Voucher for Income Tax Paid Form

What is the Voucher For Income Tax Paid Form

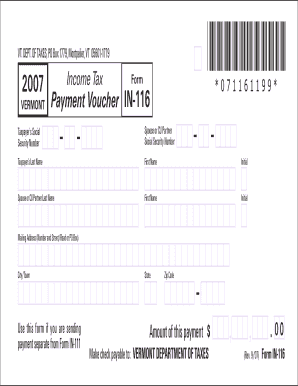

The Voucher For Income Tax Paid Form is a document used by taxpayers to report and pay their income tax obligations. This form serves as a receipt for payments made towards income tax and is essential for maintaining accurate tax records. It is particularly useful for individuals and businesses that need to demonstrate their tax payments to the Internal Revenue Service (IRS) or state tax authorities. The form typically includes details such as the taxpayer's identification information, the amount of tax paid, and the tax period for which the payment is made.

How to use the Voucher For Income Tax Paid Form

Using the Voucher For Income Tax Paid Form involves several steps to ensure that it is completed accurately. First, gather all necessary information, including your Social Security Number or Employer Identification Number, the amount of tax you are paying, and the tax period. Next, fill out the form with this information, ensuring that all entries are correct. After completing the form, you can submit it along with your payment to the appropriate tax authority. This form can also be used to track payments made throughout the year, making it easier to manage your tax responsibilities.

Steps to complete the Voucher For Income Tax Paid Form

Completing the Voucher For Income Tax Paid Form requires attention to detail. Follow these steps:

- Obtain the form from the IRS website or your state tax authority.

- Enter your personal information, including your name, address, and identification number.

- Indicate the amount of income tax you are paying.

- Specify the tax period for which the payment is being made.

- Review the form for accuracy before submission.

Once completed, submit the form along with your payment to ensure proper processing.

Legal use of the Voucher For Income Tax Paid Form

The legal use of the Voucher For Income Tax Paid Form is governed by regulations established by the IRS and state tax authorities. This form must be filled out accurately and submitted in accordance with tax laws to be considered valid. When used correctly, it serves as proof of payment and can protect taxpayers from penalties related to underpayment or late payment of taxes. It is important to keep a copy of the completed form for your records, as it may be required in case of an audit or tax dispute.

Filing Deadlines / Important Dates

Filing deadlines for the Voucher For Income Tax Paid Form vary depending on the tax period and the taxpayer's specific circumstances. Generally, payments are due on the same date as the income tax return, which is typically April fifteenth for individual taxpayers. However, businesses may have different deadlines based on their tax structure. It is essential to be aware of these deadlines to avoid penalties and interest charges. Always check with the IRS or your state tax authority for the most current deadlines relevant to your situation.

Form Submission Methods (Online / Mail / In-Person)

The Voucher For Income Tax Paid Form can be submitted through various methods, depending on the preferences of the taxpayer and the requirements of the tax authority. Common submission methods include:

- Online: Many tax authorities allow for electronic submission of tax forms, including payments.

- Mail: You can print the completed form and send it via postal service to the designated tax office.

- In-Person: Some taxpayers may choose to deliver the form and payment directly to their local tax office.

Choosing the right submission method can help ensure timely processing of your payment.

Quick guide on how to complete voucher for income tax paid form

Effortlessly Prepare Voucher For Income Tax Paid Form on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents quickly and without delays. Work on Voucher For Income Tax Paid Form using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Modify and Electronically Sign Voucher For Income Tax Paid Form with Ease

- Locate Voucher For Income Tax Paid Form and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Select important sections of your documents or obscure private information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal standing as a conventional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Select how you want to send your form, via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign Voucher For Income Tax Paid Form and maintain excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the voucher for income tax paid form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Voucher For Income Tax Paid Form?

A Voucher For Income Tax Paid Form is a document that serves as proof of payment for income tax liabilities. It is crucial for individuals and businesses to maintain accurate records of their tax payments, and this form helps facilitate that process while ensuring compliance with tax regulations.

-

How can airSlate SignNow help with the Voucher For Income Tax Paid Form?

airSlate SignNow simplifies the process of generating and electronically signing a Voucher For Income Tax Paid Form. With our user-friendly platform, you can easily prepare, send, and manage your tax documents, making it faster to submit them to tax authorities.

-

Is there a cost associated with using airSlate SignNow for the Voucher For Income Tax Paid Form?

Yes, airSlate SignNow offers various pricing plans that can accommodate your needs for handling the Voucher For Income Tax Paid Form. Our pricing is competitive, allowing businesses of all sizes to access our reliable electronic signature services without breaking the bank.

-

What features does airSlate SignNow offer for creating the Voucher For Income Tax Paid Form?

airSlate SignNow provides robust features such as customizable templates, secure eSigning, and automated workflows to streamline the creation of your Voucher For Income Tax Paid Form. These features enhance efficiency and ensure that your documents are completed accurately and securely.

-

Can I integrate airSlate SignNow with other tools for managing my Voucher For Income Tax Paid Form?

Absolutely! airSlate SignNow seamlessly integrates with various applications, including CRMs and accounting software, allowing you to manage your Voucher For Income Tax Paid Form alongside other essential business processes. This integration enhances productivity and simplifies document management.

-

What benefits does using airSlate SignNow provide when dealing with the Voucher For Income Tax Paid Form?

Using airSlate SignNow for your Voucher For Income Tax Paid Form allows for faster processing times and improved accuracy. By digitizing the document management process, you also reduce the risk of errors and enhance overall compliance with tax regulations.

-

Is it secure to use airSlate SignNow for my Voucher For Income Tax Paid Form?

Yes, airSlate SignNow prioritizes security and uses advanced encryption protocols to protect your sensitive data. When you create and sign a Voucher For Income Tax Paid Form with us, you can be confident that your information remains safe and confidential.

Get more for Voucher For Income Tax Paid Form

Find out other Voucher For Income Tax Paid Form

- Help Me With eSign Ohio Car Dealer Document

- How To eSign Ohio Car Dealer Document

- How Do I eSign Oregon Car Dealer Document

- Can I eSign Oklahoma Car Dealer PDF

- How Can I eSign Oklahoma Car Dealer PPT

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation