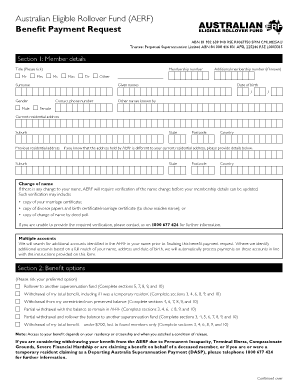

Australian Eligible Rollover Fund Withdrawal Form

What is the Australian Eligible Rollover Fund Withdrawal Form

The Australian Eligible Rollover Fund Withdrawal Form is a crucial document used by individuals seeking to transfer their retirement savings from one superannuation fund to another. This form specifically addresses the process of rolling over funds from an Australian Eligible Rollover Fund (AERF). It is designed to ensure that the transfer complies with legal and regulatory requirements, facilitating a smooth transition of funds while safeguarding the rights of the account holder.

How to use the Australian Eligible Rollover Fund Withdrawal Form

Using the Australian Eligible Rollover Fund Withdrawal Form involves several key steps. First, individuals must complete the form accurately, providing necessary personal and financial information. This includes details such as the current superannuation fund, the AERF to which the funds are being transferred, and any relevant identification information. Once completed, the form should be submitted to the appropriate financial institution, either online or via traditional mail, depending on the institution's requirements.

Steps to complete the Australian Eligible Rollover Fund Withdrawal Form

Completing the Australian Eligible Rollover Fund Withdrawal Form requires careful attention to detail. Follow these steps for a successful submission:

- Gather necessary information, including your superannuation fund details and personal identification.

- Fill out the form, ensuring all sections are completed accurately.

- Review the form for any errors or missing information.

- Submit the form according to the instructions provided by your chosen AERF.

Legal use of the Australian Eligible Rollover Fund Withdrawal Form

The legal use of the Australian Eligible Rollover Fund Withdrawal Form is governed by various regulations that ensure the protection of individuals' retirement savings. Compliance with these regulations is essential for the form to be considered valid. This includes adhering to the requirements set forth by the Australian Taxation Office (ATO) and ensuring that the form is signed and dated appropriately. Utilizing a reliable electronic signature platform can enhance the legal standing of the completed form.

Key elements of the Australian Eligible Rollover Fund Withdrawal Form

Several key elements must be included in the Australian Eligible Rollover Fund Withdrawal Form to ensure its effectiveness:

- Personal Information: Full name, address, and contact details.

- Superannuation Fund Details: Information about the current fund and the AERF.

- Signature: A valid signature is required to authenticate the request.

- Date: The date of submission must be clearly indicated.

Eligibility Criteria

To utilize the Australian Eligible Rollover Fund Withdrawal Form, individuals must meet specific eligibility criteria. Generally, this includes being a member of an eligible superannuation fund and having a balance that qualifies for rollover. Additionally, individuals must ensure that they are not currently under any restrictions that would prevent the transfer of their funds, such as legal disputes or outstanding debts associated with the superannuation account.

Quick guide on how to complete australian eligible rollover fund withdrawal form

Effortlessly Prepare Australian Eligible Rollover Fund Withdrawal Form on Any Device

Digital document management has gained signNow traction among businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow provides all the tools necessary to swiftly create, modify, and digitally sign your documents without any hassle. Manage Australian Eligible Rollover Fund Withdrawal Form on any platform using airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

How to Modify and Digitally Sign Australian Eligible Rollover Fund Withdrawal Form with Ease

- Obtain Australian Eligible Rollover Fund Withdrawal Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or conceal sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for delivering your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from your chosen device. Modify and digitally sign Australian Eligible Rollover Fund Withdrawal Form to guarantee outstanding communication at every phase of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the australian eligible rollover fund withdrawal form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are eligible rollover funds?

Eligible rollover funds are types of retirement accounts or pension plans that can be moved from one financial institution to another without incurring tax penalties. Common examples include 401(k) plans and traditional IRAs. Understanding these can help you maximize your retirement savings through strategic asset management.

-

How does airSlate SignNow support the management of eligible rollover funds?

airSlate SignNow enables businesses to send and eSign documents related to eligible rollover funds efficiently. The platform offers secure electronic signatures for all necessary paperwork, streamlining the rollover process. This ensures a hassle-free experience for both financial institutions and clients.

-

Are there any fees associated with managing eligible rollover funds through airSlate SignNow?

While airSlate SignNow offers a cost-effective solution for document management, the specific fees associated with eligible rollover funds depend on the financial institution and the plan in question. It's essential for users to consult their financial advisors for comprehensive cost analysis. Our platform ensures transparency in all transactions and processes.

-

What are the benefits of using airSlate SignNow for handling eligible rollover funds?

Using airSlate SignNow simplifies the handling of eligible rollover funds by ensuring fast document turnaround and compliance with regulations. The solution improves operational efficiency, reduces paperwork, and enhances client satisfaction through its user-friendly interface. This can lead to quicker fund transfers and better financial management.

-

Does airSlate SignNow integrate with financial software for eligible rollover funds?

Yes, airSlate SignNow integrates seamlessly with various financial software platforms, making it easier to manage eligible rollover funds. This integration helps users eliminate manual data entry, minimizes errors, and streamlines the entire process. By connecting to existing systems, businesses can enhance their document workflows.

-

How can I ensure compliance while managing eligible rollover funds with airSlate SignNow?

airSlate SignNow provides features that help users maintain compliance when dealing with eligible rollover funds. Through secure eSigning and document tracking, businesses can ensure all necessary regulations are met. Additionally, our platform offers audit trails, making it easier to demonstrate compliance during any review.

-

Is airSlate SignNow suitable for small businesses managing eligible rollover funds?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small businesses managing eligible rollover funds. Its affordability and ease of use make it an excellent choice for smaller firms looking to improve their document-related processes. Enhanced efficiency ultimately translates to better customer service.

Get more for Australian Eligible Rollover Fund Withdrawal Form

- Fsis 4339 1 certificate of medical examination with medical history form fsis usda

- Form h1530 a instructions daily meal production record for

- Certification eligibility form

- In the circuitcounty court of sixth judicial circuit in and for pinellas form

- 9e requires you to be registered for work form

- Fa 1docx form

- Irs form 1095 a faqs covered california

- Affidavit in support of a request for reopening form

Find out other Australian Eligible Rollover Fund Withdrawal Form

- How Can I Sign North Dakota Share Transfer Agreement Template

- Sign Oklahoma Debt Settlement Agreement Template Online

- Can I Sign Oklahoma Debt Settlement Agreement Template

- Sign Pennsylvania Share Transfer Agreement Template Now

- Sign Nevada Stock Purchase Agreement Template Later

- Sign Arkansas Indemnity Agreement Template Easy

- Sign Oklahoma Stock Purchase Agreement Template Simple

- Sign South Carolina Stock Purchase Agreement Template Fast

- Sign California Stock Transfer Form Template Online

- How Do I Sign California Stock Transfer Form Template

- How Can I Sign North Carolina Indemnity Agreement Template

- How Do I Sign Delaware Stock Transfer Form Template

- Help Me With Sign Texas Stock Purchase Agreement Template

- Help Me With Sign Nevada Stock Transfer Form Template

- Can I Sign South Carolina Stock Transfer Form Template

- How Can I Sign Michigan Promissory Note Template

- Sign New Mexico Promissory Note Template Now

- Sign Indiana Basketball Registration Form Now

- Sign Iowa Gym Membership Agreement Later

- Can I Sign Michigan Gym Membership Agreement