Probate Form Iht205

What is the Probate Form Iht205

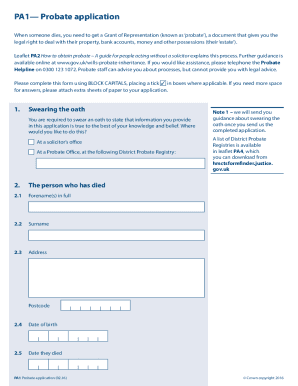

The Probate Form Iht205 is a legal document used in the probate process to report the value of an estate when someone passes away. This form is specifically designed for estates that do not exceed a certain value threshold, allowing for a simplified probate process. The Iht205 helps to establish the assets and liabilities of the deceased, ensuring that the estate is settled according to the law. It is essential for executors or administrators to understand the significance of this form in managing the estate efficiently.

Steps to Complete the Probate Form Iht205

Completing the Probate Form Iht205 requires careful attention to detail. Here are the steps involved:

- Gather necessary information about the deceased's assets, liabilities, and any debts owed.

- Fill out the form accurately, ensuring that all sections are completed according to the instructions provided.

- Include any required supporting documents, such as death certificates or proof of asset ownership.

- Review the completed form for accuracy and completeness before submission.

- Submit the form to the appropriate probate court or authority, either online or by mail.

How to Obtain the Probate Form Iht205

The Probate Form Iht205 can be obtained through several avenues. It is typically available on the official website of the probate court in your jurisdiction. Additionally, legal offices and libraries may provide copies of the form. For convenience, many users choose to download the form in PDF format, which allows for easy printing and completion. Ensuring that you have the most current version of the form is essential to avoid any complications during the probate process.

Legal Use of the Probate Form Iht205

The legal use of the Probate Form Iht205 is crucial for the proper administration of an estate. This form must be filed with the probate court to initiate the legal process of settling the deceased's affairs. It serves as a declaration of the estate's value, which is necessary for determining any inheritance tax obligations. Failure to file the form correctly or on time can lead to legal complications, including penalties or delays in the probate process.

Required Documents

When completing the Probate Form Iht205, several documents are typically required to support the information provided. These may include:

- Death certificate of the deceased.

- Proof of ownership for assets listed on the form, such as property deeds or bank statements.

- Documentation of any debts or liabilities owed by the deceased.

- Identification of the executor or administrator handling the estate.

Form Submission Methods

The Probate Form Iht205 can be submitted through various methods, depending on the requirements of the probate court in your area. Common submission methods include:

- Online submission through the court's official website.

- Mailing the completed form and supporting documents to the probate court.

- In-person submission at the probate court office.

It is advisable to check the specific submission guidelines for your jurisdiction to ensure compliance.

Quick guide on how to complete probate form iht205

Complete Probate Form Iht205 effortlessly on any device

Online document administration has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without complications. Manage Probate Form Iht205 on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

The easiest way to modify and electronically sign Probate Form Iht205 without hassle

- Obtain Probate Form Iht205 and then click Get Form to commence.

- Leverage the tools we provide to finalize your document.

- Highlight important sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all details and then click on the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new copies of documents. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Probate Form Iht205 and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the probate form iht205

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to apply for a grant of representation pdf using airSlate SignNow?

To apply for a grant of representation pdf using airSlate SignNow, simply upload your completed documents to our platform. Next, fill in any necessary information and use our eSigning tools to obtain the required signatures. Once everything is in order, you can download and submit your finalized application.

-

Is there a cost associated with applying for a grant of representation pdf through airSlate SignNow?

Yes, there is a pricing structure for using airSlate SignNow to apply for a grant of representation pdf. We offer various plans tailored to suit different needs, from individuals to businesses. You can choose a plan that best fits your requirements, ensuring a cost-effective solution for your document signing needs.

-

What features does airSlate SignNow offer for applying for a grant of representation pdf?

airSlate SignNow offers a range of features to assist you in applying for a grant of representation pdf, including customizable templates, secure eSigning options, and real-time tracking of document status. These features streamline the process, making it easier for you to complete and submit the necessary documents.

-

Can I integrate airSlate SignNow with other applications when applying for a grant of representation pdf?

Absolutely! airSlate SignNow supports integrations with various third-party applications, which helps streamline your workflow when applying for a grant of representation pdf. Whether you use CRM systems or document management tools, our platform ensures seamless connectivity to enhance your experience.

-

What are the benefits of using airSlate SignNow for applying for a grant of representation pdf?

Using airSlate SignNow to apply for a grant of representation pdf offers many benefits, including increased efficiency and reduced paperwork. Our user-friendly interface simplifies the signing and sending process, ensuring you can focus on your other tasks while managing your documents effectively.

-

Is the airSlate SignNow platform secure for applying for a grant of representation pdf?

Yes, security is a top priority at airSlate SignNow. Our platform employs advanced encryption and authentication measures to protect your data while you apply for a grant of representation pdf. You can trust that your sensitive information remains confidential and secure throughout the process.

-

Can I access my grant of representation pdf application from any device using airSlate SignNow?

Yes, airSlate SignNow is designed to be accessible from any device with internet connectivity. Whether you are on a computer, tablet, or smartphone, you can easily manage your documents and apply for a grant of representation pdf from anywhere, enhancing your flexibility and productivity.

Get more for Probate Form Iht205

- Name address ampamp phone no form

- If paternity enter form

- Sales from a missouri business location form

- Access or release medical form

- Excise tax forms and publicationsinternal revenue service irsgov

- User instruction manual full body harness form

- Orx5510 form physicianfaxindd

- Certification of health care provider dfeh form

Find out other Probate Form Iht205

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free