BORROWER FINANCIAL INFORMATION Flagstar

What is the BORROWER FINANCIAL INFORMATION Flagstar

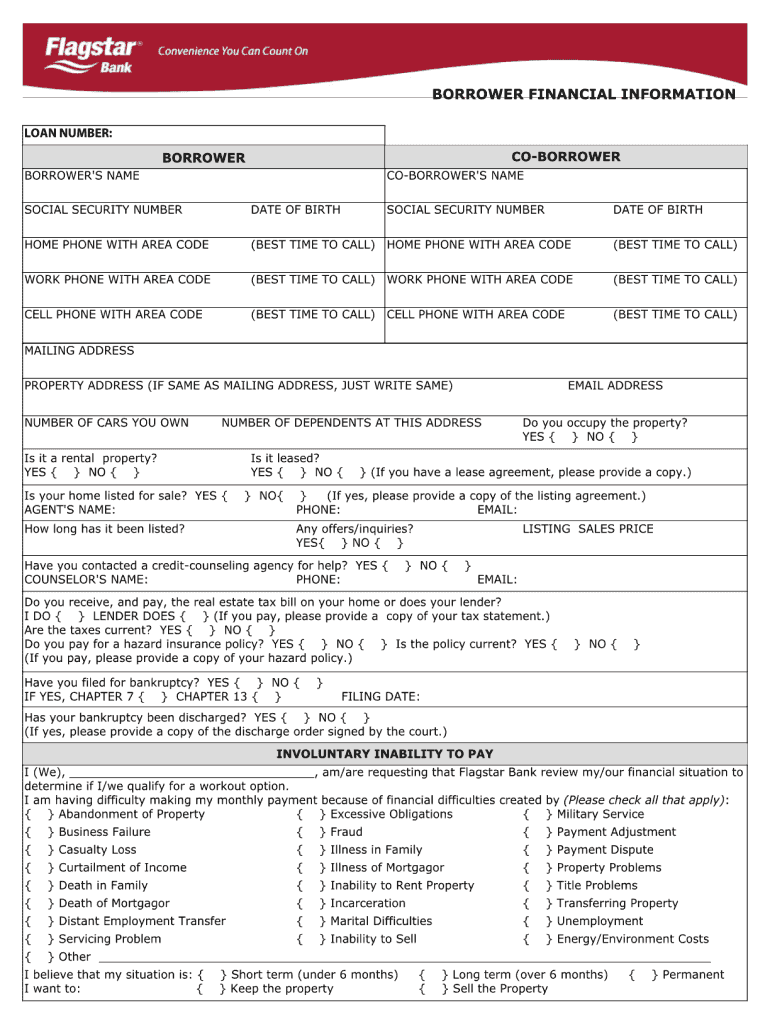

The BORROWER FINANCIAL INFORMATION Flagstar is a crucial document used in the mortgage application process. This form collects essential financial details from borrowers, including income, assets, liabilities, and credit history. By providing this information, borrowers enable lenders to assess their financial stability and determine eligibility for loan products. The accuracy and completeness of the information are vital, as they influence the approval process and loan terms.

Steps to complete the BORROWER FINANCIAL INFORMATION Flagstar

Completing the BORROWER FINANCIAL INFORMATION Flagstar involves several key steps:

- Gather necessary financial documents, such as pay stubs, bank statements, and tax returns.

- Fill in personal information, including your name, address, and Social Security number.

- Detail your income sources, specifying amounts and frequency.

- List your assets, including savings accounts, investments, and real estate.

- Disclose liabilities, such as credit card debts, loans, and mortgages.

- Review all information for accuracy before submission.

Legal use of the BORROWER FINANCIAL INFORMATION Flagstar

The BORROWER FINANCIAL INFORMATION Flagstar must be completed in compliance with applicable laws and regulations. This includes ensuring that all information provided is truthful and accurate. Misrepresentation can lead to legal repercussions, including loan denial or fraud charges. Additionally, the use of eSignatures for submitting this form is legally recognized under the ESIGN and UETA acts, provided that proper authentication measures are in place.

Key elements of the BORROWER FINANCIAL INFORMATION Flagstar

Several key elements are essential when filling out the BORROWER FINANCIAL INFORMATION Flagstar:

- Personal Information: Name, address, and Social Security number.

- Income Details: Employment history, salary, bonuses, and other income sources.

- Assets: Bank accounts, retirement accounts, real estate, and other valuable possessions.

- Liabilities: Existing debts, including credit cards, loans, and mortgages.

- Credit History: Information regarding credit scores and any past delinquencies.

How to use the BORROWER FINANCIAL INFORMATION Flagstar

Using the BORROWER FINANCIAL INFORMATION Flagstar involves accurately completing the form and submitting it to your lender. Ensure that all sections are filled out completely and truthfully. After filling out the form, you can submit it electronically through a secure platform, or print and mail it if required. Utilizing digital solutions can streamline the process, allowing for quicker processing times and easier tracking of your application status.

Who Issues the Form

The BORROWER FINANCIAL INFORMATION Flagstar is typically issued by Flagstar Bank or other lending institutions as part of their mortgage application process. This form is a standard requirement for borrowers seeking financing and is designed to provide lenders with a comprehensive view of the borrower's financial situation. It is important to obtain the most current version of the form directly from the lender to ensure compliance with their specific requirements.

Quick guide on how to complete borrower financial information flagstar

Complete BORROWER FINANCIAL INFORMATION Flagstar with ease on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute to traditional printed and signed documents, as you can easily access the right form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without any holdups. Manage BORROWER FINANCIAL INFORMATION Flagstar on any device through airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest method to modify and eSign BORROWER FINANCIAL INFORMATION Flagstar effortlessly

- Obtain BORROWER FINANCIAL INFORMATION Flagstar and click on Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of the documents or mask sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes just seconds and possesses the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign BORROWER FINANCIAL INFORMATION Flagstar while ensuring exceptional communication at every stage of your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill out FAFSA without my kid seeing all my financial information?

You will have a FSA ID. Keep it somewhere secure and where you can find it when it is needed again over the time your kid is in college. Use this ID to “sign” the parent’s part of the FAFSA.Your student will have their own FSA ID. They need to keep it somewhere secure and where they can find it when it is needed again over the time they are in college. They will use the ID to “sign” their part of the FAFSA.There is no need to show your student your part of the FAFSA. I do suggest you just casually offer to help your student fill out their part of the form.The Parent’s Guide to Filling Out the FAFSA® Form - ED.gov BlogThe FAFSA for school year 2018–19 has been available since October 1. Some financial aid is first come-first served. I suggest you get on with this.How to Fill Out the FAFSA, Step by StepNotes:Reading the other answers brings up some other points:The student pin was replaced by the parent’s FSA ID and the student’s FSA ID in May, 2015. Never the twain need meet.Families each need to deal with three issues in their own way:AffordabilityIf you read my stuff you know I am a devotee of Frank Palmasani’s, Right College, Right Price. His book describes an “affordability” exercise with the parents and the student. The purpose is to determine what the family can afford to spend on post-secondary education and to SET EXPECTATIONS. He’s not talking about putting your 1040 on the dining room table, but sharing some of the basics of family finances.I get the impression that many families ignore this issue. I have a study that shows five out of eight students assume their families are going to pay for college regardless of cost. Most of these students are in for a big surprise.PrivacySome parents may want to hold their “financial cards” closer to their chest than others. In my opinion that’s OK. I suppose an 18 year old kid, theoretically, has the right to keeping his finances private. My approach to this would not be to make a big deal out of it but to offer to help them fill out their part of the FAFSA. The main objective should be to get the FAFSA filled out properly, in a timely fashion.FraudThis is absolutely not acceptable, and, hopefully, those who try it get caught and suffer the consequences. (I had a conversation with a father recently who was filling out the CSS Profile. He wasn’t intent on committing fraud. He thought he was being clever in defining assets. After our conversation he had to file a signNow revision. This revision was a good thing because two or three years from now his mistake was going to come to light. I’m not sure what the consequences of all that would have been, but, at a minimum, it would have been a big mess to unwind.)

-

How do banks gather monthly or quarterly financial information from their small business borrowers?

Small business lending is generally regarded as a similar activity to retail banking, albeit the customers are business rather than personal.There a number of specialized small business lending packages from solution providers that support loan origination and administration.... listed here on Bobs Guide (http://www.bobsguide.com/cgi-bin...).Best practice in a given country is driven by the local business culture and financial regulation. Large international banks such as HSBC engage in small business lending in many different countries. They try to maintain consistency by using the same system and rolling it into different territories.The gathering of financial information on small business clients tends to be an activity that takes place at the time the loan is being set up (a process known as loan origination). This data is input to the loan origination system, along with reports from the credit bureau - it is then either manually assessed by an underwriter or it may be automatically assessed by a loan origination system using statistical analysis and applying rules based on business criteria. Where the automated lending systems reject an application, it may be referred to an underwriter, or it may be given a straight rejection.As of 2012, many banks in the European Union and the United States are going through a process of deleveraging (shrinking their total levels of lending) which is causing a tightening of lending to small businesses with knock-on effects to the wider economy. (http://www.ft.com/intl/cms/s/0/6...)

-

How can I add my business location on instagram"s suggested locations?

Making a custom location on Instagram is actually quite easy and gives you an advantage to other businesses because it allows you to drive traffic via location.First off, Facebook owns Instagram; therefore, any location listed on Facebook also appears on Instagram. So you are going to need to create a business location on Facebook.So let’s dive into how to create a business location on Instagram.Make sure that you have enabled location services through the Facebook App or in your phone settings. If you are using an iPhone, select “Settings” → “Account Settings” → “Location” → “While Using The App”You need to create a Facebook check-in status. You do this by making a status and type the name of what you want your location to be called. For example “Growth Hustlers HQ”. Scroll to the bottom of the options and select “Add Custom Location” then tap on it!Now that you’ve created a custom location you need to describe it. It will ask you to choose which category describes your location, which you will answer “Business”.After choosing a category Facebook will ask you to choose a location. You can either choose “I’m currently here” or you can search for a location that you want to create for your business.Finally, publish your status. Congratulations! You have just created a custom location to be used on Facebook and Instagram.Now you are able to tag your business or a custom location on Instagram.If you have any questions about Social Media Marketing for businesses feel free to check out GrowthHustlers.com where you can find tons of resources about growing your Instagram following.

-

Do you have to fill out a FAFSA if financial aid is not needed?

You are going to be in college for several years. Life has a way of throwing curveballs. What if one of your parents dies or loses their job? What would happen in the event of a divorce?Some financial aid opportunities are only available if you have filed since your Freshman year. Play it safe. Filing is not that complicated.I learned this on Quora. There was a young lady entering into her junior year. Something had changed in her family's circumstances (unspecified).

-

Is the information I fill out about myself on the PSAT/SAT tests sold to colleges?

A lot of these questions are used in the Student Search Service for colleges who are looking to signNow out to a specific group of students. If you opted in for that, you will definitely get a considerable amount of mail/email.

-

How do you fill out the NYSDI information on your W2?

Typically SDI tax is reported in box 14 of form W2. Page on irs.gov

Create this form in 5 minutes!

How to create an eSignature for the borrower financial information flagstar

How to generate an eSignature for your Borrower Financial Information Flagstar online

How to make an eSignature for your Borrower Financial Information Flagstar in Chrome

How to make an electronic signature for signing the Borrower Financial Information Flagstar in Gmail

How to create an eSignature for the Borrower Financial Information Flagstar right from your smart phone

How to create an electronic signature for the Borrower Financial Information Flagstar on iOS

How to generate an electronic signature for the Borrower Financial Information Flagstar on Android

People also ask

-

What is BORROWER FINANCIAL INFORMATION Flagstar?

BORROWER FINANCIAL INFORMATION Flagstar refers to the critical financial data required by Flagstar Bank to process loan applications and mortgages. This information typically includes income, assets, debts, and credit history. Providing accurate and complete BORROWER FINANCIAL INFORMATION Flagstar helps streamline the approval process.

-

How does airSlate SignNow facilitate the sharing of BORROWER FINANCIAL INFORMATION Flagstar?

airSlate SignNow allows businesses to securely send and eSign documents that contain BORROWER FINANCIAL INFORMATION Flagstar. Its intuitive interface makes it easy for users to collect and share sensitive information while ensuring compliance with data protection regulations. This improves communication between borrowers and lenders.

-

Is there a cost associated with using airSlate SignNow for BORROWER FINANCIAL INFORMATION Flagstar?

Yes, airSlate SignNow offers various pricing plans designed to accommodate different business needs when handling BORROWER FINANCIAL INFORMATION Flagstar. Each plan provides unique features and capabilities to help you manage document workflows effectively. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing BORROWER FINANCIAL INFORMATION Flagstar?

airSlate SignNow offers a range of features specifically designed for handling BORROWER FINANCIAL INFORMATION Flagstar, including document templates, secure eSigning, and customizable workflows. The platform allows users to track the status of documents and ensure they are signed quickly and correctly. These tools streamline the entire document management process.

-

How secure is my BORROWER FINANCIAL INFORMATION Flagstar when using airSlate SignNow?

Security is a priority for airSlate SignNow, and measures are in place to protect your BORROWER FINANCIAL INFORMATION Flagstar. The platform uses encryption, secure data storage, and multi-factor authentication to safeguard sensitive information. This commitment to security gives users confidence when sharing financial details.

-

Can airSlate SignNow integrate with other tools for managing BORROWER FINANCIAL INFORMATION Flagstar?

Absolutely! airSlate SignNow can integrate with various business applications that help manage BORROWER FINANCIAL INFORMATION Flagstar more effectively. These integrations can include CRM systems, document storage solutions, and accounting software, enhancing productivity and creating a seamless workflow.

-

What are the benefits of using airSlate SignNow for BORROWER FINANCIAL INFORMATION Flagstar?

Using airSlate SignNow for BORROWER FINANCIAL INFORMATION Flagstar simplifies the document signing process, leading to quicker approvals and a better user experience. The platform's ease-of-use and affordability make it accessible for businesses of all sizes. This efficiency can ultimately help improve customer satisfaction.

Get more for BORROWER FINANCIAL INFORMATION Flagstar

- Independent consultant agreement san joaquin county form

- Street addressing service for your po box usps ribbs form

- 1 parent application for childcare services and form

- Add case style form

- Can anyone sign a lien waiver levelset form

- Rfp lease template town of new castle form

- Solicitation offer and award form invitation for bid

- Marital settlement agreementdoc orange county divorce form

Find out other BORROWER FINANCIAL INFORMATION Flagstar

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online