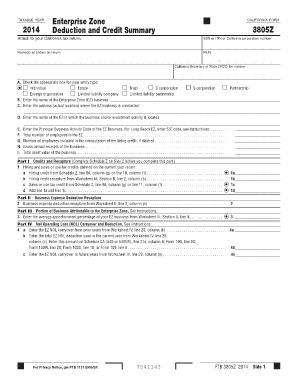

Form 3805Z Enterprise Zone Deduction and Credit Summary Ftb Ca

What is the Form 3805Z Enterprise Zone Deduction And Credit Summary Ftb Ca

The Form 3805Z Enterprise Zone Deduction and Credit Summary is a tax document used in California to report deductions and credits related to enterprise zones. These zones are designated areas aimed at encouraging economic development and job creation in specific regions. The form allows businesses to claim various tax incentives for hiring qualified employees, investing in property, and conducting business operations within these zones. Understanding this form is essential for businesses looking to maximize their tax benefits while complying with state regulations.

Steps to complete the Form 3805Z Enterprise Zone Deduction And Credit Summary Ftb Ca

Completing the Form 3805Z involves several key steps:

- Gather necessary documentation, including business records and employee information.

- Fill out the form accurately, ensuring all required fields are completed.

- Calculate eligible deductions and credits based on the enterprise zone criteria.

- Review the completed form for accuracy and completeness.

- Submit the form along with any required attachments to the appropriate tax authority.

Each step is crucial to ensure compliance and to maximize potential tax benefits.

How to obtain the Form 3805Z Enterprise Zone Deduction And Credit Summary Ftb Ca

The Form 3805Z can be obtained through the California Franchise Tax Board (FTB) website. It is available for download in PDF format, allowing businesses to print and fill it out manually or complete it electronically. Additionally, businesses may request a physical copy by contacting the FTB directly. Keeping the form accessible is important for timely filing and compliance with tax obligations.

Eligibility Criteria for the Form 3805Z Enterprise Zone Deduction And Credit Summary Ftb Ca

To qualify for the deductions and credits reported on Form 3805Z, businesses must meet specific eligibility criteria. These include:

- Operating within a designated enterprise zone in California.

- Employing qualified individuals, such as those from disadvantaged backgrounds.

- Making eligible investments in property or equipment within the zone.

Understanding these criteria is essential for businesses to ensure they can take full advantage of the available tax incentives.

Legal use of the Form 3805Z Enterprise Zone Deduction And Credit Summary Ftb Ca

The Form 3805Z is legally binding when completed accurately and submitted according to California tax regulations. Businesses must ensure they comply with all relevant laws, including maintaining proper documentation to support claims made on the form. Utilizing electronic signatures through a secure platform can enhance the legal validity of the submission, ensuring that it meets compliance standards set forth by the state.

Filing Deadlines / Important Dates

Filing deadlines for the Form 3805Z align with the general tax filing schedule in California. Typically, businesses must submit the form by the tax return due date, which is usually April 15 for individual entities or the 15th day of the fourth month following the close of the tax year for corporations. It is essential for businesses to be aware of these dates to avoid penalties and ensure timely processing of their claims.

Quick guide on how to complete form 3805z enterprise zone deduction and credit summary ftb ca

Prepare Form 3805Z Enterprise Zone Deduction And Credit Summary Ftb Ca effortlessly on any device

Online document organization has gained popularity among businesses and individuals. It offers a perfect eco-friendly substitute to conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools you require to create, modify, and eSign your documents promptly without delays. Manage Form 3805Z Enterprise Zone Deduction And Credit Summary Ftb Ca on any device using airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to alter and eSign Form 3805Z Enterprise Zone Deduction And Credit Summary Ftb Ca seamlessly

- Locate Form 3805Z Enterprise Zone Deduction And Credit Summary Ftb Ca and click on Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, text (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Form 3805Z Enterprise Zone Deduction And Credit Summary Ftb Ca and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 3805z enterprise zone deduction and credit summary ftb ca

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 3805Z Enterprise Zone Deduction and Credit Summary Ftb Ca?

The Form 3805Z Enterprise Zone Deduction and Credit Summary Ftb Ca is a tax form used by businesses operating within designated enterprise zones in California. This form enables taxpayers to claim various deductions and credits that support business growth and encourage job creation. Understanding this form is crucial for businesses to maximize their tax benefits.

-

How does airSlate SignNow assist with the Form 3805Z Enterprise Zone Deduction and Credit Summary Ftb Ca?

airSlate SignNow provides an efficient platform for businesses to eSign and manage documents, including the Form 3805Z Enterprise Zone Deduction and Credit Summary Ftb Ca. With our solution, users can create, sign, and store important tax documents securely, making compliance simpler and more efficient. This helps businesses save time, reduce errors, and ensure proper documentation.

-

What are the pricing options for airSlate SignNow and how do they support the Form 3805Z Enterprise Zone Deduction and Credit Summary Ftb Ca?

airSlate SignNow offers flexible pricing plans designed to accommodate businesses of all sizes. Our cost-effective solution ensures you can easily manage and eSign the Form 3805Z Enterprise Zone Deduction and Credit Summary Ftb Ca without breaking the bank. Choose a plan that fits your needs and maximize your business's efficiency.

-

Are there any features within airSlate SignNow beneficial for handling the Form 3805Z Enterprise Zone Deduction and Credit Summary Ftb Ca?

Absolutely! airSlate SignNow includes features like customizable templates, automated workflows, and real-time collaboration that streamline the completion of the Form 3805Z Enterprise Zone Deduction and Credit Summary Ftb Ca. These features help users efficiently gather signatures and ensure all necessary information is included for tax purposes.

-

Can airSlate SignNow integrate with other software to facilitate the Form 3805Z Enterprise Zone Deduction and Credit Summary Ftb Ca process?

Yes, airSlate SignNow offers robust integrations with various platforms and software, making it easier to manage the Form 3805Z Enterprise Zone Deduction and Credit Summary Ftb Ca alongside your existing tools. Seamless integration helps maintain consistent workflows and reduces data entry errors, saving businesses time and effort.

-

What are the main benefits of using airSlate SignNow for the Form 3805Z Enterprise Zone Deduction and Credit Summary Ftb Ca?

Using airSlate SignNow for the Form 3805Z Enterprise Zone Deduction and Credit Summary Ftb Ca allows businesses to streamline their document management process, making it easier to eSign and store important tax documents securely. Additionally, it enhances collaboration among teams and ensures that all signatures are collected timely, ultimately improving compliance and accuracy.

-

Is airSlate SignNow secure for handling sensitive documents like the Form 3805Z Enterprise Zone Deduction and Credit Summary Ftb Ca?

Yes, security is a top priority at airSlate SignNow. Our platform employs advanced encryption and security protocols to protect sensitive documents like the Form 3805Z Enterprise Zone Deduction and Credit Summary Ftb Ca. You can trust that your data is secure while you efficiently manage your business documents.

Get more for Form 3805Z Enterprise Zone Deduction And Credit Summary Ftb Ca

Find out other Form 3805Z Enterprise Zone Deduction And Credit Summary Ftb Ca

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile