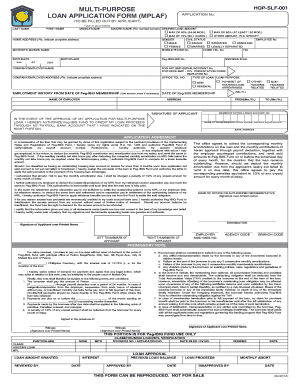

Hdmf Loan Application Form

What is the SLF Form?

The SLF form, or Special Loan Facility form, is a crucial document used in the application process for loans related to home development and mutual funds. This form is designed to collect essential information from applicants, enabling financial institutions to evaluate their eligibility for loan assistance. It typically includes personal identification details, financial information, and specifics about the intended use of the loan. Understanding the purpose and requirements of the SLF form is vital for applicants seeking financial support for home development projects.

How to Use the SLF Form

Using the SLF form effectively involves several key steps. First, ensure that you have the most recent version of the form, which can usually be obtained from your financial institution or relevant online resources. Next, carefully fill out all required fields with accurate information, including your personal details and financial situation. It is important to review the form for completeness and accuracy before submission. Once completed, the SLF form can be submitted electronically or via traditional mail, depending on the guidelines provided by the lending institution.

Steps to Complete the SLF Form

Completing the SLF form requires attention to detail and adherence to specific guidelines. The following steps outline the process:

- Obtain the latest version of the SLF form from your lender.

- Fill in your personal information, including your name, address, and contact details.

- Provide financial information, such as income, expenses, and any existing debts.

- Detail the purpose of the loan, specifying how the funds will be used for home development.

- Review the form for any errors or omissions before finalizing it.

- Submit the completed form according to the lender's instructions.

Legal Use of the SLF Form

The SLF form is legally binding once it has been duly filled out and submitted. It is essential for applicants to understand that the information provided must be truthful and accurate, as any discrepancies could lead to legal repercussions or denial of the loan application. Compliance with federal and state regulations regarding loan applications is crucial to ensure the legitimacy of the process. Additionally, digital signatures may be accepted, provided they meet the legal requirements established by eSignature laws.

Required Documents for the SLF Form

When applying with the SLF form, several supporting documents are typically required to substantiate your application. These documents may include:

- Proof of identity, such as a driver's license or passport.

- Income verification, including recent pay stubs or tax returns.

- Details of current debts and financial obligations.

- Documentation outlining the intended use of the loan funds.

- Any additional forms or information requested by the lender.

Eligibility Criteria for the SLF Form

To qualify for a loan using the SLF form, applicants must meet certain eligibility criteria set by the lending institution. Common requirements include:

- A minimum credit score, which varies by lender.

- Proof of stable income or employment.

- A clear plan for the use of the loan funds, demonstrating viability and necessity.

- Compliance with any specific lender guidelines related to home development projects.

Quick guide on how to complete hdmf loan application form

Effortlessly Prepare Hdmf Loan Application Form on Any Device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly and without delays. Manage Hdmf Loan Application Form across any platform with the airSlate SignNow Android or iOS applications and enhance any document-related task today.

Efficiently Modify and eSign Hdmf Loan Application Form with Ease

- Obtain Hdmf Loan Application Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or conceal sensitive information using tools specifically offered by airSlate SignNow.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to secure your changes.

- Choose how you wish to send your form—via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form navigation, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any chosen device. Modify and eSign Hdmf Loan Application Form while ensuring outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the hdmf loan application form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an SLF form and how does it benefit my business?

An SLF form is a standardized document format that simplifies the process of sending and signing forms electronically. By using an SLF form, your business can ensure quick turnaround times, reduce paper usage, and enhance document security, all while maintaining compliance with industry standards.

-

How much does it cost to use airSlate SignNow for SLF forms?

AirSlate SignNow offers flexible pricing plans designed to accommodate businesses of various sizes. You can choose from monthly or annual subscriptions, with costs varying based on the number of users and the features required to manage your SLF forms effectively.

-

Can I integrate SLF forms with other applications?

Yes, airSlate SignNow supports extensive integrations with popular applications such as Google Workspace, Salesforce, and Microsoft 365. This seamless integration allows you to manage your SLF forms alongside your everyday business tools, streamlining your workflow and enhancing productivity.

-

What features does airSlate SignNow offer for SLF forms?

AirSlate SignNow provides a wide range of features for managing SLF forms, including customizable templates, automated reminders, and real-time document tracking. These features help ensure that your forms are processed efficiently and securely, enhancing your overall document management experience.

-

Is it easy to switch to using SLF forms with airSlate SignNow?

Absolutely! Switching to SLF forms with airSlate SignNow is a straightforward process. The platform offers user-friendly tutorials and customer support to help you set up your account quickly and start sending and eSigning documents in no time.

-

How secure are the SLF forms created with airSlate SignNow?

Security is a top priority with airSlate SignNow. SLF forms are protected with advanced encryption technology, ensuring that your sensitive information remains confidential and secure throughout the signing process.

-

Can I track the status of my SLF forms?

Yes, airSlate SignNow provides real-time tracking for your SLF forms. You can easily monitor which documents have been viewed, signed, or are still pending, allowing you to stay organized and up-to-date on your document workflows.

Get more for Hdmf Loan Application Form

Find out other Hdmf Loan Application Form

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template