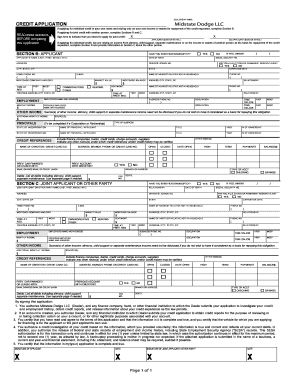

Joint or Single Application Mortgage Professor Form

What is the Joint Or Single Application Mortgage Professor

The Joint Or Single Application Mortgage Professor is a specialized form used in the mortgage application process. It allows individuals to apply for a mortgage either together with a co-applicant or individually. This form is essential for lenders to assess the financial status and creditworthiness of the applicants. By providing detailed information about income, debts, and assets, it helps in determining the eligibility for a mortgage loan. Understanding the nuances of this form can significantly impact the approval process and the terms of the loan offered.

Steps to Complete the Joint Or Single Application Mortgage Professor

Completing the Joint Or Single Application Mortgage Professor involves several key steps:

- Gather necessary documentation, such as income statements, tax returns, and identification.

- Decide whether to apply jointly or individually based on your financial situation.

- Fill out the form accurately, ensuring all fields are completed to avoid delays.

- Review the information for accuracy, as errors can affect the application outcome.

- Submit the form electronically or via traditional mail, depending on lender requirements.

Legal Use of the Joint Or Single Application Mortgage Professor

The legal use of the Joint Or Single Application Mortgage Professor is governed by various laws that ensure the validity of electronic signatures and the security of personal information. Compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA) is crucial. These laws affirm that eSignatures have the same legal standing as handwritten signatures, provided that proper protocols are followed during the signing process. This legal framework protects both the applicants and the lenders throughout the mortgage application process.

Key Elements of the Joint Or Single Application Mortgage Professor

Several key elements are essential in the Joint Or Single Application Mortgage Professor:

- Personal Information: Names, addresses, and Social Security numbers of the applicants.

- Employment Details: Current employment status, income, and job history.

- Financial Information: Assets, liabilities, and credit history.

- Property Details: Information about the property being purchased or refinanced.

Eligibility Criteria

Eligibility for the Joint Or Single Application Mortgage Professor typically includes several criteria that applicants must meet:

- Minimum credit score requirements set by the lender.

- Stable income and employment history.

- Debt-to-income ratio that falls within acceptable limits.

- Legal age to enter into contracts in the state of application.

Form Submission Methods

Submitting the Joint Or Single Application Mortgage Professor can be done through various methods:

- Online Submission: Many lenders offer an online portal for electronic submission, which is often the fastest method.

- Mail: Applicants can print the completed form and send it via postal service.

- In-Person: Some applicants may prefer to submit the form directly at the lender's office for assistance.

Quick guide on how to complete joint or single application mortgage professor

Complete Joint Or Single Application Mortgage Professor seamlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to locate the necessary form and securely store it online. airSlate SignNow offers all the tools you need to create, edit, and eSign your documents quickly without delays. Manage Joint Or Single Application Mortgage Professor on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based task today.

The easiest way to edit and eSign Joint Or Single Application Mortgage Professor with ease

- Locate Joint Or Single Application Mortgage Professor and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign feature, which takes just seconds and carries the same legal standing as a conventional wet ink signature.

- Review all the information carefully and then click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and eSign Joint Or Single Application Mortgage Professor and ensure outstanding communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the joint or single application mortgage professor

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the difference between a joint or single application for mortgages?

A joint application for a mortgage involves two or more applicants sharing financial responsibilities, while a single application is made by an individual. The 'Joint Or Single Application Mortgage Professor' can help you understand the implications of each choice, such as how it affects credit scores and loan approval chances.

-

How does a joint application affect my mortgage eligibility?

Applying jointly can enhance your purchasing power by combining incomes and assets, potentially leading to better loan terms. The 'Joint Or Single Application Mortgage Professor' emphasizes that both applicants’ credit histories will be evaluated, which could benefit or hinder eligibility depending on their financial records.

-

What are the cost implications of a joint versus a single application for a mortgage?

Overall costs may vary with either application type depending on the financial profiles of the applicants. Working with the 'Joint Or Single Application Mortgage Professor' can clarify how your combined income may lead to better rates, but also consider any additional fees associated with co-signers.

-

Can I transition from a joint to a single application during the mortgage process?

Yes, transitioning from a joint to a single application is possible but may require revisiting your loan terms. The 'Joint Or Single Application Mortgage Professor' can guide you through this process, explaining how it may impact your mortgage approval and rates.

-

What features should I look for in a mortgage provider when considering a joint or single application?

Features to consider include competitive interest rates, flexible repayment terms, and transparent fee structures. The 'Joint Or Single Application Mortgage Professor' recommends comparing providers to find those who excel in catering to the needs of both joint and single applicants.

-

What are the benefits of using a joint application for a mortgage?

A joint application allows couples or partners to pool their financial resources, increasing the likelihood of approval and possibly securing a lower interest rate. The 'Joint Or Single Application Mortgage Professor' highlights the benefit of shared responsibilities in managing mortgage payments.

-

Are there specific integrations I should consider when applying for a joint mortgage?

Look for mortgage providers that integrate with financial management tools for effective budgeting and tracking. The 'Joint Or Single Application Mortgage Professor' can recommend integrated solutions that enhance transparency and management of your finances during the mortgage application process.

Get more for Joint Or Single Application Mortgage Professor

- Dhr cdc 1951 adobe 2001 form

- Threshold override application for medicaid ny 2010 form

- Patient authorization for release of medical mssm form

- Psf printable 2009 form

- Michelle keith makeup form

- Consent for sterilization in kentucky form

- Tn lpl application new york state bar association insurance form

- Molina healthcare health delivery organization application 2011 form

Find out other Joint Or Single Application Mortgage Professor

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will