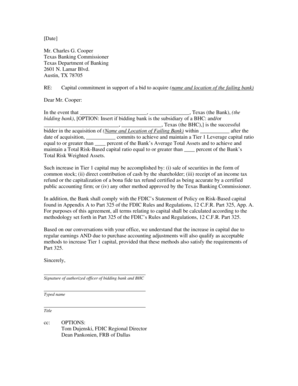

Capital Commitment Letter Form

What is the equity commitment letter?

An equity commitment letter is a formal document that outlines a party's commitment to invest a specified amount of capital into a project or business. This letter serves as a crucial element in financial transactions, particularly in mergers and acquisitions, private equity deals, and venture capital financing. It specifies the terms of the investment, including the amount, the timing of the funding, and any conditions that must be met before the investment is finalized. By providing a clear commitment, this letter helps to establish trust between parties and facilitates the smooth progression of financial negotiations.

Key elements of the equity commitment letter

When drafting an equity commitment letter, it is essential to include several key elements to ensure clarity and legal validity. These elements typically include:

- Investor Information: Details about the investor, including name, address, and contact information.

- Recipient Information: Information about the entity receiving the investment, including its name and address.

- Investment Amount: The total amount of capital the investor commits to providing.

- Conditions Precedent: Any conditions that must be satisfied before the investment is made.

- Funding Timeline: A timeline indicating when the funds will be transferred.

- Governing Law: The legal jurisdiction that will govern the letter.

Including these elements ensures that all parties have a clear understanding of their obligations and expectations, reducing the likelihood of disputes.

Steps to complete the equity commitment letter

Completing an equity commitment letter involves several important steps to ensure that it is accurate and legally binding. Here are the typical steps:

- Gather Information: Collect all necessary details about the investor and recipient, including legal names and addresses.

- Define Terms: Clearly outline the investment amount, conditions, and timeline for funding.

- Draft the Letter: Use a template or create a custom letter that incorporates all key elements.

- Review for Accuracy: Ensure that all information is correct and that the terms are clearly articulated.

- Obtain Signatures: Have all parties sign the letter to formalize the commitment.

- Store Safely: Keep a copy of the signed letter in a secure location for future reference.

Following these steps helps to ensure that the equity commitment letter is properly completed and legally enforceable.

Legal use of the equity commitment letter

The equity commitment letter is legally binding once it is signed by all parties involved. To ensure that it holds up in a legal context, it must comply with relevant laws and regulations, such as the ESIGN Act and UETA, which govern electronic signatures in the United States. Additionally, it is advisable to consult legal counsel to review the letter before it is executed, especially if it involves significant financial commitments or complex terms. This careful approach helps protect the interests of all parties and ensures compliance with applicable legal standards.

How to obtain the equity commitment letter template

Obtaining an equity commitment letter template can streamline the process of drafting this important document. Templates can often be found through various sources, including:

- Legal Websites: Many legal service websites offer downloadable templates for various types of commitment letters.

- Financial Institutions: Banks and investment firms may provide templates to their clients as part of their services.

- Professional Networks: Networking with legal and financial professionals can lead to recommendations for reliable templates.

Using a template can save time and ensure that all necessary components are included, but it is essential to customize it to fit the specific circumstances of the investment.

Examples of using the equity commitment letter

Equity commitment letters are commonly used in various financial scenarios. Some examples include:

- Venture Capital Investments: Startups often require equity commitment letters from investors to secure funding.

- Mergers and Acquisitions: Buyers may provide commitment letters to demonstrate their financial capability to acquire a target company.

- Real Estate Development: Developers may use these letters to secure funding from investors for new projects.

These examples illustrate how equity commitment letters play a vital role in facilitating investment transactions across different industries.

Quick guide on how to complete capital commitment letter

Effortlessly Prepare Capital Commitment Letter on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, enabling you to find the necessary form and securely store it online. airSlate SignNow equips you with all the resources you require to swiftly create, modify, and eSign your documents without hurdles. Manage Capital Commitment Letter across any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to Modify and eSign Capital Commitment Letter with Ease

- Find Capital Commitment Letter and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you would like to send your form: via email, SMS, or invitation link, or download it to your computer.

Forget about misplaced files, tedious document searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device. Modify and eSign Capital Commitment Letter and ensure outstanding communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the capital commitment letter

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an equity commitment letter template?

An equity commitment letter template is a standardized document used to secure funding commitments from investors for projects. It outlines the terms of the investment, ensuring clarity and compliance for both parties. With airSlate SignNow, you can easily create, customize, and eSign your equity commitment letter template.

-

How can I use the equity commitment letter template in my business?

You can use the equity commitment letter template to formalize agreements with investors, enhancing your business's credibility. This template allows you to clearly outline the investment amount and terms, streamlining your fundraising process. Utilize airSlate SignNow's features to quickly modify and send your template for eSignature.

-

Is the equity commitment letter template customizable?

Yes, the equity commitment letter template is fully customizable. You can edit the text, add specific terms, and adjust the layout to fit your needs. This flexibility ensures that your document accurately reflects your business agreements when using airSlate SignNow.

-

What features does airSlate SignNow offer for managing equity commitment letter templates?

airSlate SignNow provides various features for managing equity commitment letter templates, including document tracking, template saving, and team collaboration options. Its user-friendly interface enables you to design and send documents efficiently. Plus, you can easily integrate this with other tools to streamline your workflow.

-

What are the benefits of using an equity commitment letter template?

Using an equity commitment letter template ensures that you have a legally binding agreement that reduces misunderstandings with investors. It saves time and enhances professionalism by providing a clear outline of terms. With airSlate SignNow, you can quickly generate and send this template with confidence.

-

Are there any costs associated with using the equity commitment letter template?

While creating your equity commitment letter template can be done for free, airSlate SignNow offers various pricing plans based on your feature needs. These plans provide additional functionalities such as advanced eSigning features and integrations. Choosing the right plan can enhance your document management experience.

-

Can I integrate airSlate SignNow with other tools for managing my equity commitment letter template?

Yes, airSlate SignNow allows for seamless integration with various tools like Google Drive, Dropbox, and CRM software. This expands your ability to manage and access your equity commitment letter templates efficiently. Integrations enhance collaboration and document flow across your organization.

Get more for Capital Commitment Letter

- Florida inpatient medicaid prior authorization fax form inpatient medicaid prior authorization fax form

- Disability claim packet orange county board of county comissioners 2047 641718pdf gr 68384 form

- Arizona state universityemployee flu consent 2019 form

- The linings of the brain and spinal cord become inflamed it is called meningitis form

- Complete catalog mt sac form

- Overpayment request form

- Refer a patientucsf benioff childrens hospital oakland form

- Irs tax forum for irs use only case resolution data sheet form

Find out other Capital Commitment Letter

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF