal Tax Return IRS

Completing the Form 941 Rev January involves several key steps to ensure accuracy and compliance. First, gather all necessary payroll records, including total wages paid, tips received, and the amount of federal income tax withheld. Next, fill out the form by entering the required information in the designated fields, such as the number of employees and the total taxes owed. It's essential to double-check all calculations to prevent errors. After completing the form, sign it electronically or manually, depending on your submission method. Finally, submit the form to the IRS by the due date to avoid penalties.

How to use the Form 941 Rev January Employer's Quarterly Federal Tax Return IRS

The Form 941 Rev January is used primarily for reporting and paying employment taxes. Employers must utilize this form to report wages, tips, and other compensation paid to employees. It also includes information about the taxes withheld from employees' paychecks, such as federal income tax and FICA taxes. By accurately completing this form, employers can ensure they meet their tax obligations and avoid potential fines or penalties from the IRS. Additionally, the form serves as a record of tax payments made throughout the year, which can be useful for future reference or audits.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines for the Form 941 Rev January to remain compliant with IRS regulations. The form is due on the last day of the month following the end of each quarter. For example, the deadlines are April 30 for the first quarter, July 31 for the second quarter, October 31 for the third quarter, and January 31 for the fourth quarter. Timely submission is crucial to avoid penalties and interest on unpaid taxes. Employers should mark these dates on their calendars to ensure they meet their filing obligations.

Legal use of the Form 941 Rev January Employer's Quarterly Federal Tax Return IRS

The legal use of the Form 941 Rev January is governed by federal tax laws, which mandate that employers accurately report and pay employment taxes. This form serves as a legal document that reflects an employer's compliance with tax obligations. Proper completion and timely submission of the form are essential to avoid legal repercussions, such as fines or audits. Additionally, electronic signatures on the form are legally binding, provided they comply with regulations such as the ESIGN Act and UETA, ensuring that the form is valid and enforceable.

How to obtain the Form 941 Rev January Employer's Quarterly Federal Tax Return IRS

Employers can obtain the Form 941 Rev January from the IRS website or through tax preparation software. The form is available for download in PDF format, allowing employers to print and fill it out manually or complete it electronically. Additionally, many tax professionals can provide assistance in obtaining and completing this form. It is important for employers to ensure they are using the most current version of the form to comply with IRS requirements.

Quick guide on how to complete form 941 rev january employers quarterly federal tax return irs

Complete Form 941 Rev January Employer's Quarterly Federal Tax Return Irs effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without any delays. Handle Form 941 Rev January Employer's Quarterly Federal Tax Return Irs on any device with airSlate SignNow’s Android or iOS applications and simplify your document-related processes today.

The simplest way to adjust and eSign Form 941 Rev January Employer's Quarterly Federal Tax Return Irs effortlessly

- Find Form 941 Rev January Employer's Quarterly Federal Tax Return Irs and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive details with the tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal authority as a traditional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate the stress of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 941 Rev January Employer's Quarterly Federal Tax Return Irs while ensuring clear communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 941 rev january employers quarterly federal tax return irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 941 Rev January Employer's Quarterly Federal Tax Return Irs?

Form 941 Rev January Employer's Quarterly Federal Tax Return Irs is a form that employers use to report income taxes, Social Security tax, and Medicare tax withheld from employee’s paychecks and to pay the employer's portion of Social Security and Medicare tax. Understanding this form is crucial for compliance with IRS regulations.

-

How can airSlate SignNow help with Form 941 Rev January Employer's Quarterly Federal Tax Return Irs?

airSlate SignNow streamlines the process of preparing and submitting your Form 941 Rev January Employer's Quarterly Federal Tax Return Irs. Our eSignature solution allows businesses to electronically sign and store necessary documents securely, ensuring a seamless filing experience.

-

What are the pricing options for airSlate SignNow when dealing with Form 941 Rev January Employer's Quarterly Federal Tax Return Irs?

We offer flexible pricing plans tailored to the needs of businesses of all sizes. Each plan includes features that facilitate the preparation and eSigning of Form 941 Rev January Employer's Quarterly Federal Tax Return Irs, ensuring you get the best value for your investment.

-

Is airSlate SignNow compliant with IRS regulations for Form 941 Rev January Employer's Quarterly Federal Tax Return Irs?

Yes, airSlate SignNow is fully compliant with IRS regulations, providing the necessary security and authentication measures required when handling Form 941 Rev January Employer's Quarterly Federal Tax Return Irs. You can trust that your information is protected and meets all regulatory standards.

-

What features does airSlate SignNow offer for managing Form 941 Rev January Employer's Quarterly Federal Tax Return Irs?

Our platform offers a range of features designed to simplify the management of Form 941 Rev January Employer's Quarterly Federal Tax Return Irs, including electronic signatures, document templates, and tracking capabilities. These tools help ensure that your forms are accurate and submitted on time.

-

Can I integrate airSlate SignNow with other software for handling Form 941 Rev January Employer's Quarterly Federal Tax Return Irs?

Absolutely! airSlate SignNow supports integrations with various accounting and tax software solutions. This functionality makes it easy to manage your Form 941 Rev January Employer's Quarterly Federal Tax Return Irs alongside your other financial documents and tasks.

-

How does airSlate SignNow ensure document security for Form 941 Rev January Employer's Quarterly Federal Tax Return Irs?

airSlate SignNow employs advanced security measures, including encryption and secure access protocols, to protect documents related to Form 941 Rev January Employer's Quarterly Federal Tax Return Irs. Your data remains confidential and secure throughout the eSigning process.

Get more for Form 941 Rev January Employer's Quarterly Federal Tax Return Irs

- Ceo victorian statutory declaration form for use from 1 july 2014 2 lobbyistsregister vic gov

- Sum 130 unlawful detainer eviction judicial council forms

- If you are deaf or form

- About form w 12 irs paid preparer tax identification number

- Employers basic report of injury wc 100 form

- Sp services ltd form

- United petsafe customer acknowledgement form

- Claim form virgin atlantic

Find out other Form 941 Rev January Employer's Quarterly Federal Tax Return Irs

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors