36 U S Code153713 Distribution of Assets on Dissolution or Form

What is the 36 U S Code153713 Distribution Of Assets On Dissolution Or

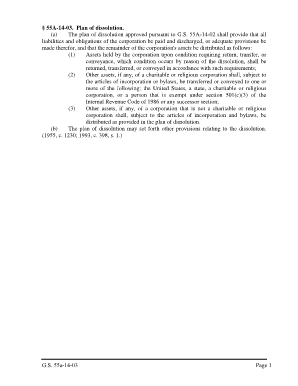

The 36 U S Code153713 Distribution Of Assets On Dissolution Or outlines the legal framework for how assets should be distributed when an organization is dissolved. This code primarily applies to non-profit organizations and provides guidelines to ensure that any remaining assets after liabilities are settled are allocated in accordance with the organization's governing documents and applicable laws. Understanding this code is essential for organizations to comply with legal requirements during dissolution.

How to use the 36 U S Code153713 Distribution Of Assets On Dissolution Or

Utilizing the 36 U S Code153713 Distribution Of Assets On Dissolution Or involves several steps. First, organizations should review their governing documents to determine the specific provisions regarding asset distribution upon dissolution. Next, it is important to assess all outstanding liabilities and obligations. Finally, any remaining assets must be distributed in accordance with the stipulations of the code, ensuring compliance with both federal and state laws.

Steps to complete the 36 U S Code153713 Distribution Of Assets On Dissolution Or

Completing the process outlined in the 36 U S Code153713 Distribution Of Assets On Dissolution Or requires a systematic approach:

- Review the organization’s governing documents for dissolution procedures.

- Identify and settle all outstanding liabilities and obligations.

- Determine the remaining assets available for distribution.

- Follow the guidelines set forth in the code for asset distribution.

- Document the entire process for transparency and compliance.

Legal use of the 36 U S Code153713 Distribution Of Assets On Dissolution Or

The legal use of the 36 U S Code153713 Distribution Of Assets On Dissolution Or ensures that organizations adhere to the established legal framework during dissolution. This code is vital for preventing disputes among stakeholders and ensuring that all actions taken during the dissolution process are legally defensible. Organizations must maintain thorough records of their compliance with this code to protect against potential legal challenges.

Key elements of the 36 U S Code153713 Distribution Of Assets On Dissolution Or

Key elements of the 36 U S Code153713 Distribution Of Assets On Dissolution Or include:

- Definition of allowable distributions to members or other entities.

- Requirements for settling liabilities before asset distribution.

- Provisions for compliance with state and federal laws.

- Guidelines for documenting the dissolution process.

Examples of using the 36 U S Code153713 Distribution Of Assets On Dissolution Or

Examples of applying the 36 U S Code153713 Distribution Of Assets On Dissolution Or can include scenarios where a non-profit organization dissolves due to financial difficulties. In such cases, the organization would first pay off any debts and then distribute remaining assets to other non-profits with similar missions, as specified in their governing documents. Another example could involve a merger, where assets are redirected to the surviving entity in accordance with the code.

Quick guide on how to complete 36 u s code153713 distribution of assets on dissolution or

Complete 36 U S Code153713 Distribution Of Assets On Dissolution Or easily on any device

Managing documents online has gained popularity among businesses and individuals. It offers a perfect environmentally friendly option to traditional printed and signed documents, allowing you to find the right form and safely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage 36 U S Code153713 Distribution Of Assets On Dissolution Or on any device using the airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

How to edit and eSign 36 U S Code153713 Distribution Of Assets On Dissolution Or effortlessly

- Obtain 36 U S Code153713 Distribution Of Assets On Dissolution Or and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or hide sensitive data with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to store your modifications.

- Select how you would like to share your form, via email, text message (SMS), invite link, or download it to your PC.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that require reprinting copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign 36 U S Code153713 Distribution Of Assets On Dissolution Or while ensuring outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 36 u s code153713 distribution of assets on dissolution or

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 36 U S Code153713 Distribution Of Assets On Dissolution Or?

36 U S Code153713 Distribution Of Assets On Dissolution Or refers to regulations governing how assets are to be distributed when an organization dissolves. This code ensures that all assets are handled legally and fairly during the dissolution process. Understanding this code is crucial for organizations planning to dissolve.

-

How can airSlate SignNow help with 36 U S Code153713 Distribution Of Assets On Dissolution Or?

airSlate SignNow offers a streamlined way to manage documents related to 36 U S Code153713 Distribution Of Assets On Dissolution Or. With our eSignature features, you can securely sign and send dissolution documents efficiently. This helps ensure compliance while saving time and reducing paperwork.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow provides a variety of pricing plans suitable for different business needs. Each plan is designed to offer value, ensuring you can manage documents related to 36 U S Code153713 Distribution Of Assets On Dissolution Or economically. Visit our pricing page to find a plan that best fits your organization.

-

What features does airSlate SignNow offer for document management?

With airSlate SignNow, you gain access to features like reusable templates, document tracking, and secure cloud storage. These features are beneficial when dealing with 36 U S Code153713 Distribution Of Assets On Dissolution Or documentation, allowing you to efficiently manage and organize essential files. Our user interface is designed to enhance productivity.

-

Is airSlate SignNow compliant with regulatory standards?

Absolutely, airSlate SignNow is fully compliant with relevant regulatory standards, including those associated with 36 U S Code153713 Distribution Of Assets On Dissolution Or. This compliance ensures that your electronic signatures and document handling processes are secure and legally binding. We prioritize your trust and legal compliance.

-

Can airSlate SignNow be integrated with other software applications?

Yes, airSlate SignNow offers seamless integration with various software applications such as CRMs, project management tools, and cloud storage services. Integrating these tools can streamline your workflow, especially when dealing with 36 U S Code153713 Distribution Of Assets On Dissolution Or documents. This flexibility enhances the overall user experience.

-

How does airSlate SignNow ensure the security of my documents?

airSlate SignNow employs top-level security measures, including encryption and secure access protocols to protect your documents. This is critical when handling sensitive documents related to 36 U S Code153713 Distribution Of Assets On Dissolution Or. Your data's safety is our priority, giving you peace of mind during document management.

Get more for 36 U S Code153713 Distribution Of Assets On Dissolution Or

- General power of attorney for care and custody of child or children kansas form

- Small business accounting package kansas form

- Kansas procedures form

- Kansas revocation 497307650 form

- Newly divorced individuals package kansas form

- Contractors forms package kansas

- Kansas attorney form

- Wedding planning or consultant package kansas form

Find out other 36 U S Code153713 Distribution Of Assets On Dissolution Or

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document