Northern Tool Online Credit Application 2012-2026

What is the Northern Tool Online Credit Application

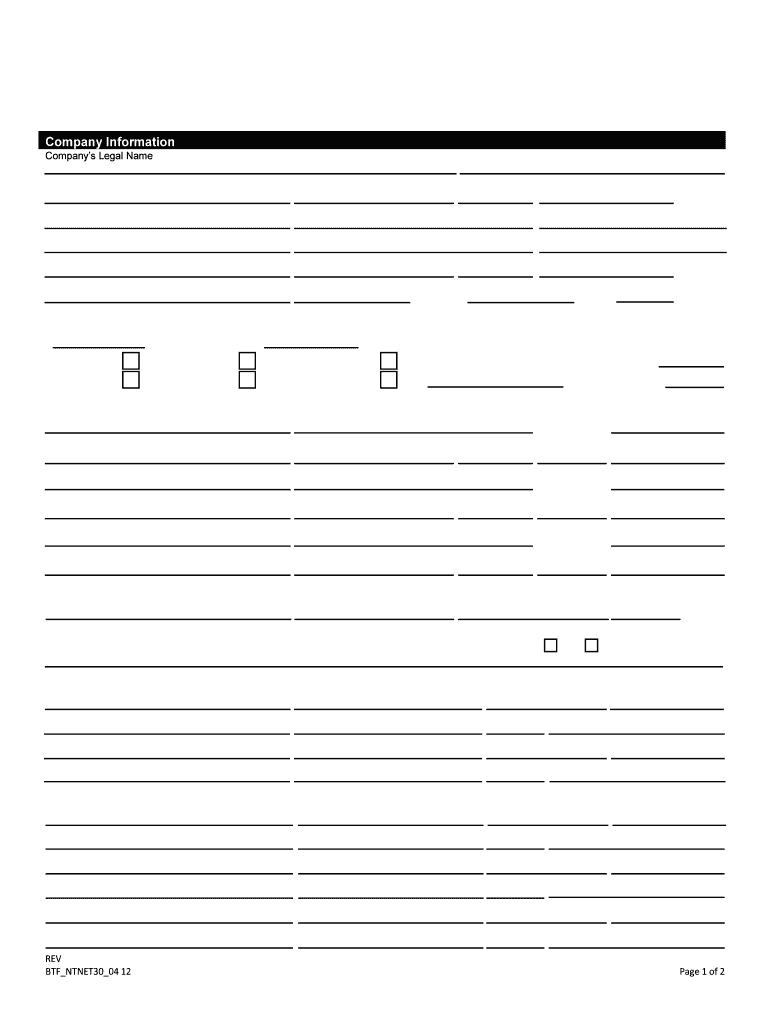

The Northern Tool Online Credit Application is a digital form that allows individuals and businesses to apply for credit to purchase tools and equipment from Northern Tool. This application streamlines the process of obtaining financing, enabling users to fill out their information electronically and submit it securely. The form collects essential details such as personal identification, financial information, and employment history, ensuring that applicants can receive a credit decision quickly.

Steps to complete the Northern Tool Online Credit Application

Completing the Northern Tool Online Credit Application involves several straightforward steps:

- Access the application through the official Northern Tool website.

- Fill in personal information, including your name, address, and contact details.

- Provide financial information, such as income and employment details.

- Review the application for accuracy before submission.

- Submit the application electronically and await a credit decision.

By following these steps, applicants can efficiently navigate the process and increase their chances of approval.

Eligibility Criteria

To apply for the Northern Tool Online Credit Application, applicants must meet specific eligibility criteria. Generally, this includes:

- Being at least eighteen years old.

- Having a valid Social Security number or Tax Identification Number.

- Providing proof of income or employment.

- Residing in the United States.

Meeting these criteria is essential for a successful application and to ensure compliance with lending regulations.

Required Documents

When completing the Northern Tool Online Credit Application, applicants should have certain documents ready to facilitate the process. These may include:

- Government-issued identification (e.g., driver’s license or passport).

- Proof of income (e.g., pay stubs or tax returns).

- Employment verification (e.g., a recent employment letter).

Having these documents on hand can help streamline the application process and reduce delays in approval.

Legal use of the Northern Tool Online Credit Application

Using the Northern Tool Online Credit Application legally requires adherence to federal and state regulations governing credit applications. Applicants must provide truthful information and understand the terms and conditions associated with the credit being sought. Additionally, the application process must comply with the Fair Credit Reporting Act (FCRA), which protects consumer information and ensures fair treatment in credit reporting.

Application Process & Approval Time

The application process for the Northern Tool Online Credit Application is designed to be efficient. After submission, applicants typically receive a credit decision within a few minutes to a few days, depending on the volume of applications being processed. If additional information is required, applicants may be contacted for clarification, which can slightly extend the approval time. Understanding this timeline can help applicants manage their expectations and plan their purchases accordingly.

Quick guide on how to complete commercial credit application northern tool equipment

The optimal method to locate and endorse Northern Tool Online Credit Application

On a company-wide scale, ineffective procedures concerning document authorization can consume a signNow amount of working hours. Signing documents such as Northern Tool Online Credit Application is a fundamental aspect of operations in any organization, which is why the effectiveness of each agreement's lifecycle signNowly impacts the overall productivity of the company. With airSlate SignNow, endorsing your Northern Tool Online Credit Application is as straightforward and rapid as possible. This platform provides you with the latest version of virtually any document. Even better, you can sign it instantly without the necessity of installing external software on your computer or printing hard copies.

Steps to obtain and endorse your Northern Tool Online Credit Application

- Browse through our collection by category or use the search bar to locate the document you require.

- View the document preview by selecting Learn more to confirm it's the correct one.

- Click Get form to start editing immediately.

- Fill out your document and include any essential information using the toolbar.

- Once finished, click the Sign feature to endorse your Northern Tool Online Credit Application.

- Choose the signature method that is most convenient for you: Draw, Create initials, or upload a picture of your handwritten signature.

- Select Done to finalize editing and proceed to document-sharing choices if required.

With airSlate SignNow, you possess everything necessary to handle your paperwork effectively. You can find, complete, edit, and even distribute your Northern Tool Online Credit Application in one tab without any complications. Streamline your workflows with a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

-

How many application forms does a person need to fill out in his/her lifetime?

As many as you want to !

-

I am trying to get my first credit card but no company will accept my application. How can I fill out the application differently to get accepted?

Look no farther than AmazonIf you are a frequent Amazon customer, as I was, you will have seen many prompts trying to get you to sign up for their rewards card. I didn’t really have a need for a credit card but I figured I might as well get the $70 or so as well as the cash back for signing up for a rewards card.I’m only 18 so I figured there was a high chance of being denied. I entered my information and was promptly denied. For some reason the prompts kept being displayed on my checkout pages, so after a month or so I applied again. Denied.Oh well… I thought.But one day I saw a new rewards card pop up. Rather than being through Synchrony Financial, this one was through Chase. Since I have no credit, it was reasonable that I was getting rejected. However, I currently have a Chase College Student Checking account and have had a Business and Savings account with them in the past. Because I was a current account holder I figured I would have a better chance.I applied one last time only to get waitlisted…? (I read too many college application questions)Waitlisted in this setting meant they needed to further review my application. I wasn’t very optimistic about the outcome but a few days later I found out I had been approved!My very first credit card: An Amazon Rewards Visa..How times have changed.Note: This only works with Chase, at least to my knowledge. You also do not need a cosigner for this method.

Create this form in 5 minutes!

How to create an eSignature for the commercial credit application northern tool equipment

How to generate an eSignature for your Commercial Credit Application Northern Tool Equipment in the online mode

How to generate an eSignature for the Commercial Credit Application Northern Tool Equipment in Google Chrome

How to make an electronic signature for signing the Commercial Credit Application Northern Tool Equipment in Gmail

How to make an electronic signature for the Commercial Credit Application Northern Tool Equipment right from your smart phone

How to make an eSignature for the Commercial Credit Application Northern Tool Equipment on iOS devices

How to generate an eSignature for the Commercial Credit Application Northern Tool Equipment on Android devices

People also ask

-

What is the Northern Tool Online Credit Application?

The Northern Tool Online Credit Application is a streamlined process that allows customers to apply for credit online through the Northern Tool platform. This user-friendly application makes it easy for businesses and individuals to obtain financing for their tool purchases, enhancing the buying experience.

-

How does the Northern Tool Online Credit Application work?

To utilize the Northern Tool Online Credit Application, simply fill out the online form with your personal and financial information. Once submitted, the application is reviewed swiftly, leading to a quick decision on your credit approval, allowing you to make purchases without delay.

-

What are the benefits of using the Northern Tool Online Credit Application?

The Northern Tool Online Credit Application offers numerous benefits, including convenience, speed, and accessibility. Customers can apply from anywhere at any time, receive quick feedback on their application status, and enjoy flexible financing options tailored to their needs.

-

Is there a fee to apply for the Northern Tool Online Credit Application?

There are no fees associated with submitting the Northern Tool Online Credit Application. It’s a free and straightforward process designed to help you gain access to credit without incurring any upfront costs.

-

What types of financing are available through the Northern Tool Online Credit Application?

The Northern Tool Online Credit Application provides various financing options, including promotional financing terms and flexible payment plans. This allows customers to select a plan that best fits their budget and purchasing needs.

-

Can I track my Northern Tool Online Credit Application status?

Yes, after submitting your Northern Tool Online Credit Application, you can easily track its status. You will receive notifications regarding the approval process, ensuring you stay informed about your credit application.

-

Is the Northern Tool Online Credit Application secure?

Absolutely! The Northern Tool Online Credit Application uses advanced encryption and security measures to protect your personal and financial information. This ensures that your data is safe while you apply for credit online.

Get more for Northern Tool Online Credit Application

- The child abuse material instrument cami ranconsulting form

- Acs certificato nascita pdf form

- Emergency shelter intake form

- Contribution letter for rent form

- Patientdoctor guidelines for givingreceiving gifts of gratitude form

- Mandatory e pay election to discontinue or waiver request form

- Hipaa compliance agreement template form

- Hipaa compliance for employees agreement template form

Find out other Northern Tool Online Credit Application

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT