Wi Schedule Wd Form

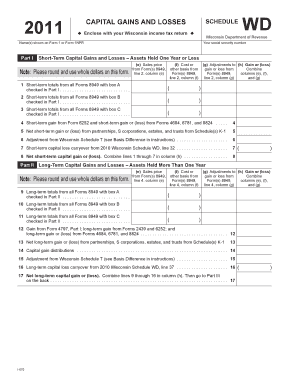

What is the Wi Schedule WD?

The Wi Schedule WD is a tax form used by individuals in Wisconsin to report income from various sources, including wages, self-employment, and other earnings. This form is specifically designed to help taxpayers calculate their state tax liability accurately. It allows for the inclusion of various deductions and credits that can reduce the overall tax burden. Understanding the purpose of this form is crucial for ensuring compliance with state tax regulations and for optimizing tax outcomes.

How to Use the Wi Schedule WD

Using the Wi Schedule WD involves several key steps that taxpayers should follow to ensure accurate completion. First, gather all necessary financial documents, including W-2s, 1099s, and any records of self-employment income. Next, fill out the form by entering your total income, applicable deductions, and credits. It is important to follow the instructions carefully to avoid errors that could lead to delays or penalties. Once completed, the form should be submitted with your Wisconsin state tax return.

Steps to Complete the Wi Schedule WD

Completing the Wi Schedule WD requires attention to detail. Start by entering your personal information, including your name and Social Security number. Then, report your total income from all sources. After that, apply any eligible deductions, such as business expenses or contributions to retirement accounts. Finally, calculate your tax liability based on the provided instructions. Double-check your entries for accuracy before submitting the form to ensure compliance with Wisconsin tax laws.

Legal Use of the Wi Schedule WD

The legal use of the Wi Schedule WD is governed by Wisconsin state tax laws. This form must be filled out accurately to reflect your income and deductions to avoid potential legal issues, such as audits or penalties. Electronic filing of the form through approved platforms is considered legally valid, provided that it meets the necessary requirements for eSignatures and data security. Adhering to these regulations ensures that your submission is recognized by the state as legitimate and binding.

Filing Deadlines / Important Dates

Filing deadlines for the Wi Schedule WD align with the overall Wisconsin state tax return deadlines. Typically, individual taxpayers must file their returns by April 15 each year. However, if you require an extension, you may file for an extension, which generally allows for an additional six months. It is essential to be aware of these deadlines to avoid late fees and penalties. Keeping track of important dates ensures that you remain compliant with state tax obligations.

Required Documents

Before completing the Wi Schedule WD, gather all necessary documents to support your income and deductions. Key documents include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Records of any self-employment income

- Receipts for deductible expenses

- Documentation for any tax credits claimed

Having these documents ready will facilitate a smoother and more accurate completion of the form.

Quick guide on how to complete wi schedule wd

Complete Wi Schedule Wd effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents quickly and efficiently. Manage Wi Schedule Wd on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Wi Schedule Wd with ease

- Locate Wi Schedule Wd and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you would like to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Wi Schedule Wd and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wi schedule wd

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 'wi schedule wd' and how does it relate to airSlate SignNow?

'wi schedule wd' refers to the feature that allows users to efficiently manage workflows and document signing schedules. With airSlate SignNow, businesses can automate their signing processes, ensuring timely document handling and compliance.

-

How much does airSlate SignNow cost with the 'wi schedule wd' feature?

airSlate SignNow offers competitive pricing plans that include the 'wi schedule wd' feature. Depending on the plan you choose, you can access a range of tools to streamline your document workflows at a cost-effective rate.

-

What are the key features of the 'wi schedule wd' functionality?

The 'wi schedule wd' functionality allows users to set specific signing times, send reminders, and track document statuses. This feature enhances efficiency by automating repetitive tasks and ensuring that deadlines are met.

-

Can I integrate airSlate SignNow with other applications while using 'wi schedule wd'?

Yes, airSlate SignNow supports integrations with many popular applications to enhance your workflows. When using 'wi schedule wd', you can connect with tools like CRM systems and project management apps to centralize your document management processes.

-

What are the benefits of using 'wi schedule wd' in airSlate SignNow?

Using 'wi schedule wd' in airSlate SignNow streamlines the signing process, reduces delays, and improves document turnaround times. This leads to better productivity and helps ensure that all necessary documents are signed and processed promptly.

-

Is it easy to set up the 'wi schedule wd' feature in airSlate SignNow?

Absolutely! Setting up the 'wi schedule wd' feature in airSlate SignNow is quick and straightforward. Our user-friendly interface guides you through the process, ensuring that you can start managing your document workflows seamlessly.

-

What industries can benefit from the 'wi schedule wd' feature?

The 'wi schedule wd' feature can benefit a wide range of industries, including real estate, healthcare, and finance. Any business that requires timely document signing and management can enhance their efficiency with airSlate SignNow.

Get more for Wi Schedule Wd

- Ret 54 application for retirement nystrs form

- Formmm18 declaration of intention to use the mark united

- Conformation frequently asked questions

- Transcript of academic record request concordia university form

- Citation re adoption proof of service form

- Help with fafsa marital status married but file as form

- Re1 data input form

- Employment update form

Find out other Wi Schedule Wd

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile