Metlife Change of Beneficiary by Policy Owner Form Mail to

What is the Metlife Change of Beneficiary By Policy Owner Form Mail To

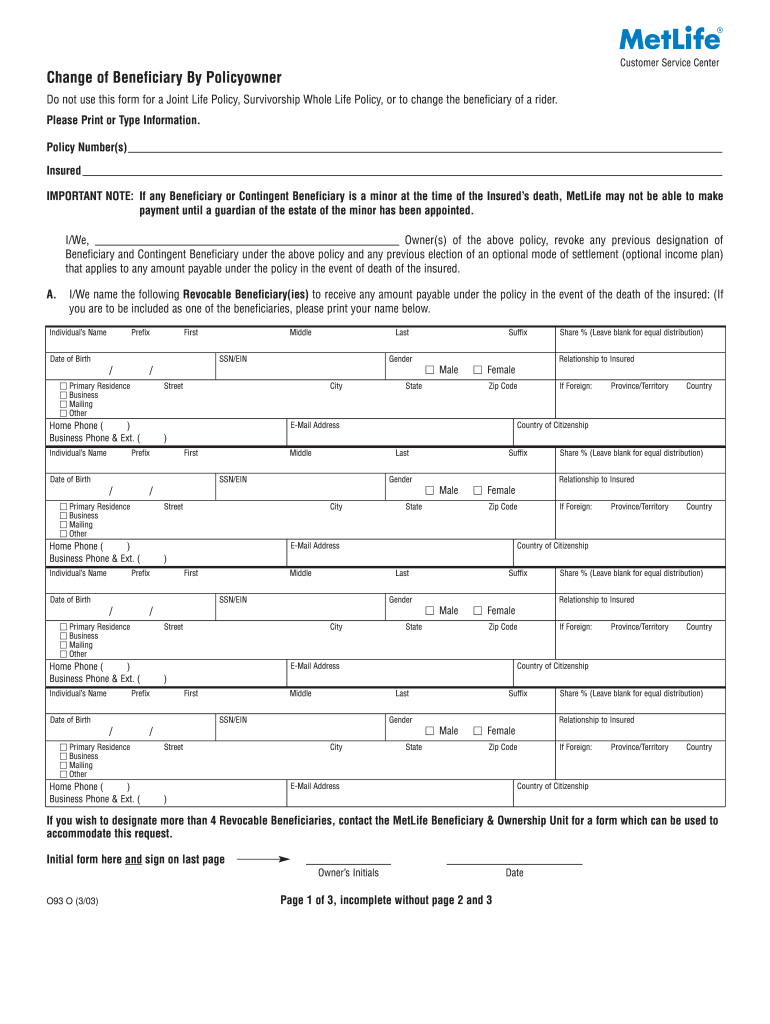

The Metlife Change of Beneficiary By Policy Owner Form is a crucial document for policyholders wishing to update their beneficiary designations. This form allows individuals to specify who will receive benefits from their Metlife life insurance policy in the event of their passing. It is essential for ensuring that the intended recipients are recognized by Metlife, thereby avoiding potential disputes or delays in benefit distribution. The form must be completed accurately and submitted to the appropriate Metlife address to be processed effectively.

How to Obtain the Metlife Change of Beneficiary By Policy Owner Form

To obtain the Metlife Change of Beneficiary By Policy Owner Form, policyholders can visit the official Metlife website or contact their customer service for assistance. The form is typically available for download as a printable PDF. Policyholders may also receive a physical copy of the form by requesting it through their Metlife representative or by mail. Ensuring you have the correct version of the form is vital for the successful processing of your beneficiary changes.

Steps to Complete the Metlife Change of Beneficiary By Policy Owner Form

Completing the Metlife Change of Beneficiary By Policy Owner Form involves several key steps:

- Begin by entering your policy number and personal information as the policy owner.

- Clearly list the names and details of the new beneficiaries, including their relationship to you.

- Indicate the percentage of benefits each beneficiary will receive, ensuring the total equals one hundred percent.

- Review the form for accuracy, ensuring all information is complete and correct.

- Sign and date the form to validate your request.

After completing the form, it should be mailed to the designated Metlife address for processing.

Legal Use of the Metlife Change of Beneficiary By Policy Owner Form

The legal use of the Metlife Change of Beneficiary By Policy Owner Form is governed by state laws and regulations. This form is recognized as a legal document, and its proper completion and submission are essential for it to be enforceable. It is advisable for policyholders to familiarize themselves with any specific state requirements that may affect the beneficiary designation process. Ensuring compliance with these regulations helps to safeguard the interests of both the policyholder and the beneficiaries.

Form Submission Methods

The Metlife Change of Beneficiary By Policy Owner Form can be submitted through various methods, including:

- Mail: Send the completed form to the address specified by Metlife for processing beneficiary changes.

- Online: Some policyholders may have the option to submit changes electronically through their Metlife online account, if available.

- In-Person: Policyholders can also visit a local Metlife office to submit the form directly to a representative.

Choosing the right submission method can help ensure that your changes are processed in a timely manner.

Key Elements of the Metlife Change of Beneficiary By Policy Owner Form

Key elements of the Metlife Change of Beneficiary By Policy Owner Form include:

- Policy Information: Essential details about the policyholder and the insurance policy must be provided.

- Beneficiary Details: Accurate names, relationships, and contact information for each beneficiary are required.

- Signature and Date: The policy owner must sign and date the form to authenticate the request.

- Percentage Allocation: Clear indication of how benefits are to be divided among beneficiaries is necessary.

Ensuring all these elements are correctly filled out is vital for the form’s acceptance and processing by Metlife.

Quick guide on how to complete metlife change of beneficiary by policy owner form mail to

Complete Metlife Change Of Beneficiary By Policy Owner Form Mail To effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed materials, allowing you to locate the appropriate form and securely save it in the cloud. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents swiftly without any delays. Handle Metlife Change Of Beneficiary By Policy Owner Form Mail To on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to edit and eSign Metlife Change Of Beneficiary By Policy Owner Form Mail To with ease

- Locate Metlife Change Of Beneficiary By Policy Owner Form Mail To and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Metlife Change Of Beneficiary By Policy Owner Form Mail To to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

In what circumstances will the owner of a life insurance policy not have the ability to change the beneficiary?

Only if Beneficiary defined as IrrevocableBeneficiaries are of 4 types:Primary beneficiary: The primary beneficiary is the person (or persons) who will receive the proceeds of the life insurance policy when the insured person dies. However, the primary beneficiary will not receive any proceeds if he or she dies before the death of the named insured.Contingent beneficiary: This is also known as the secondary beneficiary. The contingent beneficiary will not receive any of the life insurance proceeds if the primary beneficiary is still alive when the insured person dies. The contingent beneficiary is only entitled to receive proceeds if the primary beneficiary dies before the named insured.Revocable beneficiaries: The owner of the life insurance policy has the right to change the beneficiary designation at any time without the consent of the previously named beneficiary.Irrevocable beneficiaries: The owner of the life insurance policy cannot change the designation of the beneficiary without the consent of the original beneficiary.

-

I filled out a change of address form from the USPS over 3 weeks ago. I received my confirmation letter, but still have not received a stick of mail. What can I do to get my mail delivered to me?

Depending on how far you live, any mail from your old address may still be in the process of being forwarded to you. Your previous post office still receives your mail and then proceeds to send it to your new address. The mail doesn’t get re-routed to you at the first facility it signNowes then headed straight to you, because if it did, the forwarded mail would come a lot faster.Or it’s possible you haven’t had any mail sent to you yet. Try mailing yourself a letter via your previous address…?

-

How do I find out if the executor of my father's will changed the life insurance policy to name her and not the estates beneficiary?

First, only the owner of a life insurance policy may change anything on the insurance policy. If you contact the carrier they will ONLY talk with the owner. Step 1: Find the policy number of the insurance policy. Step 2: Call the insurance company and go as far as they will allow you by asking about the policy/owner. If you’re not the owner this will be your dead end on the phone. Step 3: Ask the executor what has been done. If this is not an option then know that the owner/beneficiary must prove insurable interest to become beneficiary on a policy. Hope this helps.UPVOTE, comment, go to my website Kent Sawyers and subscribe to my Youtube channel Financial Advice-Kent Sawyers.Regards,Kent

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How a Non-US residence company owner (has EIN) should fill the W-7 ITIN form out? Which option is needed to be chosen in the first part?

Depends on the nature of your business and how it is structured.If you own an LLC taxed as a passthrough entity, then you probably will check option b and submit the W7 along with your US non-resident tax return. If your LLC’s income is not subject to US tax, then you will check option a.If the business is a C Corp, then you probably don’t need an ITIN, unless you are receiving taxable compensation from the corporation and then we are back to option b.

-

How do I mail a regular letter to Venezuela? Do I need to fill out a customs form for a regular letter or do I just need to add an international mail stamp and send it?

You do not need to fill out a customs form for a regular letter sent from the US to any other country. Postage for an international letter under 1 ounce is currently $1.15. You may apply any stamp - or combination of stamps - which equals that amount.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

Create this form in 5 minutes!

How to create an eSignature for the metlife change of beneficiary by policy owner form mail to

How to generate an eSignature for your Metlife Change Of Beneficiary By Policy Owner Form Mail To in the online mode

How to generate an eSignature for the Metlife Change Of Beneficiary By Policy Owner Form Mail To in Chrome

How to make an eSignature for signing the Metlife Change Of Beneficiary By Policy Owner Form Mail To in Gmail

How to generate an eSignature for the Metlife Change Of Beneficiary By Policy Owner Form Mail To straight from your mobile device

How to make an eSignature for the Metlife Change Of Beneficiary By Policy Owner Form Mail To on iOS

How to generate an electronic signature for the Metlife Change Of Beneficiary By Policy Owner Form Mail To on Android OS

People also ask

-

What is the Metlife Change Of Beneficiary By Policy Owner Form Mail To process?

The Metlife Change Of Beneficiary By Policy Owner Form Mail To process involves submitting a specific form to Metlife to update your beneficiary information on a policy. This ensures that your chosen beneficiaries receive the benefits upon your passing. It's crucial to complete this form accurately and submit it to the correct address provided by Metlife.

-

How can airSlate SignNow help with the Metlife Change Of Beneficiary By Policy Owner Form Mail To?

airSlate SignNow simplifies the process of completing the Metlife Change Of Beneficiary By Policy Owner Form Mail To by allowing users to electronically fill out and sign the document. Our platform ensures that all information is securely captured and ready for submission, saving you time and reducing errors in the process.

-

Is there a cost associated with using airSlate SignNow for the Metlife Change Of Beneficiary By Policy Owner Form Mail To?

Yes, airSlate SignNow offers various pricing plans to accommodate individual and business needs. While there is a fee for using our electronic signature services, the efficiency and convenience of managing documents like the Metlife Change Of Beneficiary By Policy Owner Form Mail To often outweigh the costs.

-

What features does airSlate SignNow provide for managing the Metlife Change Of Beneficiary By Policy Owner Form Mail To?

airSlate SignNow offers features such as document templates, eSignature capabilities, and secure cloud storage, which are all beneficial for managing the Metlife Change Of Beneficiary By Policy Owner Form Mail To. These tools allow you to edit, sign, and send your documents with ease, ensuring a seamless workflow.

-

Can I track the status of my Metlife Change Of Beneficiary By Policy Owner Form Mail To submission?

Yes, with airSlate SignNow, you can track the status of your Metlife Change Of Beneficiary By Policy Owner Form Mail To submission in real-time. This feature provides peace of mind, allowing you to verify when the form has been sent, signed, and received by Metlife.

-

Are there integrations available with airSlate SignNow for the Metlife Change Of Beneficiary By Policy Owner Form Mail To?

Absolutely! airSlate SignNow integrates with various platforms, enhancing the process of completing the Metlife Change Of Beneficiary By Policy Owner Form Mail To. You can connect with popular tools like Google Drive, Dropbox, and more, ensuring your documents are accessible and manageable.

-

What are the benefits of using airSlate SignNow for the Metlife Change Of Beneficiary By Policy Owner Form Mail To?

Using airSlate SignNow for the Metlife Change Of Beneficiary By Policy Owner Form Mail To offers numerous benefits, including enhanced security, faster processing times, and reduced paperwork. Our platform allows you to manage your beneficiary changes efficiently, ensuring that your loved ones are protected without unnecessary delays.

Get more for Metlife Change Of Beneficiary By Policy Owner Form Mail To

Find out other Metlife Change Of Beneficiary By Policy Owner Form Mail To

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent