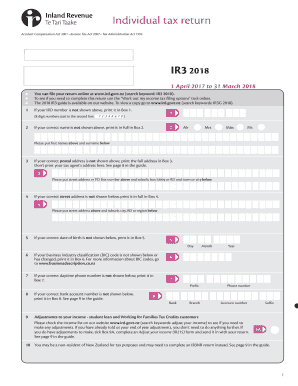

Individual Tax Return Ird Govt Nz Form

What is the Individual Tax Return Ird govt nz

The Individual Tax Return Ird govt nz is a form used by individuals to report their income, claim deductions, and calculate their tax obligations. This document is essential for ensuring compliance with tax regulations and is typically required annually. The form captures various income sources, including wages, dividends, and interest, and allows taxpayers to detail eligible deductions, such as charitable contributions and business expenses. Proper completion of this form is crucial for accurate tax assessment and potential refunds.

Steps to complete the Individual Tax Return Ird govt nz

Completing the Individual Tax Return Ird govt nz involves several key steps that ensure accuracy and compliance. First, gather all necessary documents, including W-2 forms, 1099s, and any receipts for deductible expenses. Next, fill out the form by entering your personal information, income details, and any applicable deductions. It's important to double-check all entries for accuracy. After completing the form, review it to ensure all information is correct and complete. Finally, submit the form electronically or via mail, depending on your preference.

Legal use of the Individual Tax Return Ird govt nz

The Individual Tax Return Ird govt nz is legally binding when filled out and submitted according to established regulations. To ensure its legal standing, the form must be signed and dated by the taxpayer. Additionally, compliance with eSignature laws, such as the ESIGN Act and UETA, is essential when submitting the form electronically. These laws provide the framework that recognizes electronic signatures as valid, provided they meet specific criteria, such as intent to sign and consent to use electronic records.

Required Documents

To successfully complete the Individual Tax Return Ird govt nz, several documents are necessary. These typically include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Bank statements for interest income

- Receipts for deductible expenses

- Records of any other income sources

Having these documents organized and accessible will facilitate a smoother filing process and help ensure that all income and deductions are accurately reported.

Filing Deadlines / Important Dates

Filing deadlines for the Individual Tax Return Ird govt nz are critical to avoid penalties. Typically, the deadline for submission falls on April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It's advisable to stay informed about any changes to deadlines and to file as early as possible to avoid last-minute complications.

Form Submission Methods (Online / Mail / In-Person)

The Individual Tax Return Ird govt nz can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission via approved e-filing platforms

- Mailing a paper copy to the appropriate tax authority address

- In-person submission at designated tax offices

Each method has its benefits, such as the speed of online filing or the personal touch of in-person submission. Taxpayers should choose the option that best suits their needs and preferences.

Quick guide on how to complete individual tax return ird govt nz

Effortlessly Prepare Individual Tax Return Ird govt nz on Any Device

Digital document management has become increasingly favored by companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your papers quickly without any delays. Manage Individual Tax Return Ird govt nz across any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The Easiest Way to Alter and Electronically Sign Individual Tax Return Ird govt nz with Ease

- Obtain Individual Tax Return Ird govt nz and click Get Form to begin.

- Utilize the tools provided to fill in your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or a sharing link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors necessitating reprints of new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Individual Tax Return Ird govt nz and maintain excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the individual tax return ird govt nz

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Individual Tax Return for ird.govt.nz?

An Individual Tax Return for ird.govt.nz is a mandatory declaration of your income, expenses, and tax obligations as a New Zealand taxpayer. The return helps ensure that you meet your tax requirements accurately and on time. Using airSlate SignNow can streamline this process, making it easy to sign and submit your documents electronically.

-

How can airSlate SignNow assist with the Individual Tax Return ird.govt.nz?

airSlate SignNow empowers you to prepare and eSign your Individual Tax Return for ird.govt.nz from anywhere. The platform offers a straightforward interface that simplifies document management and supports seamless electronic signatures. This way, you can efficiently handle your tax responsibilities without the hassle of physical paperwork.

-

Is airSlate SignNow cost-effective for managing Individual Tax Return ird.govt.nz?

Yes, airSlate SignNow offers a cost-effective solution for managing your Individual Tax Return for ird.govt.nz. With flexible pricing plans scaled to your needs, you can choose the option that best fits your budget. The savings from streamlined processes and reduced paperwork signNowly enhance the value of the service.

-

What features does airSlate SignNow provide for Individual Tax Returns?

airSlate SignNow offers robust features that cater to your Individual Tax Return for ird.govt.nz, including customizable templates, real-time collaborative editing, and secure storage. Its user-friendly design allows anyone to navigate and execute documents with ease. These features ensure that your tax return process is efficient and secure.

-

How secure is airSlate SignNow for submitting Individual Tax Returns?

Security is a top priority for airSlate SignNow when managing your Individual Tax Return for ird.govt.nz. The platform employs advanced encryption and complies with industry standards to safeguard your sensitive tax information. You can confidently eSign and submit your tax documents, knowing your data is protected.

-

Can I integrate airSlate SignNow with other platforms for my Individual Tax Return?

Absolutely! airSlate SignNow integrates with various platforms to facilitate the management of your Individual Tax Return for ird.govt.nz. This enables you to sync documents and information easily, saving time and improving accuracy. Check the list of integrations to find the best fit for your workflow.

-

What are the benefits of using airSlate SignNow for filing Individual Tax Returns?

Using airSlate SignNow for your Individual Tax Return for ird.govt.nz offers numerous benefits, including time savings, reduced errors, and enhanced convenience. The ability to manage documents electronically allows for quicker processing and submission. Additionally, the user-friendly interface makes it straightforward even for those unfamiliar with digital platforms.

Get more for Individual Tax Return Ird govt nz

- Solved an employee has an employee id first name last n form

- 40 us code501 services for executive agenciesus form

- Procurement request and receiving report preparationgsa form

- Sfd number form

- Annual report on relocation and real property acquisition form

- Public tenders for bags search engine for public tenders form

- Health screening template form

- Birth certificate application new york city form

Find out other Individual Tax Return Ird govt nz

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form