Form 3528

What is the Form 3528

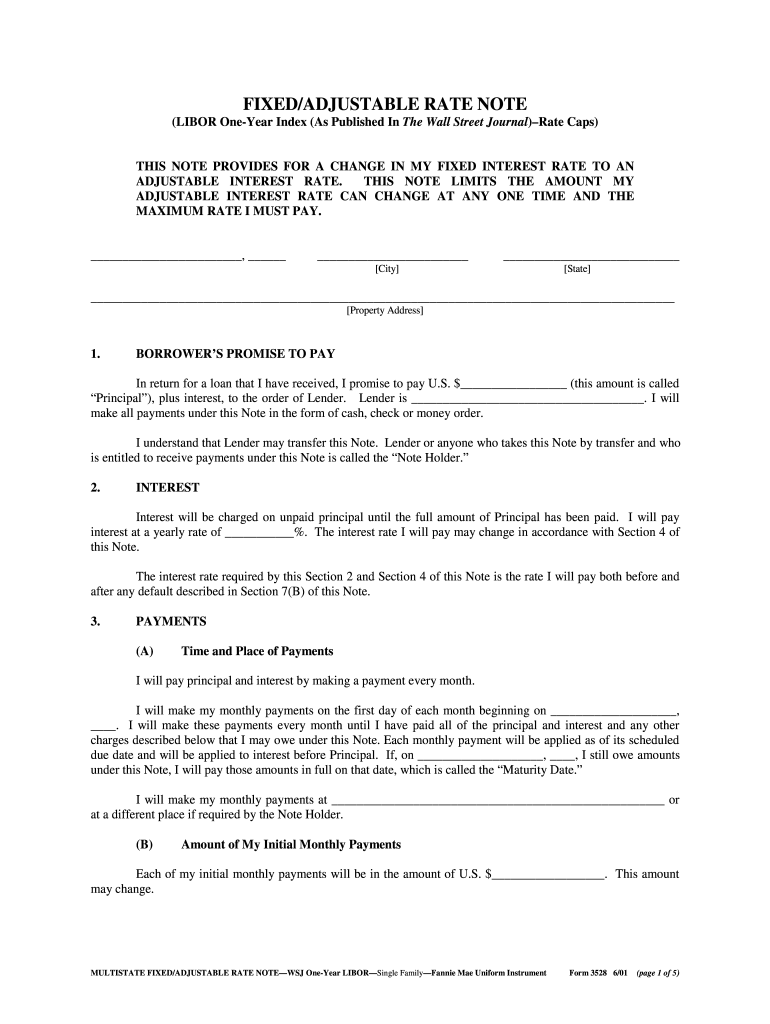

The Form 3528 is a document used in specific legal and tax-related contexts within the United States. It is typically utilized to report information to the Internal Revenue Service (IRS) and may be required for various compliance purposes. Understanding the purpose of this form is essential for individuals and businesses to ensure they meet their legal obligations and avoid potential penalties.

How to use the Form 3528

Using the Form 3528 involves several key steps to ensure accurate completion and submission. First, gather all necessary information and documentation required to fill out the form. This may include personal identification details, financial records, or other relevant data. Next, carefully complete each section of the form, ensuring that all information is accurate and up to date. After filling out the form, review it for any errors before submission to avoid delays or complications.

Steps to complete the Form 3528

Completing the Form 3528 requires attention to detail and adherence to specific guidelines. Follow these steps for successful completion:

- Gather necessary documents: Collect all relevant information needed to fill out the form.

- Fill out the form: Enter your information accurately in each section of the form.

- Review your entries: Check for any mistakes or missing information before finalizing the document.

- Submit the form: Follow the appropriate submission method, whether online, by mail, or in person.

Legal use of the Form 3528

The legal use of the Form 3528 is governed by specific regulations and requirements set forth by the IRS. To ensure that the form is legally binding, it must be completed accurately and submitted within the designated timeframe. Additionally, using a reliable eSignature solution can enhance the legal validity of the document, as it provides necessary security features and compliance with relevant laws.

Key elements of the Form 3528

Understanding the key elements of the Form 3528 is crucial for its effective use. Important components include:

- Personal information: This section typically requires details such as name, address, and taxpayer identification number.

- Financial details: Information regarding income, deductions, and credits may be necessary depending on the form's purpose.

- Signature: A valid signature is required to authenticate the form, which can be done electronically or physically.

Form Submission Methods

The Form 3528 can be submitted through various methods, depending on the requirements set by the IRS. Common submission methods include:

- Online submission: Many forms can be filed electronically through the IRS website or authorized e-filing services.

- Mail: The form can be printed and sent via postal service to the appropriate IRS address.

- In-person submission: Individuals may also choose to submit the form directly at designated IRS offices.

Quick guide on how to complete form 3528

Effortlessly Prepare Form 3528 on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-conscious alternative to conventional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly and without complications. Manage Form 3528 on any device using the airSlate SignNow apps for Android or iOS, and simplify any document-related process today.

The easiest way to modify and electronically sign Form 3528 effortlessly

- Obtain Form 3528 and select Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specially designed by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Decide how you wish to send your form—via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, exhausting form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Modify and electronically sign Form 3528 to ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 3528

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 3528?

Form 3528 is a specific document required for various business transactions. Using airSlate SignNow, you can easily fill out, eSign, and send Form 3528 electronically, ensuring efficiency and compliance with regulations.

-

How does airSlate SignNow simplify the process of completing Form 3528?

airSlate SignNow simplifies the completion of Form 3528 by providing a user-friendly interface that allows you to fill out the form digitally. Plus, our eSignature feature allows you to obtain signatures quickly, streamlining your document workflow.

-

Is there a cost associated with using airSlate SignNow for Form 3528?

Yes, airSlate SignNow offers various pricing plans to suit your needs when working with Form 3528. Our plans are cost-effective, allowing businesses of all sizes to benefit from our eSigning solution without breaking the bank.

-

What features does airSlate SignNow offer for Form 3528 management?

When handling Form 3528, airSlate SignNow provides features such as template creation, automated workflows, and real-time tracking of document status. These tools ensure that managing your forms is both efficient and effective.

-

Can I integrate airSlate SignNow with other software to manage Form 3528?

Absolutely! airSlate SignNow easily integrates with a variety of third-party applications, allowing you to manage Form 3528 alongside your existing tools. This ensures a seamless workflow, enhancing your overall productivity.

-

What are the benefits of using airSlate SignNow for Form 3528?

Using airSlate SignNow for Form 3528 offers numerous benefits including time savings, reduced paper usage, and enhanced document security. With our easy-to-use platform, you can handle your forms digitally, streamlining your processes.

-

How secure is airSlate SignNow when processing Form 3528?

airSlate SignNow prioritizes your security when processing Form 3528 by utilizing advanced encryption methods and secure cloud storage. Our platform complies with industry standards to protect your sensitive information.

Get more for Form 3528

- Medgar evers immunization form 383640902

- Vcu reactivation 20963989 form

- Residency information for tuition coloradoedu

- Scholarship disbursement form 301127036

- Online asset request form

- Panel discussion evaluation form

- School pledge form

- Occupational therapy assistant documentation of observation hours icc form

Find out other Form 3528

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple