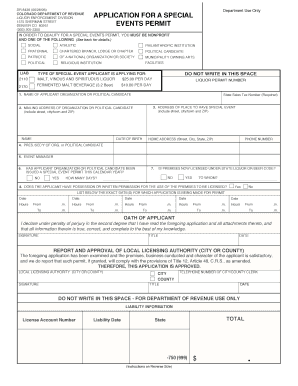

COLORADO DEPARTMENT of REVENUE APPLICATION for a SPECIAL Form

What is the Colorado Department of Revenue Application for a Special?

The Colorado Department of Revenue Application for a Special is a specific form used to apply for various special licenses or permits within the state of Colorado. This application is crucial for individuals or businesses seeking to operate under special conditions, such as those related to alcohol sales, marijuana cultivation, or other regulated activities. Understanding the purpose of this application is essential for compliance with state regulations.

Steps to Complete the Colorado Department of Revenue Application for a Special

Completing the Colorado Department of Revenue Application for a Special involves several key steps to ensure accuracy and compliance. Here’s a structured approach:

- Gather necessary information, including personal identification and business details.

- Review the specific requirements for the type of special license or permit you are applying for.

- Fill out the application accurately, ensuring all fields are completed.

- Attach any required documentation, such as proof of residency or business licenses.

- Submit the application through the designated method, whether online, by mail, or in person.

Legal Use of the Colorado Department of Revenue Application for a Special

The legal use of the Colorado Department of Revenue Application for a Special is governed by state laws and regulations. It is essential to ensure that the application is filled out truthfully and submitted in accordance with the law. Misrepresentation or failure to comply with the stated requirements can result in penalties or denial of the application. Therefore, understanding the legal implications and ensuring compliance is vital for applicants.

Required Documents for the Colorado Department of Revenue Application for a Special

When applying for a special license or permit, certain documents are typically required to support your application. These may include:

- Proof of identity, such as a driver's license or state ID.

- Business registration documents, if applicable.

- Financial statements or tax returns to demonstrate financial stability.

- Background check information, particularly for licenses related to sensitive industries.

Eligibility Criteria for the Colorado Department of Revenue Application for a Special

Eligibility criteria for the Colorado Department of Revenue Application for a Special vary depending on the type of license or permit being sought. Common criteria may include:

- Age requirements, typically being at least 21 years old for certain licenses.

- Residency status in Colorado.

- No prior felony convictions related to the type of license being applied for.

- Compliance with local zoning laws and regulations.

Application Process & Approval Time for the Colorado Department of Revenue Application for a Special

The application process for the Colorado Department of Revenue Application for a Special generally involves several stages, including submission, review, and approval. After submitting the application, it may take several weeks to receive a decision, depending on the complexity of the application and the volume of requests being processed. Applicants are encouraged to check for updates and respond promptly to any requests for additional information from the department.

Quick guide on how to complete colorado department of revenue application for a special

Effortlessly Prepare COLORADO DEPARTMENT OF REVENUE APPLICATION FOR A SPECIAL on Any Device

Managing documents online has gained popularity among organizations and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Handle COLORADO DEPARTMENT OF REVENUE APPLICATION FOR A SPECIAL on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The Easiest Way to Modify and Electronically Sign COLORADO DEPARTMENT OF REVENUE APPLICATION FOR A SPECIAL

- Locate COLORADO DEPARTMENT OF REVENUE APPLICATION FOR A SPECIAL and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information with specialized tools offered by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you choose. Modify and electronically sign COLORADO DEPARTMENT OF REVENUE APPLICATION FOR A SPECIAL and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the colorado department of revenue application for a special

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the COLORADO DEPARTMENT OF REVENUE APPLICATION FOR A SPECIAL?

The COLORADO DEPARTMENT OF REVENUE APPLICATION FOR A SPECIAL is a specific application process designed for individuals and businesses to request special licenses or permits as mandated by the state of Colorado. This process streamlines submissions through an efficient system, ensuring that all necessary documentation is evaluated promptly.

-

How can airSlate SignNow assist with the COLORADO DEPARTMENT OF REVENUE APPLICATION FOR A SPECIAL?

airSlate SignNow simplifies the process of submitting the COLORADO DEPARTMENT OF REVENUE APPLICATION FOR A SPECIAL by allowing users to electronically sign and send documents securely. The platform provides templates that can be tailored to meet specific requirements, ensuring compliance with state regulations and speeding up approval times.

-

Is there a cost associated with using airSlate SignNow for the COLORADO DEPARTMENT OF REVENUE APPLICATION FOR A SPECIAL?

Yes, using airSlate SignNow does involve costs, but it offers various pricing plans to accommodate different business needs. The cost is typically a fraction of traditional methods, making it a cost-effective solution for submitting the COLORADO DEPARTMENT OF REVENUE APPLICATION FOR A SPECIAL.

-

What features does airSlate SignNow offer for the COLORADO DEPARTMENT OF REVENUE APPLICATION FOR A SPECIAL?

airSlate SignNow offers features such as customizable templates, secure eSigning, document tracking, and integration with other applications. These features ensure that the COLORADO DEPARTMENT OF REVENUE APPLICATION FOR A SPECIAL is managed efficiently from start to finish.

-

Can I integrate airSlate SignNow with other tools for the COLORADO DEPARTMENT OF REVENUE APPLICATION FOR A SPECIAL?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and more. This allows you to easily manage your documentation related to the COLORADO DEPARTMENT OF REVENUE APPLICATION FOR A SPECIAL without switching between multiple platforms.

-

What are the benefits of using airSlate SignNow for the COLORADO DEPARTMENT OF REVENUE APPLICATION FOR A SPECIAL?

Using airSlate SignNow for the COLORADO DEPARTMENT OF REVENUE APPLICATION FOR A SPECIAL offers numerous benefits including time savings, enhanced security, and improved accuracy. The ability to track documents in real-time ensures that all parties are kept in the loop regarding the status of their applications.

-

How does airSlate SignNow ensure the security of my COLORADO DEPARTMENT OF REVENUE APPLICATION FOR A SPECIAL documents?

airSlate SignNow prioritizes security through advanced encryption methods and secure storage solutions. Your COLORADO DEPARTMENT OF REVENUE APPLICATION FOR A SPECIAL documents are protected at all stages, from signing to storage, providing peace of mind for sensitive information.

Get more for COLORADO DEPARTMENT OF REVENUE APPLICATION FOR A SPECIAL

- How to write a codicil with sample codicil wikihow form

- Hereinafter referred to as landlord and lessees and form

- First reprint assembly no 2752 state of new jersey 208th form

- County state of kansas said property being described as follows type form

- Indiana will instructions form

- Sample separation agreement findlaw form

- Louisiana no fault agreed uncontested divorce package for form

- Field 11 form

Find out other COLORADO DEPARTMENT OF REVENUE APPLICATION FOR A SPECIAL

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online