Form 3832

What is the Form 3832

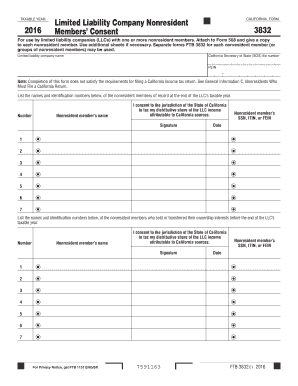

The California Form 3832 is a tax form used primarily for reporting certain tax-related information to the state of California. This form is typically associated with the California Franchise Tax Board and is essential for individuals and businesses to ensure compliance with state tax laws. It may involve reporting income, deductions, or other tax-related details necessary for accurate tax filings. Understanding the purpose and requirements of Form 3832 is crucial for maintaining proper tax records and fulfilling legal obligations.

How to use the Form 3832

Using the California Form 3832 involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and any relevant deductions. Next, download the form from the official California Franchise Tax Board website or obtain a physical copy. Fill out the form carefully, ensuring all information is accurate and complete. Once completed, review the form for errors before submission. The form can be submitted online, by mail, or in person, depending on your preference and the requirements set by the California Franchise Tax Board.

Steps to complete the Form 3832

Completing the California Form 3832 requires careful attention to detail. Follow these steps for a smooth process:

- Gather necessary documentation, such as W-2s and 1099 forms.

- Download or request a physical copy of Form 3832.

- Fill in personal information, including your name, address, and Social Security number.

- Report your income and any applicable deductions accurately.

- Double-check all entries for accuracy to avoid mistakes.

- Submit the completed form via your chosen method: online, by mail, or in person.

Legal use of the Form 3832

The legal use of California Form 3832 is governed by state tax laws and regulations. To be considered valid, the form must be completed accurately and submitted within the designated deadlines. Ensuring compliance with these regulations is essential, as failure to do so may result in penalties or legal repercussions. Additionally, the information provided on the form must be truthful and supported by appropriate documentation to maintain its legal standing.

Filing Deadlines / Important Dates

Filing deadlines for the California Form 3832 can vary based on individual circumstances, such as whether you are filing as an individual or a business entity. Generally, the form must be submitted by the tax filing deadline, which is typically April 15 for individuals. Businesses may have different deadlines depending on their fiscal year. It is crucial to stay informed about these dates to avoid late filing penalties and ensure compliance with state tax regulations.

Who Issues the Form

The California Form 3832 is issued by the California Franchise Tax Board (FTB). This state agency is responsible for administering California's personal income tax and corporate tax laws. The FTB provides the necessary forms, guidelines, and support for taxpayers to ensure accurate and timely tax reporting. Understanding the role of the FTB can help taxpayers navigate the complexities of state tax obligations.

Quick guide on how to complete form 3832

Complete Form 3832 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the correct form and securely preserve it online. airSlate SignNow provides all the resources required to create, modify, and eSign your documents quickly without delays. Handle Form 3832 on any device with the airSlate SignNow Android or iOS applications and simplify any document-centric process today.

How to edit and eSign Form 3832 with ease

- Find Form 3832 and click on Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize important sections of your documents or hide sensitive information with tools that airSlate SignNow provides uniquely for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from the device of your choice. Modify and eSign Form 3832 while ensuring excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 3832

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the California Form 3832?

The California Form 3832 is a critical document for businesses operating in California, particularly for those involved in certain tax situations. It is essential to understand this form to ensure compliance and proper reporting of income. Utilizing airSlate SignNow can streamline the process of completing and sending this form.

-

How can airSlate SignNow assist with California Form 3832?

airSlate SignNow simplifies the process of filling out and eSigning the California Form 3832. The platform provides intuitive templates and easy access to the form, allowing businesses to complete their documentation efficiently. This can save time and reduce errors in submissions.

-

Is airSlate SignNow affordable for small businesses needing California Form 3832?

Yes, airSlate SignNow is a cost-effective solution ideal for small businesses. We offer various pricing plans that suit different budgets, ensuring that even smaller enterprises can access the tools they need for handling the California Form 3832 efficiently. This affordability helps businesses remain compliant without overspending.

-

Are there any integrations available with airSlate SignNow for California Form 3832?

Absolutely! airSlate SignNow integrates seamlessly with various applications and software programs, enhancing functionality for users completing the California Form 3832. This means you can easily link your existing tools, making document management and eSigning more efficient.

-

What features does airSlate SignNow offer for eSigning California Form 3832?

airSlate SignNow provides robust eSigning features that allow users to securely sign the California Form 3832 online. Our platform includes options for in-person signing, automated reminders, and secure storage, ensuring the signing process is both efficient and compliant.

-

What are the benefits of using airSlate SignNow for California Form 3832?

Using airSlate SignNow for the California Form 3832 can enhance productivity and reduce the complexities associated with document handling. The platform's user-friendly interface allows for quick completion, while eSigning features ensure that signed documents are securely stored and easily accessible.

-

Can I track the status of my California Form 3832 with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your California Form 3832 submissions in real-time. You receive notifications and updates regarding the progress of your documents, which helps you stay informed and manage deadlines effectively.

Get more for Form 3832

- Amag assist reimbursement program enrollment form rxassist rxassist

- Instructions dhs 1139a 0408 psychiatrypsychology credentialing attachment purpose form dhs 1139a shall be used by health care

- Instructions dhs 1139e rev med quest form

- Notices us government publishing office med quest form

- Erm 14 2000 form

- Claim form allianz worldwide care

- Medical claim form anthem blue cross

- Tuberculosis prescription medication request form

Find out other Form 3832

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online