Form Ct 4852

What is the Form Ct 4852

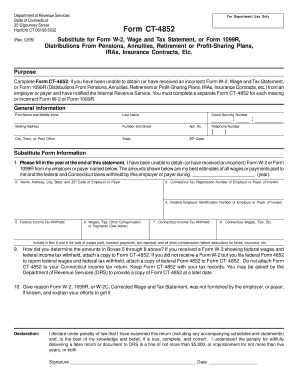

The Form Ct 4852 is a tax form used in the United States for reporting income when a taxpayer has not received a W-2 or 1099 from their employer or payer. This form serves as a substitute for these documents, allowing individuals to report their earnings to the Internal Revenue Service (IRS) accurately. It is crucial for taxpayers to complete this form when they are unable to obtain the necessary income documentation, ensuring compliance with tax obligations.

How to use the Form Ct 4852

Using the Form Ct 4852 involves several key steps. First, gather all relevant information regarding your income, including the amount earned and any applicable taxes withheld. Next, fill out the form with accurate details about your earnings and the reasons for not receiving a W-2 or 1099. Once completed, the form should be submitted along with your tax return. It is essential to ensure that all information is correct to avoid issues with the IRS.

Steps to complete the Form Ct 4852

Completing the Form Ct 4852 requires careful attention to detail. Follow these steps:

- Obtain a copy of the Form Ct 4852 from the IRS website or through tax preparation software.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details about your income, including the total amount earned and any taxes withheld.

- Explain why you are using this form instead of the standard W-2 or 1099.

- Review the form for accuracy and completeness.

- Attach the completed form to your tax return before submitting it to the IRS.

Legal use of the Form Ct 4852

The Form Ct 4852 is legally recognized by the IRS as a valid substitute for W-2 and 1099 forms. To ensure its legal standing, it must be filled out accurately and submitted in a timely manner. Taxpayers should retain copies of the completed form and any supporting documentation to provide evidence of income reporting if requested by the IRS. Compliance with IRS guidelines is essential to avoid potential penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Form Ct 4852 align with the general tax return deadlines. Typically, individual tax returns are due on April fifteenth of each year. If additional time is needed, taxpayers may file for an extension, but it is important to note that any taxes owed must still be paid by the original deadline to avoid penalties. Keeping track of these dates is crucial for timely compliance.

Required Documents

When completing the Form Ct 4852, certain documents may be required to support your income claims. These can include:

- Pay stubs or other proof of income.

- Any correspondence from your employer regarding the missing W-2 or 1099.

- Records of any taxes withheld from your earnings.

Gathering these documents will help ensure that your form is completed accurately and can assist in resolving any discrepancies with the IRS.

Quick guide on how to complete form ct 4852

Effortlessly Prepare Form Ct 4852 on Any Device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the essentials to create, modify, and electronically sign your documents swiftly without delays. Handle Form Ct 4852 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric procedure today.

The Easiest Way to Edit and eSign Form Ct 4852 with Ease

- Locate Form Ct 4852 and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information carefully and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Form Ct 4852 and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ct 4852

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form Ct 4852 and why is it important?

Form Ct 4852 is a tax form used to report income for individuals who do not receive a Form 1099 from their employers. Understanding this form is crucial for accurate tax reporting and avoiding issues with the IRS. airSlate SignNow simplifies the completion and submission of Form Ct 4852, ensuring that your tax filing process is smooth and efficient.

-

How can airSlate SignNow help with filling out Form Ct 4852?

With airSlate SignNow, users can easily access templates and guides for completing Form Ct 4852. The platform allows you to fill out the form digitally, ensuring that all information is accurately entered and securely stored. Our user-friendly interface streamlines the process, making it simple for anyone to complete their Form Ct 4852.

-

Is airSlate SignNow cost-effective for handling Form Ct 4852?

Yes, airSlate SignNow offers a cost-effective solution for managing important documents like Form Ct 4852. Our pricing plans are designed to cater to businesses of all sizes, providing features that ensure efficient and economical document management. By choosing airSlate SignNow, you save time and money on paper-based processes and administrative tasks.

-

What features does airSlate SignNow offer for Form Ct 4852?

airSlate SignNow includes features like eSignature capabilities, cloud storage, and easy collaboration tools specifically for Form Ct 4852. Users can send the form for signatures directly through the platform, track the document's progress, and store completed forms securely. These features enhance productivity and streamline the tax filing process.

-

Can I integrate airSlate SignNow with other software for Form Ct 4852 management?

Absolutely! airSlate SignNow seamlessly integrates with various applications and software systems that assist in managing Form Ct 4852. Whether you are using accounting software or CRMs, our integration options enhance your workflow and ensure that all tax-related documents are efficiently managed in one place.

-

How secure is airSlate SignNow when handling Form Ct 4852?

Security is a top priority for airSlate SignNow. When handling sensitive documents like Form Ct 4852, we implement advanced encryption and security protocols to protect your information. Users can feel confident knowing their data is safeguarded while using our platform for eSigning and document management.

-

What are the benefits of using airSlate SignNow for Form Ct 4852?

The primary benefits of using airSlate SignNow for Form Ct 4852 include enhanced efficiency, improved accuracy, and reduced risk of errors. Our platform simplifies the process of completing and submitting the form, ensuring that your tax documents are ready on time. Additionally, the ability to eSign electronically saves valuable time in the tax preparation process.

Get more for Form Ct 4852

Find out other Form Ct 4852

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself