Certification for No Information Reporting Form Irs

What is the Certification for No Information Reporting Form IRS

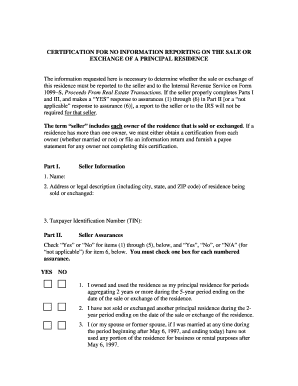

The Certification for No Information Reporting Form IRS is a document used by individuals and businesses to certify that they do not meet the reporting requirements for certain types of income, specifically related to the 1099 series. This form is essential for those who may receive payments that typically require reporting but fall under specific exemptions. By submitting this certification, filers can clarify their tax status and avoid unnecessary reporting obligations.

How to Use the Certification for No Information Reporting Form IRS

Using the Certification for No Information Reporting Form IRS involves several straightforward steps. First, ensure that you meet the eligibility criteria for submitting this form. Next, accurately fill out the required fields, providing necessary information such as your name, address, and taxpayer identification number. Once completed, the form should be submitted to the relevant party requesting the certification, often a payer or financial institution. It is advisable to keep a copy for your records.

Steps to Complete the Certification for No Information Reporting Form IRS

Completing the Certification for No Information Reporting Form IRS can be done in a few simple steps:

- Gather necessary personal information, including your taxpayer identification number.

- Access the form, either online or in physical format, ensuring you have the latest version.

- Fill out the form accurately, double-checking for any errors.

- Sign and date the form, as required.

- Submit the form to the requesting party, retaining a copy for your records.

Legal Use of the Certification for No Information Reporting Form IRS

The legal use of the Certification for No Information Reporting Form IRS is governed by IRS regulations. This document serves as a formal declaration of your tax status, indicating that you are not subject to reporting requirements for certain payments. It is crucial to ensure that all information provided is accurate and truthful, as any discrepancies may lead to penalties or legal issues. Compliance with IRS guidelines is essential for the certification to be considered valid.

IRS Guidelines

The IRS provides specific guidelines regarding the Certification for No Information Reporting Form IRS. These guidelines outline who is eligible to use the form, the types of income that may qualify for exemption, and the necessary documentation required to support your certification. Familiarizing yourself with these guidelines can help ensure that you complete the form correctly and avoid potential issues with the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Certification for No Information Reporting Form IRS can vary based on the specific circumstances of the filer. Generally, it is advisable to submit the form as soon as you determine that you qualify for no information reporting. Keeping track of important tax dates, such as the annual tax filing deadline, can help ensure timely submission. Failure to submit the form by relevant deadlines may result in complications with tax reporting.

Quick guide on how to complete certification for no information reporting form irs

Complete Certification For No Information Reporting Form Irs effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without delays. Manage Certification For No Information Reporting Form Irs on any device using the airSlate SignNow apps for Android or iOS and simplify your document-related tasks today.

The easiest method to edit and electronically sign Certification For No Information Reporting Form Irs without hassle

- Find Certification For No Information Reporting Form Irs and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Craft your electronic signature using the Sign feature, which takes mere seconds and carries the same legal significance as a traditional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or shareable link, or download it to your computer.

Eliminate concerns about lost files, tedious form searching, or mistakes that require printing new copies of documents. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and electronically sign Certification For No Information Reporting Form Irs to ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the certification for no information reporting form irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is certification for no information reporting 1099 s?

Certification for no information reporting 1099 s is a mechanism that allows businesses to affirm that they are not required to report certain payments to the IRS. This certification helps streamline the reporting process while ensuring compliance with federal tax regulations.

-

How does airSlate SignNow help with certification for no information reporting 1099 s?

AirSlate SignNow simplifies the certification process for no information reporting 1099 s by providing a user-friendly platform to prepare, send, and eSign necessary documents. This solution allows businesses to maintain compliance efficiently without the hassle of paper-based documentation.

-

What are the pricing options for airSlate SignNow related to 1099 s certification?

AirSlate SignNow offers flexible pricing plans that cater to businesses of all sizes seeking certification for no information reporting 1099 s. These plans are designed to be budget-friendly, ensuring that companies can take advantage of essential features without overspending.

-

Are there any specific features in airSlate SignNow that assist in 1099 s certification?

Yes, airSlate SignNow includes features such as customizable templates, real-time tracking of document status, and automated reminders, making it easier for users to manage their certification for no information reporting 1099 s and ensuring timely compliance.

-

What are the benefits of using airSlate SignNow for 1099 s certification?

Using airSlate SignNow for certification for no information reporting 1099 s offers numerous benefits, including increased efficiency, reduced paperwork, and secure document management. It helps businesses avoid costly errors associated with paper filing, while also saving time in administrative processes.

-

Can airSlate SignNow integrate with other software for 1099 s reporting?

Absolutely, airSlate SignNow provides integrations with various accounting and financial software platforms. This ensures a seamless workflow for businesses involved in certification for no information reporting 1099 s, enhancing overall productivity.

-

Is there customer support available for questions about 1099 s certification?

Yes, airSlate SignNow offers robust customer support that can assist with any questions regarding certification for no information reporting 1099 s. Users have access to resources, tutorials, and live support to navigate their certification needs effectively.

Get more for Certification For No Information Reporting Form Irs

- Std 204 cagov form

- Application for certificate of title for a motor vehicle pdffiller form

- California department of tax and fee administration train form

- Govform8932 for the latest information

- City of yonkers certificate of nonresidence and form

- Box 7228 form

- Court visitor name form

- Final judgment of dissolution of marriage with property but no dependent or minor children uncontested this cause came before form

Find out other Certification For No Information Reporting Form Irs

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation