Form 536

What is the Form 536

The Form 536 is a specific document used for various administrative and legal purposes, primarily in the context of tax and financial reporting. It is essential for individuals and businesses to understand the implications and requirements associated with this form. The form serves as a formal declaration that may be required by governmental agencies or financial institutions to verify information related to income, deductions, or other financial matters.

How to obtain the Form 536

To obtain the Form 536, individuals can visit the official website of the relevant government agency, such as the Internal Revenue Service (IRS) or state tax authority. The form is typically available for download in PDF format, allowing users to print and complete it at their convenience. In some cases, forms may also be available at local government offices or through authorized third-party providers.

Steps to complete the Form 536

Completing the Form 536 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including identification and financial records. Next, carefully read the instructions provided with the form to understand the requirements. Fill out the form with accurate information, ensuring that all sections are completed as required. Review the form for any errors or omissions before submission. Finally, submit the form through the designated method, whether online, by mail, or in person.

Legal use of the Form 536

The legal use of the Form 536 hinges on its compliance with relevant regulations and guidelines. When properly completed and submitted, the form serves as a legally binding document that can be used in various legal and financial contexts. It is crucial to adhere to the specific requirements outlined by the issuing authority to ensure that the form is accepted and recognized as valid.

Key elements of the Form 536

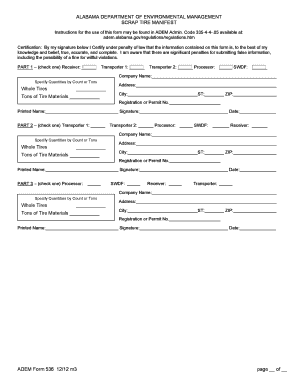

Key elements of the Form 536 include personal identification information, financial data, and any necessary signatures. Each section of the form is designed to capture specific information required for processing. It is important to provide accurate and complete information to avoid delays or issues with the submission. Additionally, certain forms may require supporting documentation to validate the information provided.

Form Submission Methods (Online / Mail / In-Person)

The Form 536 can be submitted through various methods, including online, by mail, or in person. Online submission is often the fastest and most efficient method, allowing for immediate processing. Mail submissions should be sent to the appropriate address as indicated in the form instructions, while in-person submissions may be made at designated government offices. Each method has its own processing times and requirements, so it is important to choose the one that best suits your needs.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of the Form 536. These guidelines outline the necessary information required, deadlines for submission, and any penalties for non-compliance. It is essential to familiarize yourself with these guidelines to ensure that the form is completed correctly and submitted on time, thus avoiding potential legal or financial repercussions.

Quick guide on how to complete form 536

Complete Form 536 effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools you require to create, edit, and eSign your documents swiftly without delays. Manage Form 536 on any platform using airSlate SignNow Android or iOS applications and streamline any document-centric process today.

How to edit and eSign Form 536 with ease

- Locate Form 536 and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal weight as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, SMS, or invite link, or download it to your PC.

Don’t worry about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 536 and ensure exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 536

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 536 and how can airSlate SignNow help with it?

Form 536 is a document often required for specific verifications and transactions. With airSlate SignNow, you can easily create, send, and eSign form 536, streamlining the process and ensuring compliance with necessary regulations.

-

What are the pricing options for using airSlate SignNow for form 536?

airSlate SignNow offers various pricing tiers to accommodate businesses of all sizes. Depending on your needs regarding form 536 management, you can choose from affordable plans that provide robust features for document signing and management.

-

Can I integrate airSlate SignNow with other applications for handling form 536?

Yes, airSlate SignNow supports multiple integrations with popular applications like Google Drive, Dropbox, and more. This allows for seamless management of form 536 and other documents, enhancing workflow efficiency.

-

What are the key features of airSlate SignNow related to form 536?

Key features include the ability to create templates, automate workflows, and track the status of form 536. Additionally, airSlate SignNow offers secure eSignature options, ensuring that your documents are signed and stored safely.

-

Is airSlate SignNow secure for handling sensitive form 536 documents?

Absolutely! airSlate SignNow employs top-notch security measures, including encryption and compliance with data protection regulations. This means your sensitive form 536 documents are handled with the highest level of security and privacy.

-

How does airSlate SignNow improve the efficiency of processing form 536?

By automating the document signing process, airSlate SignNow signNowly speeds up the handling of form 536. Users can send and receive signed documents instantly, reducing turnaround times and enhancing overall productivity.

-

Are there mobile options for managing form 536 with airSlate SignNow?

Yes, airSlate SignNow offers a mobile application that allows users to manage form 536 on the go. This flexibility means you can create, send, and sign documents anytime, anywhere, ensuring that your workflow remains uninterrupted.

Get more for Form 536

- Harding character reference form

- Salter college form

- Arizona eastern star scholarship renewal application form

- Petition for exception form california state university bakersfield csub

- Risk assessment for eyewash station form

- Change uaf form

- Georgia health form 3231

- Annual tuberculosis questionnaire form

Find out other Form 536

- eSignature Texas Roommate Contract Easy

- eSignature Arizona Sublease Agreement Template Free

- eSignature Georgia Sublease Agreement Template Online

- eSignature Arkansas Roommate Rental Agreement Template Mobile

- eSignature Maryland Roommate Rental Agreement Template Free

- How Do I eSignature California Lodger Agreement Template

- eSignature Kentucky Lodger Agreement Template Online

- eSignature North Carolina Lodger Agreement Template Myself

- eSignature Alabama Storage Rental Agreement Free

- eSignature Oregon Housekeeping Contract Computer

- eSignature Montana Home Loan Application Online

- eSignature New Hampshire Home Loan Application Online

- eSignature Minnesota Mortgage Quote Request Simple

- eSignature New Jersey Mortgage Quote Request Online

- Can I eSignature Kentucky Temporary Employment Contract Template

- eSignature Minnesota Email Cover Letter Template Fast

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online