Salestaxindia Form

What is the Salestaxindia

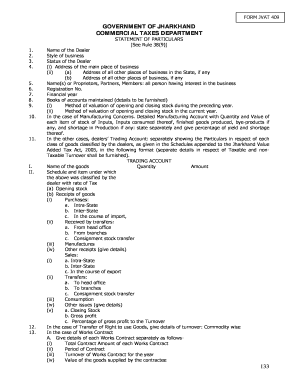

The Salestaxindia form is a crucial document used for reporting sales tax obligations in India. It serves as a declaration of the taxable sales made by businesses and is essential for compliance with local tax laws. The form helps in calculating the amount of sales tax due and ensures that businesses meet their tax responsibilities accurately. Understanding the specifics of the Salestaxindia form is vital for any business operating in the Indian market.

Steps to complete the Salestaxindia

Completing the Salestaxindia form involves several key steps to ensure accuracy and compliance. The process typically includes:

- Gathering necessary financial records, including sales invoices and receipts.

- Calculating total taxable sales for the reporting period.

- Determining the applicable sales tax rate based on the type of goods or services sold.

- Filling out the form with accurate sales figures and tax calculations.

- Reviewing the completed form for any errors or omissions.

- Submitting the form electronically or via mail, depending on local regulations.

Legal use of the Salestaxindia

The legal use of the Salestaxindia form is governed by tax regulations that require businesses to report their sales accurately. Compliance with these regulations is crucial, as failure to file the form correctly can lead to penalties. The form must be completed in accordance with local laws, ensuring that all sales are reported and the correct amount of tax is remitted to the authorities. Understanding the legal implications of the Salestaxindia form helps businesses avoid potential legal issues.

Examples of using the Salestaxindia

Businesses utilize the Salestaxindia form in various scenarios. For instance, a retail store must report its monthly sales and the corresponding sales tax collected from customers. Similarly, an online service provider may need to report sales made to clients in different states, each with varying tax rates. These examples illustrate the form's importance in maintaining compliance and ensuring accurate tax reporting across diverse business operations.

Required Documents

To complete the Salestaxindia form, certain documents are necessary. These typically include:

- Sales invoices and receipts that detail the transactions made during the reporting period.

- Records of any exempt sales, if applicable.

- Previous tax returns, which may assist in ensuring consistency in reporting.

- Bank statements that reflect sales deposits, aiding in the verification of reported figures.

Filing Deadlines / Important Dates

Filing deadlines for the Salestaxindia form vary by jurisdiction and the type of business. It is essential for businesses to be aware of these dates to avoid late penalties. Typically, businesses must file the form monthly or quarterly, depending on their sales volume. Keeping track of these important dates helps ensure timely compliance and avoids unnecessary fines.

Quick guide on how to complete salestaxindia

Effortlessly prepare Salestaxindia on any device

Digital document management has become increasingly popular with businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly and without delays. Manage Salestaxindia on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

Edit and eSign Salestaxindia with ease

- Obtain Salestaxindia and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes seconds and has the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method to send your form—via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or the hassle of printing new copies due to errors. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign Salestaxindia and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the salestaxindia

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is salestaxindia?

Salestaxindia refers to the taxation system in India that governs the collection and remittance of sales tax on goods and services. Understanding salestaxindia is essential for businesses operating in India to ensure compliance and avoid penalties. This knowledge helps streamline operations and maintain good standing with tax authorities.

-

How can airSlate SignNow help with salestaxindia compliance?

AirSlate SignNow provides an easy-to-use eSigning solution that helps businesses manage and store documents related to salestaxindia compliance. By digitizing document workflows, companies can ensure accurate record-keeping and timely submissions. This reduces the risk of misfiling and simplifies audits.

-

What features does airSlate SignNow offer for document management related to salestaxindia?

AirSlate SignNow offers features like customizable templates, secure cloud storage, and real-time tracking for all your documents, which is crucial for managing salestaxindia paperwork. These features enable businesses to send, sign, and store important documents securely and efficiently. Moreover, integration options allow seamless management alongside other business tools.

-

Is there a pricing model for airSlate SignNow that suits small businesses dealing with salestaxindia issues?

Yes, airSlate SignNow offers flexible pricing models that cater to businesses of all sizes, including small businesses facing salestaxindia compliance challenges. With various plans available, small businesses can choose one that matches their specific needs and budget. This allows them to access essential features without overspending.

-

What benefits does airSlate SignNow provide in terms of workflow efficiency for salestaxindia documentation?

AirSlate SignNow enhances workflow efficiency by streamlining the entire document signing process related to salestaxindia. With automated reminders and notifications, businesses can reduce delays and ensure timely processing. This results in signNow time savings and allows teams to focus on other critical areas.

-

Can airSlate SignNow integrate with accounting software for managing salestaxindia?

Absolutely! AirSlate SignNow offers integrations with popular accounting software like QuickBooks and Xero, which are essential for managing salestaxindia-related finances. These integrations help synchronize data and maintain accurate financial records, improving overall tax compliance and reporting.

-

How does airSlate SignNow enhance security for documents related to salestaxindia?

AirSlate SignNow prioritizes security by utilizing advanced encryption and authentication protocols, ensuring that all documents related to salestaxindia are safe from unauthorized access. This commitment to security helps businesses maintain confidentiality and protect sensitive information. Regular audits and compliance checks further bolster the security framework.

Get more for Salestaxindia

Find out other Salestaxindia

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy