ANZ Home Loan Application Form Mortgage Solution

What is the ANZ Home Loan Application Form?

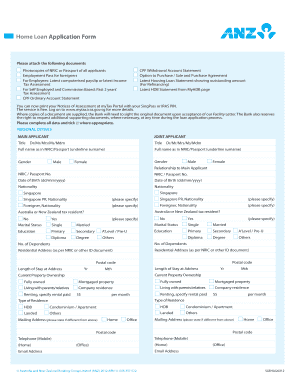

The ANZ Home Loan Application Form is a crucial document for individuals seeking to secure a mortgage through ANZ. This form collects essential information about the applicant's financial situation, including income, expenses, and credit history. It serves as the foundation for the lender's assessment of the borrower's eligibility for a home loan. Completing this form accurately is vital, as it influences the approval process and the terms of the mortgage offered.

Steps to complete the ANZ Home Loan Application Form

Completing the ANZ Home Loan Application Form involves several key steps to ensure accuracy and completeness:

- Gather necessary documentation, such as proof of income, bank statements, and identification.

- Fill out personal details, including your full name, address, and contact information.

- Provide financial information, detailing your income sources, monthly expenses, and existing debts.

- Indicate the type of property you wish to purchase and its estimated value.

- Review the completed form for accuracy and ensure all required fields are filled.

- Submit the form electronically or via mail, depending on your preference.

Legal use of the ANZ Home Loan Application Form

The ANZ Home Loan Application Form is legally binding once submitted, provided it meets specific requirements. It is essential to ensure that all information is truthful and accurate, as providing false information can lead to legal consequences, including denial of the application or future liability. The form must also comply with federal and state regulations governing mortgage lending practices.

Required Documents for the ANZ Home Loan Application Form

To successfully complete the ANZ Home Loan Application Form, applicants must provide several key documents, including:

- Proof of income, such as pay stubs or tax returns.

- Bank statements from the past three months.

- Identification documents, like a driver's license or passport.

- Details of existing debts and liabilities.

- Information regarding the property being purchased.

Eligibility Criteria for the ANZ Home Loan Application Form

Eligibility for a home loan through ANZ generally depends on several factors, including:

- Your credit score and credit history.

- Your income level and employment stability.

- The amount of your down payment.

- The type of property you are purchasing.

Meeting these criteria is essential for a successful application and favorable loan terms.

Application Process & Approval Time for the ANZ Home Loan Application Form

The application process for the ANZ Home Loan typically follows these stages:

- Submission of the completed application form along with required documents.

- Review by ANZ's underwriting team, which assesses the application based on eligibility criteria.

- Approval or denial notification, usually communicated within a few days to weeks.

The approval time can vary based on the complexity of the application and the completeness of the submitted documentation.

Quick guide on how to complete anz home loan application form mortgage solution

Prepare ANZ Home Loan Application Form Mortgage Solution effortlessly on any device

Online document management has become popular with businesses and individuals. It offers a great eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow provides you with all the tools you require to create, modify, and electronically sign your documents quickly and without delays. Handle ANZ Home Loan Application Form Mortgage Solution on any device using airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

How to modify and electronically sign ANZ Home Loan Application Form Mortgage Solution with ease

- Locate ANZ Home Loan Application Form Mortgage Solution and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or black out sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign ANZ Home Loan Application Form Mortgage Solution and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the anz home loan application form mortgage solution

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ANZ preapproval and how does it work?

ANZ preapproval is a service that allows potential homebuyers to secure a conditional agreement for a loan amount from ANZ, giving them a clear idea of their budget. This process involves submitting your financial information to ANZ for evaluation. Once approved, you'll receive a preapproval certificate, making it easier to negotiate offers when house hunting.

-

How can airSlate SignNow assist with ANZ preapproval documents?

With airSlate SignNow, you can efficiently manage and eSign all documents related to your ANZ preapproval. The platform streamlines the signing process, ensuring that you can quickly submit necessary paperwork to ANZ without unnecessary delays. This convenience is particularly beneficial when timing is crucial in securing your preapproval.

-

What are the benefits of obtaining ANZ preapproval?

Obtaining ANZ preapproval gives you a competitive edge in the property market, as it shows sellers you're a serious buyer. It also helps you set a realistic budget for your home purchase, reducing the risk of financial strain later on. Furthermore, having preapproval can streamline the mortgage process once you find your ideal property.

-

What features does airSlate SignNow offer for eSigning ANZ preapproval?

AirSlate SignNow offers several features that enhance the eSigning of ANZ preapproval documents, including customizable templates, multi-party signing, and real-time tracking of document status. These tools enable you to send, sign, and manage your documents seamlessly, ensuring you stay organized throughout the preapproval process.

-

Is there a cost associated with using airSlate SignNow for ANZ preapproval?

AirSlate SignNow provides a cost-effective solution with flexible pricing options to suit different business needs. With various subscription plans, you can select one that aligns with your usage, especially when managing ANZ preapproval documents. Additionally, the time saved using the platform can translate into cost savings in the long run.

-

How does airSlate SignNow integrate with other tools for managing ANZ preapproval?

AirSlate SignNow integrates with a variety of applications, enhancing your ability to manage ANZ preapproval documents alongside other business processes. This includes integrations with popular CRMs, cloud storage services, and productivity tools, allowing for seamless workflows and collaboration. These integrations can boost efficiency in your document management tasks.

-

What security features does airSlate SignNow provide for ANZ preapproval documents?

AirSlate SignNow prioritizes security by using advanced encryption protocols to protect your ANZ preapproval documents. Additionally, the platform provides secure access controls and audit trails, ensuring that your sensitive information remains confidential. You'll have peace of mind knowing that your documents are stored securely while being easily accessible when needed.

Get more for ANZ Home Loan Application Form Mortgage Solution

Find out other ANZ Home Loan Application Form Mortgage Solution

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast