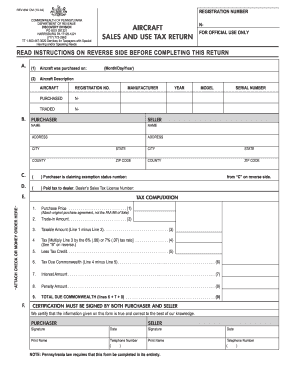

Aircraft Sales and Use Tax Return REV 832 Form

What is the Aircraft Sales And Use Tax Return REV 832

The Aircraft Sales and Use Tax Return REV 832 is a form used in the United States for reporting the sale or use of aircraft. This form is essential for individuals and businesses to comply with state tax regulations. It provides a structured way to declare the tax owed on aircraft purchases, ensuring that all transactions are recorded accurately for tax purposes. Understanding this form is crucial for anyone involved in buying or selling aircraft, as it helps avoid potential legal issues related to tax compliance.

Steps to complete the Aircraft Sales And Use Tax Return REV 832

Completing the Aircraft Sales and Use Tax Return REV 832 involves several key steps:

- Gather necessary information: Collect details about the aircraft, including its make, model, and purchase price.

- Identify the appropriate tax rate: Research the applicable state tax rate for aircraft sales.

- Fill out the form: Enter the required information accurately in the designated fields of the form.

- Review for accuracy: Double-check all entries to ensure there are no mistakes that could lead to penalties.

- Submit the form: Choose your submission method, whether online, by mail, or in-person, and ensure it is sent by the deadline.

Legal use of the Aircraft Sales And Use Tax Return REV 832

The legal use of the Aircraft Sales and Use Tax Return REV 832 is governed by state tax laws. It is important to ensure that the form is filled out correctly and submitted on time to avoid any legal repercussions. The form serves as a declaration of tax liability and must be used in accordance with the regulations set forth by the state tax authority. Failure to comply with these regulations can result in penalties, fines, or audits.

Form Submission Methods

There are several methods available for submitting the Aircraft Sales and Use Tax Return REV 832:

- Online submission: Many states offer an electronic filing option that allows users to submit their forms through a secure online portal.

- Mail submission: Completed forms can be printed and mailed to the appropriate state tax office.

- In-person submission: Taxpayers may also choose to deliver their forms directly to their local tax office for processing.

Filing Deadlines / Important Dates

Filing deadlines for the Aircraft Sales and Use Tax Return REV 832 vary by state. It is essential to be aware of these deadlines to ensure timely submission and avoid penalties. Typically, the form must be filed within a specified period following the purchase of the aircraft. Checking with the state tax authority for specific dates is advisable to remain compliant.

Required Documents

To complete the Aircraft Sales and Use Tax Return REV 832, certain documents may be required. These often include:

- Proof of purchase, such as a bill of sale or invoice.

- Documentation of the aircraft's specifications, including its registration number.

- Any previous tax exemption certificates, if applicable.

Quick guide on how to complete aircraft sales and use tax return rev 832

Effortlessly Prepare Aircraft Sales And Use Tax Return REV 832 on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Aircraft Sales And Use Tax Return REV 832 on any device using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

The Simplest Way to Edit and Electronically Sign Aircraft Sales And Use Tax Return REV 832 with Ease

- Locate Aircraft Sales And Use Tax Return REV 832 and click Get Form to commence.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive data with tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal standing as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you'd like to send your form, whether by email, SMS, invite link, or download it directly to your computer.

Eliminate concerns over lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Aircraft Sales And Use Tax Return REV 832 and maintain exceptional communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the aircraft sales and use tax return rev 832

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an 832 form and how can I use it with airSlate SignNow?

The 832 form is a specific document type that can be easily created, sent, and signed using airSlate SignNow. Our platform allows you to upload this form, add fields for signatures, and send it to your recipients for electronic signing. This streamlined process ensures that your 832 form is handled efficiently and securely.

-

What are the pricing options for using airSlate SignNow with the 832 form?

airSlate SignNow offers flexible pricing plans suitable for businesses of any size. Whether you need a single-user plan or a comprehensive business solution, you'll find features tailored to facilitate the smooth management of your 832 form and other documents at competitive rates.

-

What features does airSlate SignNow provide for managing the 832 form?

With airSlate SignNow, you can take advantage of features like document templates, customizable fields, and tracking capabilities specifically for the 832 form. This helps ensure that every essential detail is captured and that you can monitor the signing status of your documents in real-time.

-

How does airSlate SignNow ensure the security of my 832 form?

Security is a top priority at airSlate SignNow. When you use our platform for your 832 form, your sensitive data is protected through encryption, secure cloud storage, and compliance with industry standards. This guarantees that your information remains confidential and secure at all times.

-

Can I integrate airSlate SignNow with other tools while working on the 832 form?

Yes, airSlate SignNow seamlessly integrates with a variety of popular applications, making it easy to work on your 832 form alongside tools such as Google Drive, Salesforce, and more. This enhances your workflow efficiency and keeps all relevant information centrally located.

-

What benefits does using airSlate SignNow for the 832 form provide?

Using airSlate SignNow to manage your 832 form boosts productivity with its user-friendly interface and rapid turnaround for document signing. Not only can you expedite approval processes, but you'll also save on printing and mailing costs, making your operations more eco-friendly and efficient.

-

Is there support available if I encounter issues with the 832 form?

Absolutely! airSlate SignNow provides comprehensive customer support, including live chat, email assistance, and a robust knowledge base. If you encounter any issues with your 832 form, our dedicated team is ready to help you resolve them promptly.

Get more for Aircraft Sales And Use Tax Return REV 832

Find out other Aircraft Sales And Use Tax Return REV 832

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple