Residential Relative Homestead Application Mower County Form

What is the Residential Relative Homestead Application Mower County

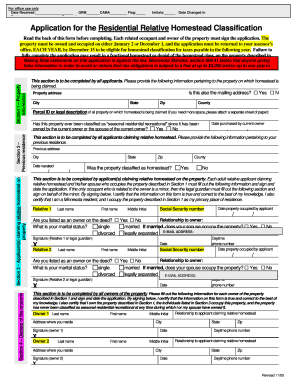

The Residential Relative Homestead Application Mower County is a form that allows eligible individuals to apply for a homestead property tax benefit. This application is specifically designed for relatives living in the same household as the property owner, providing them with potential tax reductions. The program aims to support families by alleviating some financial burdens associated with property taxes.

Steps to Complete the Residential Relative Homestead Application Mower County

Completing the Residential Relative Homestead Application Mower County involves several key steps:

- Gather necessary information, including property details and the relationship between the applicant and the property owner.

- Obtain the application form from the appropriate county office or online resources.

- Fill out the form accurately, ensuring all required fields are completed.

- Provide any supporting documentation that may be required, such as proof of residency or relationship.

- Submit the application by the specified deadline, either online, by mail, or in person.

Eligibility Criteria for the Residential Relative Homestead Application Mower County

To qualify for the Residential Relative Homestead Application Mower County, applicants must meet specific eligibility criteria. Generally, the applicant must be a relative of the property owner and reside in the same household. Additionally, the property must be their primary residence. It is essential to review local regulations, as eligibility may vary based on specific circumstances and county rules.

Required Documents for the Residential Relative Homestead Application Mower County

When submitting the Residential Relative Homestead Application Mower County, applicants should prepare several documents to support their application. Commonly required documents include:

- Proof of residency, such as a utility bill or lease agreement.

- Documentation verifying the relationship to the property owner, like a birth certificate or marriage license.

- Any additional forms or statements as requested by the county office.

Form Submission Methods for the Residential Relative Homestead Application Mower County

Applicants have multiple options for submitting the Residential Relative Homestead Application Mower County. These methods typically include:

- Online submission through the county's official website.

- Mailing the completed form to the designated county office.

- In-person submission at the county office during business hours.

Legal Use of the Residential Relative Homestead Application Mower County

The Residential Relative Homestead Application Mower County is legally recognized as a valid document for obtaining property tax benefits. To ensure its legal standing, it must be completed accurately and submitted according to local regulations. Adhering to the guidelines set forth by the county will help prevent any issues related to the application process.

Quick guide on how to complete residential relative homestead application mower county

Complete Residential Relative Homestead Application Mower County effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Residential Relative Homestead Application Mower County on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to alter and eSign Residential Relative Homestead Application Mower County with ease

- Find Residential Relative Homestead Application Mower County and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign function, which takes moments and carries the same legal authority as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you would like to submit your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or errors that require printing new document copies. airSlate SignNow manages all your document management needs in just a few clicks from any device of your choice. Edit and eSign Residential Relative Homestead Application Mower County and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the residential relative homestead application mower county

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Residential Relative Homestead Application Mower County?

The Residential Relative Homestead Application Mower County is a form that allows property owners to apply for a homestead exemption for relatives residing on their property. This exemption can signNowly reduce property taxes, making it beneficial for families. Using airSlate SignNow for this application streamlines the process and ensures all documents are signed electronically.

-

How can airSlate SignNow assist with the Residential Relative Homestead Application Mower County?

airSlate SignNow provides an easy-to-use platform for completing and signing the Residential Relative Homestead Application Mower County electronically. This means you can fill out the application, gather necessary signatures, and submit it all from one location. The platform increases efficiency and saves time during the application process.

-

What features does airSlate SignNow offer for homestead applications?

airSlate SignNow offers features such as customizable templates, advanced security measures, and real-time tracking for the Residential Relative Homestead Application Mower County. Users can create, send, and manage documents effortlessly, ensuring that all filings are compliant with state regulations. Additionally, eSigning functionality helps expedite the whole process.

-

Is airSlate SignNow cost-effective for filing the Residential Relative Homestead Application Mower County?

Yes, airSlate SignNow is a cost-effective solution for filing the Residential Relative Homestead Application Mower County. The pricing plans are designed to accommodate different needs, whether you are an individual or a business. This affordability, coupled with the convenience of eSigning, makes it an excellent choice for managing homestead applications.

-

Can I integrate airSlate SignNow with other software for my homestead application?

Absolutely! airSlate SignNow allows for seamless integration with various software tools, enhancing your efficiency in filing the Residential Relative Homestead Application Mower County. You can connect it with popular platforms like Google Drive and CRM systems, making document management and storage more straightforward.

-

What benefits do I gain by using airSlate SignNow for my application?

By using airSlate SignNow for the Residential Relative Homestead Application Mower County, you benefit from a faster turnaround time and reduced administrative burden. The intuitive interface simplifies the process, while the robust security features protect your sensitive information. Overall, it enhances your experience by streamlining the typically complex application procedures.

-

What support is available if I have questions about the application process?

airSlate SignNow provides comprehensive support for users completing the Residential Relative Homestead Application Mower County. You can access guides, tutorials, and customer support via chat or email for assistance. This ensures that any questions or concerns about the application process can be resolved quickly and efficiently.

Get more for Residential Relative Homestead Application Mower County

Find out other Residential Relative Homestead Application Mower County

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast