Sample Letter to Irs Claiming Dependents Form

What is the Sample Letter To Irs Claiming Dependents

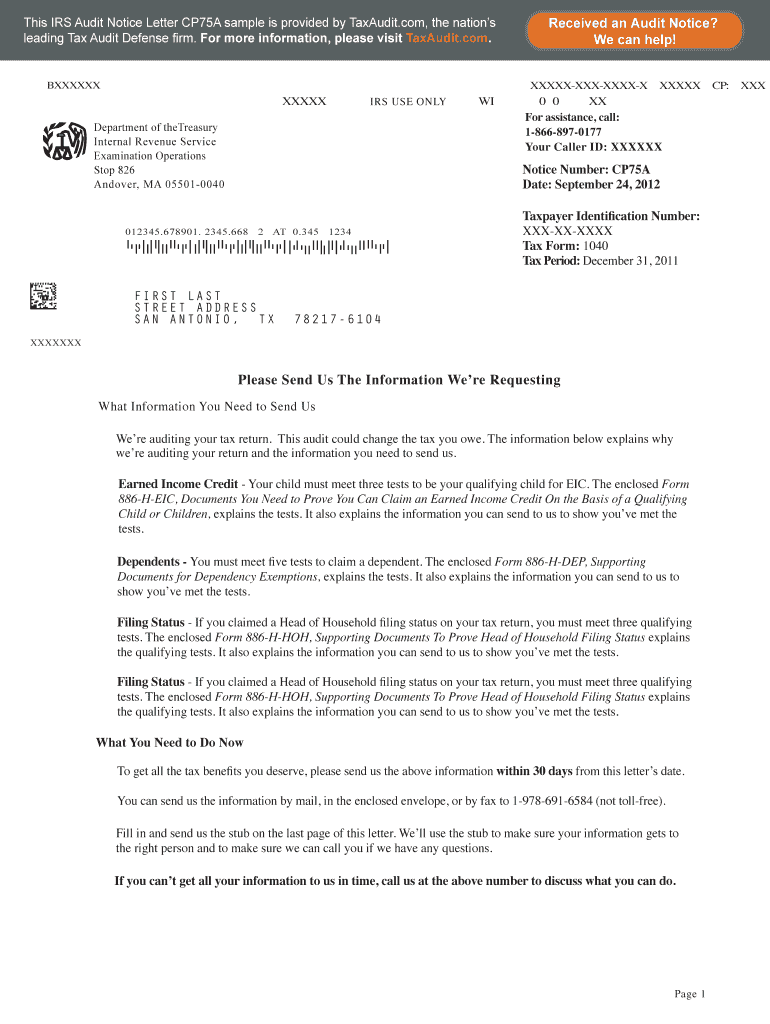

A sample letter to the IRS claiming dependents is a formal document used by taxpayers to assert their eligibility for claiming dependents on their tax returns. This letter may be necessary if the IRS requests additional information regarding dependents claimed on a tax return. It serves to clarify the relationship and support provided to the dependents, ensuring compliance with IRS regulations.

Key Elements of the Sample Letter To Irs Claiming Dependents

When drafting a letter to the IRS claiming dependents, several key elements should be included to ensure clarity and completeness:

- Taxpayer Information: Include your full name, address, and Social Security number.

- Dependent Information: Provide the names, dates of birth, and Social Security numbers of the dependents.

- Relationship: Clearly state your relationship to each dependent (e.g., child, sibling).

- Support Statement: Outline how you provide financial support to the dependents.

- IRS Correspondence Reference: Mention any IRS letters or notices received regarding the dependents.

Steps to Complete the Sample Letter To Irs Claiming Dependents

Completing a sample letter to the IRS claiming dependents involves several steps:

- Gather Information: Collect all necessary details about yourself and your dependents.

- Draft the Letter: Use a clear and formal tone. Start with your information, followed by the dependent details.

- Review for Accuracy: Ensure all information is correct, including Social Security numbers and relationships.

- Sign the Letter: Include your signature at the end to validate the document.

- Send the Letter: Choose your submission method, whether by mail or electronically, depending on IRS guidelines.

IRS Guidelines

The IRS has specific guidelines regarding the claiming of dependents. It is essential to understand these rules to avoid issues:

- Only qualifying individuals can be claimed as dependents, based on age, relationship, and residency.

- Taxpayers must provide proof of support and residency if requested by the IRS.

- Documentation such as birth certificates, school records, or medical records may be required to substantiate claims.

Required Documents

When submitting a letter to the IRS claiming dependents, certain documents may be necessary to support your claims:

- Proof of Relationship: Birth certificates or adoption papers.

- Proof of Residency: Utility bills or lease agreements showing the dependent's address.

- Financial Support Documentation: Bank statements or tax returns indicating support provided to the dependents.

Form Submission Methods

There are various methods for submitting your letter to the IRS:

- By Mail: Send the letter to the address specified in the IRS correspondence or the appropriate tax center.

- Electronically: If applicable, use the IRS e-file system to submit your documentation.

- In-Person: Visit a local IRS office to deliver your letter directly, if necessary.

Quick guide on how to complete get

Discover the easiest method to complete and endorse your Sample Letter To Irs Claiming Dependents

Are you still investing time in preparing your official documents on paper instead of online? airSlate SignNow offers a superior alternative to complete and endorse your Sample Letter To Irs Claiming Dependents and similar forms for public services. Our intelligent eSignature solution equips you with everything necessary to work on documents swiftly and in compliance with official standards - robust PDF editing, management, protection, signing, and sharing tools are all available in a user-friendly interface.

Only a few steps are required to complete the process of filling out and endorsing your Sample Letter To Irs Claiming Dependents:

- Upload the fillable document to the editor using the Get Form button.

- Assess which information you need to enter in your Sample Letter To Irs Claiming Dependents.

- Move between the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to populate the fields with your information.

- Update the content with Text fields or Images from the top toolbar.

- Emphasize important sections or Obscure information that is no longer relevant.

- Click on Sign to create a legally binding eSignature using the method you prefer.

- Add the Date next to your signature and conclude your work with the Done button.

Store your completed Sample Letter To Irs Claiming Dependents in the Documents folder within your profile, download it, or transfer it to your preferred cloud storage. Our solution also offers flexible file sharing options. There’s no need to print your forms when you need to submit them to the appropriate public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it out today!

Create this form in 5 minutes or less

FAQs

-

What are some useful computer-related technical skills I can learn within a day?

Registry Hack to Disable Writing to USB Drives. (Don't you want others copying your confidential data from your computer? You are in a right place. Go ahead...)Go to Start->Run->type regedit & press Enter.Go to the path HKEY_LOCAL_MACHINE\SYSTEM\CurrentControlSet\Control\StorageDevicePoliciesOn the Right side panel, Double click the WriteProtect. Change the value data from 0 to 1.Click ok. Hurray... Nobody can copy any file from your computer to any USB that connected to your computer. The following window will appear if they trying to copy,P.S: If you want to reverse the operation, Follow the above-mentioned steps and finally just replace the value from 1 to 0.If you couldn't find StorageDevicePolicy key, Step 1: Go to the path HKEY_LOCAL_MACHINE\SYSTEM\CurrentControlSet\ControlStep 2: Right Click at Control key. Create a new key & rename it as StorageDevicePolicies.Step 3: Now click the StorageDevicePolicies key. On the empty Right side panel Right Click->New->DWORD 32-bit value & Enter.Step Update 1: Click below to know about choosing subtitles automatically in vlc media player.Vasanth Prabakar's answer to What are some useful skills I can learn in minutes?Update 2: If you want to watch your favorite TV series with subtitles, but don't want to wait until the whole series to be downloaded. Just download the subtitles for the TV series that you want to watch. And finally you can stream those episodes by adding youtube link of the TV series to vlc media player.Enjoy watching by add subtitles for the episodes.

-

How can I get a lot of people to fill out my Google form survey for a research paper?

First of all, to get a lot of responses for your survey don't forget to follow main rules of creating a survey. Here are some of them:Create and design an invitation page, sett the information about why it is so important for you to get the answers there; also write the purpose of your survey.Make your survey short. Remember that people spend their time answering questions.Preset your goal, decide what information you want to get in the end. Prepare list of questions, which would be the most important for you.Give your respondents enough time to answer a survey.Don't forget to say "Thank you!", be polite.Besides, if you want to get more responses, you can use these tips:1.The first one is to purchase responses from survey panel. You can use MySurveyLab’s survey panel for it. In this case you will get reliable and useful results. You can read more about it here.2.If you don’t want to spent money for responses, you can use the second solution. The mentioned tool enables sharing the survey via different channels: email (invitations and e-mail embedded surveys, SMS, QR codes, as a link.You can share the link on different social media, like Twitter, Facebook, Facebook groups, different forums could be also useful, Pinterest, LinkedIn, VKontakte and so on… I think that if you use all these channels, you could get planned number of responses.Hope to be helpful! Good luck!

-

How can you get your family doctor to fill out a disability form?

Definitely ask for a psychologist referral! You want someone on your side who can understand your issues and be willing and eager to advocate for you with the beancounters because disability can be rather hard to get some places, like just south of the border in America.Having a psychologist means you have a more qualified specialist filling out your papers (which is a positive for you and for the government), and it means you can be seeing someone who can get to know your issues in greater depth and expertise for further government and non-profit organization provided aid.If seeing a psychologist on a regular basis is still too difficult for you, start with your initial appointment and then perhaps build up a rapport with a good therapist through distanced appointments (like via telephone, if that is easier) until you can be going into a physical office. It would probably look good on the form if your psychologist can truthfully state that you are currently seeking regular treatment for your disorders because of how serious and debilitating they are.I don't know how disability in Canada works, but I have gone through the process in the US, and specifically for anxiety and depression, like you. Don't settle for a reluctant or wishywashy doctor or psychologist, especially when it comes to obtaining the resources for basic survival. I also advise doing some internet searches on how to persuasively file for disability in Canada. Be prepared to fight for your case through an appeal, if it should come to that, and understand the requirements and processes involved in applying for disability by reading government literature and reviewing success stories on discussion websites.

-

How can a job ask you to fill out forms but then tell you that you didn't get the job?

By managing your expectations; that is, by informing you that filling out the forms does not guarantee that you will be chosen for the job. Companies should further manage expectations by describing the actual selection process in more detail and including a time line for the final selection. Armed with this information you can decide whether you wish to spend the time required to fill out the forms.

-

How do I get updates about the government jobs to fill out the form?

Employment news is the best source to know the notifications published for govt job vacancy. The details are given in the notices. The news available on net also. One can refer the news on net too. It is published regularly on weekly basis. This paper includes some good article also written by experts which benefits the students and youths for improving their skill and knowledge. Some time it gives information regarding carrier / institution/ special advance studies.

-

How do I get a B Pharm admission at Jamia Hamdard University? Do I need to fill out a form or is it through NEET?

Both who have given NEET or not given NEET are eligible for applying for b pharm in Jamia Hamdard. You can apply for the course through the given link:Jamia Hamdard Admissions 2018://admissions.jamiahamdard.eduAdmission in b pharm in Jamia Hamdard is based upon the personal interview conducted by the officials. The call for the interview is based upon the of aggregate of marks in PCB.

-

How can someone get a translator for a USA tourist visa interview? Is there any form to fill out or do they give a translator during interview time?

The officer who interviews the visa applicant will usually speak and understand the most common local language. If not, another officer or a local consular employee will probably be able to translate. If the language is obscure enough, the consular officer might still find, somewhere in the embassy/consulate, an employee who has it.I remember an instance when the only employee who spoke both the primary local language and the very rare language of the visa applicant was one of the oldest, shyest, most reticent, lowest-level gardeners. He was so proud of the officers’ need of and appreciation for that rare skill that one time, that he began to dress better, stand straighter, feel and act more confident, and volunteer for and learn from special, complicated jobs. He eventually earned a permanent promotion to head gardener and did an excellent job at it.

-

How do I get an admission in ALLEN Satyarth for an achiever? Is there any option available online (like a form to fill out)?

There is no option available at formBut phases are decidingWhich phase are in which building are pre decideBut probably all phases of achiever are start in satyarth.

Create this form in 5 minutes!

How to create an eSignature for the get

How to generate an electronic signature for your Get in the online mode

How to generate an electronic signature for the Get in Chrome

How to create an electronic signature for putting it on the Get in Gmail

How to generate an eSignature for the Get straight from your smart phone

How to generate an eSignature for the Get on iOS devices

How to create an eSignature for the Get on Android

People also ask

-

What is a Sample Letter To IRS Claiming Dependents?

A Sample Letter To IRS Claiming Dependents is a template that individuals can use to formally request the IRS to recognize their dependents for tax purposes. This letter typically includes essential information such as the dependent's details, relationship to the taxpayer, and relevant tax years. Utilizing a sample letter can streamline the process and ensure all necessary information is included.

-

How can airSlate SignNow help with creating a Sample Letter To IRS Claiming Dependents?

airSlate SignNow provides users with easy-to-use templates that can be customized to create a Sample Letter To IRS Claiming Dependents. With our platform, you can quickly fill in the required information and eSign the document, making the process seamless and efficient. This feature ensures that your letter is professional and ready for submission.

-

Is there a cost associated with using airSlate SignNow for my Sample Letter To IRS Claiming Dependents?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. You can choose a plan that suits your requirements, whether you need basic features or advanced functionalities for creating documents like a Sample Letter To IRS Claiming Dependents. We also provide a free trial so you can explore our features before committing.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers a wide range of features including document templates, eSigning capabilities, and real-time collaboration tools. For a Sample Letter To IRS Claiming Dependents, you can easily create, edit, and share your document with others for review or signature. These features enhance productivity and ensure that your documents are handled efficiently.

-

Can I integrate airSlate SignNow with other software for my Sample Letter To IRS Claiming Dependents?

Absolutely! airSlate SignNow offers integrations with various applications such as Google Drive, Dropbox, and CRM systems. This allows you to easily access and store your Sample Letter To IRS Claiming Dependents alongside other important documents, ensuring a streamlined workflow across different platforms.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including a Sample Letter To IRS Claiming Dependents, provides several benefits. You can save time with quick document creation, ensure accuracy with templates, and enhance security with eSigning features. These benefits contribute to a more efficient tax preparation process.

-

How secure is airSlate SignNow when handling sensitive documents like a Sample Letter To IRS Claiming Dependents?

airSlate SignNow prioritizes security and employs industry-standard encryption to protect your sensitive documents. When creating a Sample Letter To IRS Claiming Dependents, you can trust that your information is safeguarded against unauthorized access. Additionally, our platform complies with various regulations to ensure your data remains confidential.

Get more for Sample Letter To Irs Claiming Dependents

Find out other Sample Letter To Irs Claiming Dependents

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer