Mandatory E Pay Election to Discontinue or Waiver Request 2014-2026

What is the Mandatory E Pay Election To Discontinue Or Waiver Request

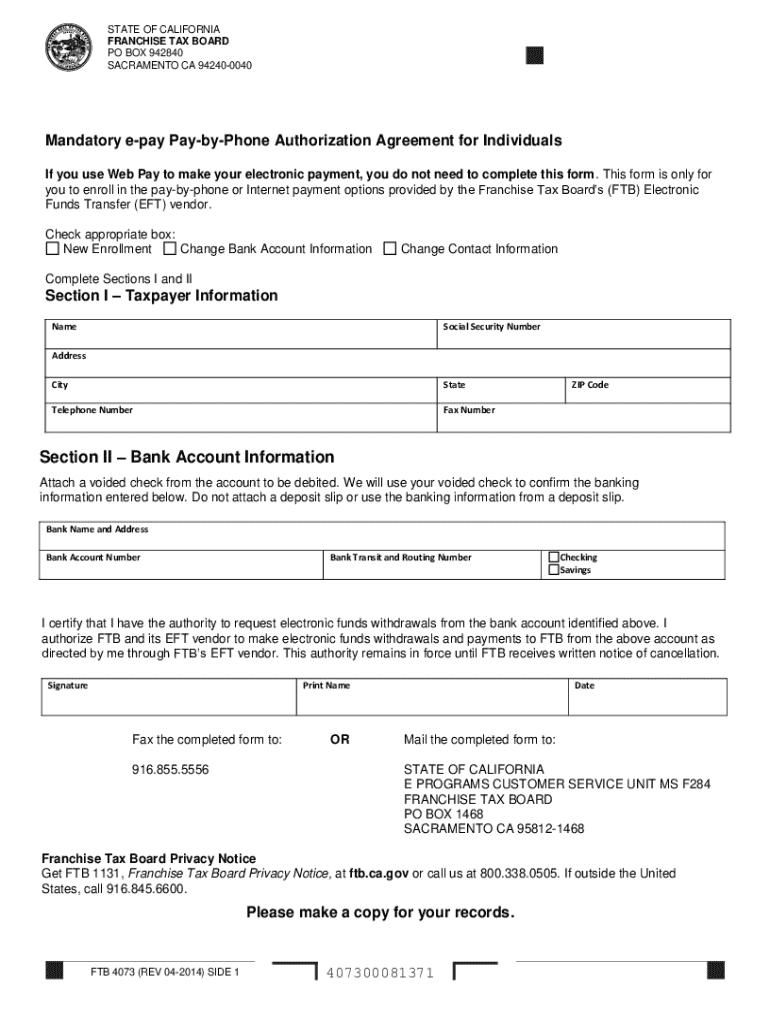

The Mandatory E Pay Election To Discontinue Or Waiver Request is a form used by taxpayers in California to formally request a change in their electronic payment obligations. This form is essential for individuals or businesses who wish to discontinue mandatory electronic payments for their tax obligations or seek a waiver for specified reasons. Understanding the purpose of this form is crucial for compliance with California tax regulations.

How to use the Mandatory E Pay Election To Discontinue Or Waiver Request

To effectively use the Mandatory E Pay Election To Discontinue Or Waiver Request, taxpayers need to complete the form accurately. This involves providing personal or business information, detailing the reasons for the request, and ensuring all required fields are filled out. Once completed, the form must be submitted according to the specified submission methods to ensure it is processed correctly by the California Franchise Tax Board (FTB).

Steps to complete the Mandatory E Pay Election To Discontinue Or Waiver Request

Completing the Mandatory E Pay Election To Discontinue Or Waiver Request involves several key steps:

- Gather necessary personal or business information, including tax identification numbers.

- Clearly state the reasons for discontinuing or waiving electronic payments.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form through the designated method, ensuring it reaches the FTB by the required deadline.

Required Documents

When submitting the Mandatory E Pay Election To Discontinue Or Waiver Request, taxpayers may need to provide supporting documentation. This can include proof of financial hardship, previous tax returns, or any other relevant documents that substantiate the request for discontinuation or waiver. Having these documents ready can facilitate a smoother processing experience.

Eligibility Criteria

Eligibility for submitting the Mandatory E Pay Election To Discontinue Or Waiver Request typically depends on specific circumstances, such as financial hardship or changes in business operations. Taxpayers must meet certain criteria set forth by the California Franchise Tax Board to qualify for a waiver or discontinuation of mandatory electronic payments. Understanding these criteria is essential for a successful application.

Penalties for Non-Compliance

Failing to comply with the requirements related to the Mandatory E Pay Election To Discontinue Or Waiver Request can result in penalties. Taxpayers may face fines or additional interest on unpaid taxes if they do not adhere to the electronic payment mandates. It is important to be aware of these potential consequences to avoid any financial repercussions.

Create this form in 5 minutes or less

Find and fill out the correct mandatory e pay election to discontinue or waiver request

Create this form in 5 minutes!

How to create an eSignature for the mandatory e pay election to discontinue or waiver request

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CA FTB 4073 tax bank account?

The CA FTB 4073 tax bank account is a specific account used for managing tax payments and refunds related to California's Franchise Tax Board. It helps taxpayers streamline their financial transactions and ensure compliance with state tax regulations.

-

How can airSlate SignNow help with the CA FTB 4073 tax bank account?

airSlate SignNow provides a seamless way to eSign and send documents related to your CA FTB 4073 tax bank account. With our platform, you can easily manage your tax documents, ensuring they are signed and submitted on time, which helps avoid penalties.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, all of which are essential for managing your CA FTB 4073 tax bank account documents. These features enhance efficiency and ensure that your tax-related paperwork is organized and accessible.

-

Is airSlate SignNow cost-effective for small businesses handling CA FTB 4073 tax bank accounts?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses managing their CA FTB 4073 tax bank accounts. Our pricing plans are flexible, allowing businesses to choose the best option that fits their budget while still accessing essential features.

-

Can I integrate airSlate SignNow with other financial software for my CA FTB 4073 tax bank account?

Absolutely! airSlate SignNow integrates with various financial software, making it easier to manage your CA FTB 4073 tax bank account alongside your other financial tools. This integration streamlines your workflow and enhances productivity.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for your tax-related documents, including those for your CA FTB 4073 tax bank account, offers numerous benefits. These include increased efficiency, reduced paperwork, and enhanced security for sensitive financial information.

-

How secure is airSlate SignNow for handling CA FTB 4073 tax bank account documents?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your CA FTB 4073 tax bank account documents. You can trust that your sensitive information is safe while using our platform.

Get more for Mandatory E Pay Election To Discontinue Or Waiver Request

- 2220 underpayment of estimated tax by corporations form 990

- 2020 instructions for form 1120 s instructions for form 1120 s us income tax return for an s corporation

- Internal revenue service shareholders instructions for form

- 2017 alaska oil and gas facility tax credit form

- Pdf publication 5354 rev 9 2020 internal revenue service form

- Form 7200 rev january 2021 advance payment of employer credits due to covid 19

- Denr discharge permit requirements form

- Instructions for form 6322 2016 alaska gas storage facility tax credit

Find out other Mandatory E Pay Election To Discontinue Or Waiver Request

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF