Ttb Form 5000 24

What is the TTB Form 5000 24?

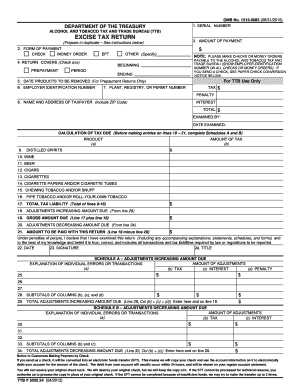

The TTB Form 5000 24, also known as the TTB excise tax form, is a crucial document used by businesses involved in the production and distribution of alcohol. This form is required by the Alcohol and Tobacco Tax and Trade Bureau (TTB) to report and pay federal excise taxes on alcoholic beverages. It is essential for compliance with federal regulations, ensuring that all businesses adhere to the tax obligations associated with their operations.

Steps to Complete the TTB Form 5000 24

Completing the TTB Form 5000 24 involves several key steps to ensure accuracy and compliance. First, gather all necessary information regarding your business operations, including production volumes and sales data. Next, accurately fill out each section of the form, ensuring that all figures are correct and supported by appropriate documentation. Once completed, review the form for any errors or omissions before submitting it to the TTB.

How to Obtain the TTB Form 5000 24

The TTB Form 5000 24 can be obtained directly from the TTB's official website. It is available as a downloadable PDF, which can be filled out electronically or printed for manual completion. Additionally, businesses can contact the TTB for assistance in acquiring the form or for any questions regarding its use.

Legal Use of the TTB Form 5000 24

The TTB Form 5000 24 must be used in accordance with federal regulations governing the production and taxation of alcoholic beverages. This form serves as a legal declaration of the taxes owed and must be filed accurately and on time to avoid penalties. Understanding the legal implications of this form is essential for any business operating in the alcohol industry.

Key Elements of the TTB Form 5000 24

Key elements of the TTB Form 5000 24 include detailed sections for reporting production volumes, sales, and tax calculations. The form requires specific information about the types of alcoholic beverages produced and sold, as well as the corresponding tax rates applicable to each category. Accuracy in these elements is vital for compliance and to ensure that the correct amount of tax is reported and paid.

Form Submission Methods

The TTB Form 5000 24 can be submitted through various methods, including online submission via the TTB's electronic filing system, mailing a completed paper form, or delivering it in person to a TTB office. Each method has its own requirements and processing times, so it is important for businesses to choose the most efficient option for their needs.

Quick guide on how to complete ttb form 5000 24

Complete Ttb Form 5000 24 seamlessly on any gadget

Digital document administration has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute to traditional printed and signed paperwork, allowing you to locate the right template and securely keep it online. airSlate SignNow provides all the tools necessary for you to create, edit, and electronically sign your documents promptly without delays. Manage Ttb Form 5000 24 on any gadget with airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

The simplest way to edit and electronically sign Ttb Form 5000 24 with ease

- Locate Ttb Form 5000 24 and click Get Form to initiate.

- Utilize the tools available to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that task.

- Generate your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and then select the Done button to save your changes.

- Choose your preferred method to share your form, either via email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, cumbersome form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Ttb Form 5000 24 while ensuring effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ttb form 5000 24

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ttb form 5000 24 and why is it important?

The ttb form 5000 24 is a key application required by the Alcohol and Tobacco Tax and Trade Bureau (TTB) for businesses involved in alcohol production. It serves to ensure compliance with federal regulations, and submitting this form accurately is crucial for obtaining the necessary permits.

-

How can airSlate SignNow assist with the ttb form 5000 24?

airSlate SignNow simplifies the process of completing and submitting the ttb form 5000 24 by providing an intuitive platform for eSigning documents. Our solution allows users to securely sign and send their forms electronically, ensuring a quick and hassle-free submission.

-

What are the pricing options for using airSlate SignNow for ttb form 5000 24?

airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan includes features that facilitate the completion of forms like the ttb form 5000 24 and provide flexibility for businesses based on their document management requirements.

-

Are there any integrations available that work with the ttb form 5000 24?

Yes, airSlate SignNow integrates seamlessly with various applications that can assist in the management of the ttb form 5000 24. This allows users to streamline workflows and enhance efficiency, ensuring that all necessary documents are easily accessible.

-

What features does airSlate SignNow offer for completing the ttb form 5000 24?

airSlate SignNow includes features such as customizable templates, advanced editing tools, and automated workflows to expedite the filling out of the ttb form 5000 24. These features enhance productivity by reducing the time spent on paperwork.

-

Is airSlate SignNow secure for submitting the ttb form 5000 24?

Absolutely! airSlate SignNow employs industry-leading security practices to protect sensitive information. When submitting the ttb form 5000 24 through our platform, you can trust that your data is encrypted and handled with the highest level of security.

-

Can I track the status of my ttb form 5000 24 after sending?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your ttb form 5000 24 submissions. You will receive notifications when your document has been viewed and signed, ensuring you stay informed throughout the process.

Get more for Ttb Form 5000 24

- Healthcare account service center form

- Authorization to disclose to third party mount sinai hospital mountsinai form

- Do my own qdro form

- Medical clearance form

- Prenatal massage form

- Lehigh valley health network form

- Mdvip com form

- Healthcare conversation tracker life senior services lifeseniorservices form

Find out other Ttb Form 5000 24

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract