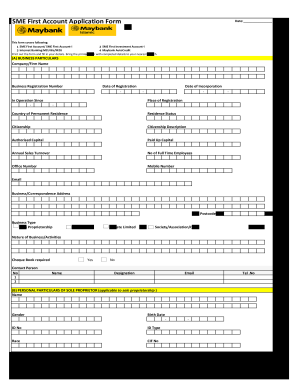

Maybank Sme First Account Form

What is the Maybank SME First Account

The Maybank SME First Account is designed specifically for small and medium enterprises (SMEs) to facilitate their banking needs. This account offers a range of features tailored to support business operations, including low initial deposit requirements and minimal maintenance fees. It provides a convenient way for SMEs to manage their finances while also benefiting from various banking services that cater to their unique requirements.

How to use the Maybank SME First Account

Utilizing the Maybank SME First Account involves several straightforward steps. First, businesses can access their account through Maybank's online banking platform, allowing for easy management of transactions and account settings. Users can deposit funds, transfer money, and monitor their account activity in real time. Additionally, the account may offer features such as mobile banking and transaction alerts, enhancing user convenience and financial oversight.

Steps to complete the Maybank SME First Account

To complete the application for a Maybank SME First Account, follow these steps:

- Gather necessary documentation, including business registration details and identification.

- Visit a Maybank branch or access the online application portal.

- Fill out the SME First Account application form, ensuring all information is accurate.

- Submit the application along with the required documents for verification.

- Wait for approval, which typically takes a few business days.

Legal use of the Maybank SME First Account

The legal use of the Maybank SME First Account requires compliance with applicable banking regulations and guidelines. Businesses must ensure that their account activities adhere to laws governing financial transactions, including anti-money laundering regulations. Proper documentation and record-keeping are essential to maintain the account's legal standing and to facilitate any audits or reviews by regulatory authorities.

Eligibility Criteria

To qualify for the Maybank SME First Account, applicants must meet specific eligibility criteria. Generally, the account is available to registered small and medium enterprises operating within the designated industry sectors. Applicants may need to provide proof of business registration, tax identification, and other relevant documentation to demonstrate their eligibility and business legitimacy.

Application Process & Approval Time

The application process for the Maybank SME First Account is designed to be efficient. After submitting the completed application form along with the necessary documents, the approval time typically ranges from three to five business days. During this period, Maybank will review the application to ensure all criteria are met and that the business is eligible for the account.

Quick guide on how to complete maybank sme first account

Effortlessly Prepare Maybank Sme First Account on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without any holdups. Manage Maybank Sme First Account on any platform using airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to Modify and eSign Maybank Sme First Account with Ease

- Find Maybank Sme First Account and click on Get Form to initiate the process.

- Use the tools we offer to fill out your form.

- Select important sections of your documents or redact sensitive information with specialized tools provided by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to share your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Maybank Sme First Account while ensuring outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the maybank sme first account

The way to generate an electronic signature for a PDF online

The way to generate an electronic signature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The way to create an eSignature straight from your smartphone

The best way to make an eSignature for a PDF on iOS

The way to create an eSignature for a PDF document on Android

People also ask

-

What is SME First Account and how does it benefit small businesses?

The SME First Account is designed specifically for small and medium enterprises, providing an affordable and efficient way to manage your documents. By utilizing airSlate SignNow, businesses can easily send and eSign documents, streamlining workflows and reducing turnaround times. Understanding what is SME First Account can help you leverage features catered for your business size and needs.

-

What features are included with the SME First Account?

The SME First Account includes essential features like document templates, customizable workflows, and real-time tracking. It allows businesses to send and receive eSignatures effortlessly, ensuring that all documentation is processed securely. Knowing what is SME First Account means recognizing the powerful tools it offers to enhance your document management process.

-

How much does the SME First Account cost?

The pricing for the SME First Account is tailored to accommodate the budgetary constraints of small businesses. Typically, it operates on a subscription model with various tiers. Understanding what is SME First Account pricing helps businesses choose the right plan that aligns with their operational needs.

-

Can I integrate the SME First Account with other applications?

Yes, the SME First Account offers seamless integrations with various third-party applications such as CRM systems and productivity tools. This enhances your workflow by allowing you to manage documents from multiple platforms. Knowing what is SME First Account integrations can signNowly improve overall efficiency for your business.

-

Is it secure to use the SME First Account for sensitive documents?

Absolutely! The SME First Account ensures high-level security protocols are in place to protect sensitive information. It complies with global security standards, giving businesses peace of mind when eSigning important documents. Understanding what is SME First Account security features is essential for maintaining your confidentiality and compliance.

-

How can the SME First Account improve my business's document workflow?

The SME First Account simplifies the document workflow by minimizing the steps required to send and sign documents. By digitizing and automating the signing process, businesses can reduce administrative burdens and increase efficiency. Learning what is SME First Account can reveal how it helps streamline communication and collaboration across teams.

-

What types of documents can I send through the SME First Account?

The SME First Account supports a wide range of document types, from contracts to agreements and forms. This versatility makes it an ideal solution for businesses needing to manage various documentation quickly and securely. Recognizing what is SME First Account in terms of document types can aid in choosing the right tools for your specific needs.

Get more for Maybank Sme First Account

Find out other Maybank Sme First Account

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement