Bf M Insurance Form

What is the Bf M Insurance?

The Bf M Insurance is a specific type of insurance policy designed to provide coverage for various risks associated with business operations. It typically includes elements such as liability protection, property coverage, and other essential safeguards tailored to the needs of businesses. This form is essential for ensuring that businesses can operate smoothly while mitigating potential financial losses due to unforeseen events.

How to use the Bf M Insurance

Using the Bf M Insurance involves understanding the coverage it provides and how it applies to your specific business situation. Start by reviewing the terms and conditions outlined in the policy. This will help you identify what is covered and any exclusions. When an incident occurs that may be covered by the policy, document the details and notify your insurance provider promptly to initiate the claims process.

Steps to complete the Bf M Insurance

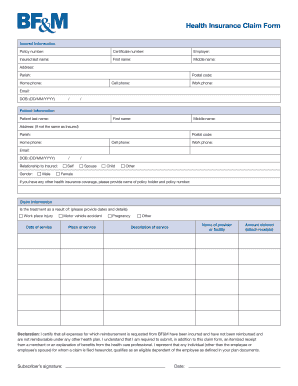

Completing the Bf M Insurance form requires careful attention to detail. Follow these steps for a smooth process:

- Gather necessary information about your business, including financial records and operational details.

- Fill out the form accurately, ensuring all sections are complete.

- Review the form for any errors or omissions before submission.

- Submit the form through the designated method, whether online or via mail.

Legal use of the Bf M Insurance

The legal use of the Bf M Insurance is governed by various regulations that ensure compliance with state and federal laws. It is crucial to understand the legal implications of the coverage provided. This includes being aware of any requirements for maintaining the policy and the obligations of both the insurer and the insured. Proper documentation and adherence to legal standards are essential for the policy to remain valid.

Key elements of the Bf M Insurance

Several key elements define the Bf M Insurance, including:

- Coverage Types: Different types of coverage, such as general liability, property damage, and business interruption.

- Premiums: The cost associated with maintaining the insurance policy, which can vary based on risk factors.

- Exclusions: Specific situations or conditions that are not covered by the insurance policy.

- Policy Limits: The maximum amount the insurer will pay for a covered loss.

Who Issues the Form

The Bf M Insurance form is typically issued by licensed insurance companies that specialize in business insurance. These companies assess the risks associated with your business and provide tailored policies to meet your needs. It is important to choose a reputable insurer to ensure that you receive adequate coverage and support throughout the policy term.

Quick guide on how to complete bf m insurance

Complete Bf M Insurance effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Bf M Insurance on any device with airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to edit and electronically sign Bf M Insurance seamlessly

- Obtain Bf M Insurance and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive data with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign feature, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to finalize your updates.

- Choose how you wish to send your form, by email, text message (SMS), or via an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, exhausting form searches, or mistakes that necessitate reprinting document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your chosen device. Edit and electronically sign Bf M Insurance and maintain effective communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bf m insurance

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is bf m insurance and how does it work?

BF M insurance provides comprehensive coverage options tailored for individual and business needs. It functions by assessing your specific risks and offering policies that protect against potential losses. Understanding how bf m insurance works can help you choose the right coverage for your situation.

-

What are the benefits of bf m insurance?

BF M insurance offers several benefits including financial security and peace of mind. It helps businesses mitigate risks and recover from unexpected events, ensuring continuity. Additionally, having bf m insurance can often enhance your credibility with clients and partners.

-

How much does bf m insurance cost?

The cost of bf m insurance varies based on several factors, including the type of coverage, the amount of risk, and your business size. It's essential to request multiple quotes to find a policy that fits your budget. Comparing prices while considering the value of coverage is crucial when evaluating bf m insurance.

-

What features should I look for in bf m insurance?

When looking for bf m insurance, consider features such as customizable policies, comprehensive coverage options, and excellent customer service. It's also beneficial to check for add-ons or endorsements that suit your specific business needs. Evaluating these features can help you make an informed choice regarding bf m insurance.

-

Can I integrate bf m insurance with my existing systems?

Yes, many providers of bf m insurance offer integration capabilities with existing business systems. This can streamline documentation and claims processes, making management easier. It's advisable to confirm integration options with your bf m insurance provider for seamless operation.

-

How do I file a claim with my bf m insurance?

Filing a claim with bf m insurance typically involves submitting a claim form and providing necessary documentation regarding the loss. Most insurance companies have a straightforward process that can be completed online or via phone. Promptly reporting your loss can expedite the claims process for your bf m insurance.

-

Is bf m insurance necessary for small businesses?

BF M insurance is essential for small businesses, as it protects against various risks that could jeopardize your operations. Without it, you might face signNow financial losses from unforeseen events. Investing in bf m insurance can safeguard your business and provide long-term security.

Get more for Bf M Insurance

Find out other Bf M Insurance

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple