City of Troy Tax Department Form

What is the City of Troy Tax Department

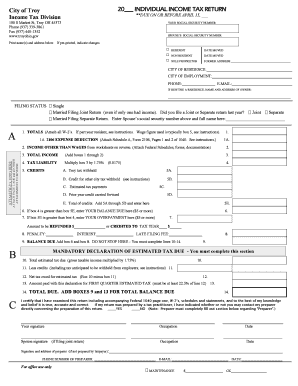

The City of Troy Tax Department is a municipal body responsible for the administration and collection of various taxes within the city. This department plays a crucial role in ensuring that tax regulations are enforced and that residents and businesses comply with local tax laws. The department oversees property taxes, business licenses, and other tax-related functions, providing essential services to the community. Understanding the role of this department is vital for residents and business owners to navigate their tax obligations effectively.

How to use the City of Troy Tax Department

Utilizing the City of Troy Tax Department involves understanding the services offered and the processes in place for tax filing and payment. Residents can access various resources, including tax forms, guidelines, and contact information for assistance. The department typically provides online services, allowing users to submit forms electronically, check their tax status, and make payments. Familiarizing oneself with the department's website and available resources can streamline the tax process and ensure compliance with local regulations.

Steps to complete the City of Troy Tax Department form

Completing the City of Troy Tax Department form requires careful attention to detail. Here are the general steps to follow:

- Gather necessary documentation, including income statements and property information.

- Access the appropriate form from the City of Troy Tax Department's website.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form electronically or by mail, following the specific submission guidelines provided.

Following these steps can help ensure that your submission is processed smoothly and efficiently.

Legal use of the City of Troy Tax Department

The legal use of the City of Troy Tax Department forms is governed by local tax laws and regulations. To ensure that your submissions are legally valid, it is essential to comply with all requirements outlined by the department. This includes providing accurate information, adhering to filing deadlines, and using the correct forms for your specific tax situation. Understanding the legal implications of your submissions can help avoid penalties and ensure compliance with municipal tax obligations.

Required Documents

When filing with the City of Troy Tax Department, certain documents are typically required to support your submission. These may include:

- Income tax returns from the previous year.

- Proof of residency or business location.

- Property tax statements, if applicable.

- Any relevant financial documents that support your tax claims.

Gathering these documents in advance can facilitate a smoother filing process and ensure that all necessary information is provided.

Form Submission Methods (Online / Mail / In-Person)

The City of Troy Tax Department offers various methods for submitting tax forms, accommodating different preferences and needs. Residents can typically choose from the following options:

- Online Submission: Many forms can be completed and submitted electronically through the department's website.

- Mail: Forms can be printed, completed, and mailed to the department's designated address.

- In-Person: Residents may also visit the tax department office to submit forms directly or seek assistance.

Understanding these submission methods can help ensure that your forms are submitted correctly and on time.

Quick guide on how to complete city of troy tax department

Complete City Of Troy Tax Department effortlessly on any device

Managing documents online has gained popularity among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, since you can find the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly without any delays. Handle City Of Troy Tax Department on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign City Of Troy Tax Department without hassle

- Obtain City Of Troy Tax Department and then click Get Form to start.

- Make use of the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Alter and eSign City Of Troy Tax Department and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the city of troy tax department

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What services does the City of Troy Tax Department offer?

The City of Troy Tax Department provides essential services including tax collection, assessment, and information on local tax regulations. They ensure that residents and businesses are informed about tax obligations and deadlines. Understanding these services can help you stay compliant and make the most of your tax planning strategies.

-

How can I contact the City of Troy Tax Department for inquiries?

You can easily contact the City of Troy Tax Department by visiting their official website, where you’ll find phone numbers, email addresses, and office hours. They are dedicated to assisting taxpayers with any questions or concerns regarding their tax obligations. Prompt communication can help clarify any doubts you might have regarding your tax situation.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for your tax documents streamlines the eSigning process, making it faster and more efficient. With features tailored for the City of Troy Tax Department requirements, you can ensure compliance and easy submission of necessary forms. Additionally, it also enhances the security of your sensitive tax information.

-

Are there any costs associated with using the City of Troy Tax Department services?

While certain services provided by the City of Troy Tax Department may have fees associated, many resources and assistance options are available at no cost. It’s advisable to check their website for the most up-to-date information on any fees or costs that may apply to your tax filings. Budgeting for these costs can help you manage your finances effectively.

-

What features should I look for when choosing eSignature solutions for tax documents?

When selecting an eSignature solution for tax documents, look for features that prioritize security, compliance with local regulations, and user-friendliness. airSlate SignNow offers robust features that align with the specific needs of the City of Troy Tax Department, ensuring that your signed documents are valid and securely stored. These features ensure a seamless signing experience.

-

Can airSlate SignNow integrate with other software used by the City of Troy Tax Department?

Yes, airSlate SignNow supports integrations with various software solutions that the City of Troy Tax Department may utilize. This capability enhances your workflow by allowing for a streamlined process for handling tax documents electronically. Integration can save time and reduce the potential for errors during document processing.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow utilizes high-level encryption and secure protocols to protect your tax documents throughout the signing process. Compliance with industry standards ensures that all sensitive information remains confidential and secure when engaging with the City of Troy Tax Department. This focus on security helps to maintain trust in your electronic communications.

Get more for City Of Troy Tax Department

- Flaglerschools form

- Josef silny form

- 24 month stem opt extension for students on f 1 visas form

- Employees authorization of direct deposit of pay svsu form

- Colorado application fee waiver form

- Middlesex comm college transcript pdf form

- Biennial controlled substance inventory form

- Marketing project request form

Find out other City Of Troy Tax Department

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement