Applicationauthorisation for Inward Processing HM Revenue Hmrc Gov Form

What is the Applicationauthorisation For Inward Processing HM Revenue HMRC Gov

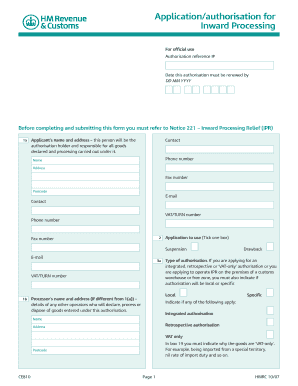

The Applicationauthorisation for Inward Processing is a crucial document used by businesses that import goods into the United Kingdom for processing before re-exporting them. This application allows companies to benefit from duty exemptions on imported goods, provided they meet specific criteria set by HM Revenue and Customs (HMRC). The form ensures compliance with customs regulations and facilitates smoother international trade operations.

Steps to complete the Applicationauthorisation For Inward Processing HM Revenue HMRC Gov

Completing the Applicationauthorisation for Inward Processing involves several key steps:

- Gather necessary documentation, including details about the goods, processing methods, and intended export destinations.

- Fill out the application form accurately, ensuring all required fields are completed.

- Submit the application to HMRC, either online or via traditional mail, depending on your preference.

- Await confirmation from HMRC regarding the approval of your application.

Legal use of the Applicationauthorisation For Inward Processing HM Revenue HMRC Gov

The legal use of the Applicationauthorisation for Inward Processing is defined by HMRC regulations. This form must be filled out correctly to ensure that the goods imported for processing are eligible for duty relief. Non-compliance with the guidelines can lead to penalties, including fines or the requirement to pay back duties that were previously exempted.

Eligibility Criteria

To be eligible for the Applicationauthorisation for Inward Processing, businesses must meet certain criteria, including:

- Being a registered business with HMRC.

- Demonstrating that the goods will be processed and re-exported.

- Providing a detailed description of the processing activities and the final product.

Required Documents

When applying for the Applicationauthorisation for Inward Processing, businesses must submit several documents, such as:

- Proof of business registration.

- Detailed descriptions of the goods to be imported.

- Information on processing methods and final products.

Form Submission Methods

The Applicationauthorisation for Inward Processing can be submitted through various methods. Businesses can choose to submit the form online via the HMRC portal or send it through traditional mail. Each method has its advantages, with online submissions generally being faster and more efficient.

Quick guide on how to complete applicationauthorisation for inward processing hm revenue hmrc gov

Complete Applicationauthorisation For Inward Processing HM Revenue Hmrc Gov effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally-friendly substitute for conventional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents promptly without delays. Manage Applicationauthorisation For Inward Processing HM Revenue Hmrc Gov on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest method to modify and electronically sign Applicationauthorisation For Inward Processing HM Revenue Hmrc Gov seamlessly

- Obtain Applicationauthorisation For Inward Processing HM Revenue Hmrc Gov and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with the tools that airSlate SignNow specifically offers for that function.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you would like to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, cumbersome form navigation, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and electronically sign Applicationauthorisation For Inward Processing HM Revenue Hmrc Gov and foster excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the applicationauthorisation for inward processing hm revenue hmrc gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Applicationauthorisation For Inward Processing HM Revenue HMRC Gov?

Applicationauthorisation For Inward Processing HM Revenue HMRC Gov refers to the authorization process required for businesses to import goods with relief from customs duties. This procedure allows companies to process incoming products without upfront tax costs, facilitating smoother international trade. Understanding this process is crucial for businesses looking to optimize their supply chain.

-

How can airSlate SignNow help with Applicationauthorisation For Inward Processing HM Revenue HMRC Gov?

AirSlate SignNow streamlines the documentation process related to Applicationauthorisation For Inward Processing HM Revenue HMRC Gov by enabling users to send, sign, and manage forms electronically. Our easy-to-use platform reduces the time and complexity involved in document handling, ensuring compliance and efficiency in your import processes. Leverage our solution to enhance your operational productivity.

-

What are the pricing plans for airSlate SignNow?

We offer flexible pricing plans for airSlate SignNow to suit businesses of all sizes needing assistance with Applicationauthorisation For Inward Processing HM Revenue HMRC Gov. Our plans include options for individual users, small businesses, and enterprises, ensuring you find a solution that fits your budget. Contact our sales team for detailed pricing based on your specific needs.

-

Are there any specific features of airSlate SignNow that support customs compliance?

Yes, airSlate SignNow comes with features that help businesses maintain compliance with customs regulations, including those related to Applicationauthorisation For Inward Processing HM Revenue HMRC Gov. Our document templates and electronic signature options allow you to easily create and sign necessary paperwork, ensuring you have all required documentation in order. Automated reminders also help keep your timelines on track.

-

What benefits does airSlate SignNow offer regarding document management?

By using airSlate SignNow for Applicationauthorisation For Inward Processing HM Revenue HMRC Gov, you gain a host of benefits in document management. Our cloud-based platform provides secure storage, easy access, and seamless sharing of documents, allowing you to keep your records organized and readily available. This convenience enhances collaboration and ensures compliance with legal standards.

-

Can airSlate SignNow integrate with other software systems?

Absolutely! airSlate SignNow offers integrations with various software systems, enhancing its functionality for handling Applicationauthorisation For Inward Processing HM Revenue HMRC Gov documents. Our platform can connect with popular CRMs, e-commerce platforms, and accounting software, enabling a cohesive workflow that improves overall operational efficiency. Explore our integration options to find the best fit for your business.

-

Is airSlate SignNow secure for handling sensitive documents?

Yes, security is a top priority at airSlate SignNow, especially when it comes to sensitive documents like those related to Applicationauthorisation For Inward Processing HM Revenue HMRC Gov. Our platform employs advanced encryption and security protocols to ensure your information is protected at all times. You can confidently manage your documents without compromising on safety.

Get more for Applicationauthorisation For Inward Processing HM Revenue Hmrc Gov

- Authorization for use and disclosure of protected health information hawaii fillable

- About comprehensive womens care form

- Physical therapy referral form university of puget sound

- Purehealthintegrativemedicine client intake form the practice of integrative medicine requires the understanding of clients as

- Client care record form

- Meba medical plan designation of authorized representative form

- Camp bsa medical form with ny state scouting event

- Colonial life insurance wellness claim form

Find out other Applicationauthorisation For Inward Processing HM Revenue Hmrc Gov

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself