Amusement Tax Form

What is the amusement tax?

The amusement tax is a specific tax levied on activities that provide entertainment or amusement to the public. This tax can apply to various events, including concerts, sporting events, movie theaters, and amusement parks. The rate of the amusement tax can vary by jurisdiction, often determined by local government regulations. Understanding this tax is essential for both consumers and businesses involved in providing entertainment services.

How to use the amusement tax

Using the amusement tax involves understanding its application and ensuring compliance with local regulations. Businesses that charge for entertainment services need to calculate the amusement tax based on the ticket price or admission fee. This tax must be collected from customers at the point of sale and reported to the appropriate local tax authority. Accurate record-keeping is crucial for businesses to ensure they meet their tax obligations.

Steps to complete the amusement tax

Completing the amusement tax process requires several key steps:

- Determine the applicable amusement tax rate based on your location.

- Calculate the total tax amount based on ticket sales or admission fees.

- Collect the amusement tax from customers at the time of sale.

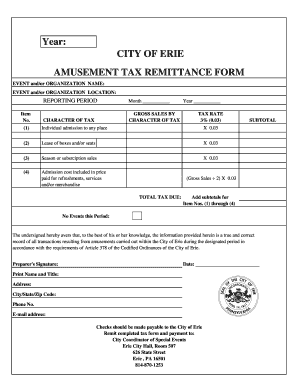

- Complete the necessary forms for tax remittance.

- Submit the collected tax to the local tax authority by the specified deadline.

Key elements of the amusement tax

Several key elements define the amusement tax, including:

- Tax Rate: The percentage charged on the total admission fee or ticket price.

- Taxable Activities: Specific events or services that fall under the amusement tax jurisdiction.

- Compliance Requirements: Legal obligations for businesses to collect, report, and remit the tax.

- Exemptions: Certain activities or organizations may qualify for exemptions from the amusement tax.

Filing deadlines / Important dates

Filing deadlines for the amusement tax can vary by location. Generally, businesses must remit the collected tax on a monthly or quarterly basis. It is essential to check with local tax authorities for specific deadlines to avoid penalties. Keeping a calendar of important dates can help ensure timely compliance with amusement tax obligations.

Penalties for non-compliance

Failure to comply with amusement tax regulations can result in significant penalties for businesses. These may include:

- Fines based on the amount of tax owed.

- Interest charges on late payments.

- Potential legal action from local tax authorities.

Businesses are encouraged to stay informed about their tax responsibilities to avoid these consequences.

Quick guide on how to complete amusement tax

Accomplish Amusement Tax effortlessly on any device

Digital document management has become favored among businesses and individuals. It offers an ideal environmentally-friendly substitute for conventional printed and signed documents, as you can access the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your paperwork quickly without delays. Manage Amusement Tax on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven procedure today.

The simplest way to edit and eSign Amusement Tax with ease

- Find Amusement Tax and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact confidential information using tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Verify all the details and then click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of losing or misplacing documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and eSign Amusement Tax and ensure outstanding communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the amusement tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is amusement tax and how does it apply to my business?

Amusement tax is a type of tax that applies to various entertainment and recreational activities, often imposed by local governments. If your business provides services like events, concerts, or amusement parks, understanding how to comply with amusement tax regulations is crucial. Using airSlate SignNow can help streamline the documentation required to ensure compliance without confusion.

-

How does airSlate SignNow handle amusement tax-related documents?

airSlate SignNow simplifies the management of documents related to amusement tax by allowing you to easily create, send, and eSign them online. This ensures that all relevant agreements and tax documents are securely handled, reducing the risk of compliance issues. With our platform, you can maintain organized records for any amusement tax submissions required by local authorities.

-

Is there a cost associated with using airSlate SignNow for amusement tax documents?

Yes, there is a pricing structure for using airSlate SignNow, which is designed to be cost-effective for businesses needing to manage amusement tax-related documents. Depending on your specific needs and usage, different subscription plans may offer varying features and benefits. Investing in our solution can save you time and reduce potential costs associated with errors in tax documentation.

-

What features does airSlate SignNow offer for managing amusement tax transactions?

airSlate SignNow includes features such as document templates, in-app signing, integration with other software, and detailed tracking of document status, which are invaluable for managing amusement tax transactions. These functionalities make it easy to ensure that all required paperwork is completed accurately and on time. This comprehensive approach alleviates the administrative burden often associated with amusement tax compliance.

-

Can airSlate SignNow integrate with other tools relevant to amusement tax?

Absolutely! airSlate SignNow offers integrations with popular business tools that can assist you in effectively managing amusement tax documents. For example, you can connect your accounting software or customer relationship management (CRM) system to ensure seamless information flow between platforms. This integration capability helps streamline processes and maintain accurate records for amusement tax purposes.

-

How does airSlate SignNow ensure the security of amusement tax documents?

Security is a top priority for airSlate SignNow, especially when handling sensitive amusement tax documents. Our platform employs robust encryption methods and compliance with industry standards to protect your data. You can trust that your documents are secure while being processed and stored, giving you peace of mind for your amusement tax documentation.

-

What benefits can my business gain from using airSlate SignNow for amusement tax management?

Using airSlate SignNow for amusement tax management can improve efficiency, reduce paperwork errors, and ensure compliance with local tax regulations. By streamlining the eSigning process, your business can save valuable time and resources, allowing you to focus more on providing exceptional entertainment experiences. Additionally, better management of documents can lead to fewer disputes and clearer communication with tax authorities.

Get more for Amusement Tax

- Sheet restraining order form

- Co parental rights form

- Colorado relinquishment counseling form

- Verified statement of fees charged colorado form

- Petition sex offender form

- Instructions to discontinue sex offender registration for a colorado and non colorado conviction colorado form

- Sex registration colorado form

- Colorado notice hearing 497300432 form

Find out other Amusement Tax

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free