At T W 9 Form

What is the AT T W-9?

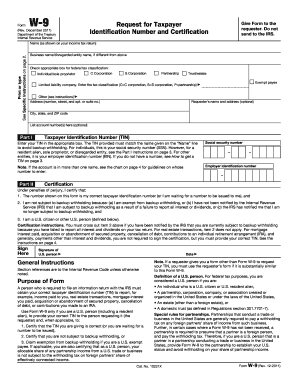

The AT T W-9 form is a tax document used by businesses and individuals to provide their taxpayer identification information to another party. This form is essential for reporting income to the Internal Revenue Service (IRS). It is primarily used by independent contractors, freelancers, and vendors who need to report their earnings. By completing the AT T W-9, the requester can ensure compliance with tax laws and facilitate accurate reporting of payments made to the individual or entity.

Steps to Complete the AT T W-9

Completing the AT T W-9 form involves several straightforward steps:

- Provide your name as it appears on your tax return.

- Enter your business name if applicable.

- Fill in your address, including city, state, and ZIP code.

- Indicate your taxpayer identification number (TIN), which can be your Social Security Number (SSN) or Employer Identification Number (EIN).

- Check the appropriate box for your tax classification, such as individual, corporation, or partnership.

- Sign and date the form to certify that the information provided is accurate.

Legal Use of the AT T W-9

The AT T W-9 form is legally binding when filled out correctly and signed. It serves as a declaration of your taxpayer status and is used by the requester to report payments made to you to the IRS. It is crucial to ensure that all information is accurate to avoid potential legal issues or penalties related to tax reporting. The form must be kept on file by the requester for a specific period, usually until the information is no longer relevant for tax purposes.

Who Issues the Form

The AT T W-9 form is not issued by a specific agency but is a standard form provided by the IRS. Individuals and businesses requesting the form typically provide it to their contractors or vendors to collect necessary tax information. The requester is responsible for ensuring that the form is completed correctly and retained for their records.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the AT T W-9 form. It is essential to follow these guidelines to ensure compliance with tax regulations. The IRS requires that the form be filled out accurately and submitted when requested. Failure to provide a completed W-9 can result in backup withholding on payments made to you, which means that a percentage of your earnings will be withheld for tax purposes.

Examples of Using the AT T W-9

Common scenarios for using the AT T W-9 form include:

- An independent contractor providing services to a company.

- A freelancer submitting work for payment.

- A vendor supplying goods to a business.

In each case, the requester needs the W-9 to report the payments made to the individual or entity to the IRS accurately.

Quick guide on how to complete at t w 9

Complete At T W 9 seamlessly on any device

Online document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, alter, and eSign your documents quickly without delays. Manage At T W 9 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

The easiest way to modify and eSign At T W 9 effortlessly

- Acquire At T W 9 and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal weight as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign At T W 9 and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the at t w 9

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an AT T W 9 form and why is it important?

The AT T W 9 form is a crucial document used for tax purposes, allowing businesses to provide their taxpayer identification information to entities that may need to report payments made to them. Understanding how to properly complete and submit an AT T W 9 form ensures compliance with IRS regulations and helps avoid unnecessary tax withholding.

-

How can airSlate SignNow help with completing AT T W 9 forms?

airSlate SignNow offers an intuitive platform where users can easily fill out and eSign AT T W 9 forms, streamlining the process. With features like auto-fill and templates, the platform reduces time spent on paperwork and ensures accuracy, making it the ideal solution for busy professionals.

-

Is there a cost associated with using airSlate SignNow for AT T W 9 forms?

Yes, airSlate SignNow provides various pricing plans that cater to different business needs, including a plan specifically designed for handling documents like the AT T W 9 form. These plans are cost-effective and offer features that enhance productivity and document management.

-

What features does airSlate SignNow offer for sending AT T W 9 forms?

airSlate SignNow offers a range of features for sending AT T W 9 forms, including secure document sharing, customizable templates, and real-time tracking of document status. These features help ensure that your documents signNow the right parties quickly and efficiently.

-

Can I track my AT T W 9 form submissions with airSlate SignNow?

Absolutely! With airSlate SignNow, you can easily track your AT T W 9 form submissions. The platform provides real-time notifications and updates, allowing you to know exactly when your document has been viewed, signed, or completed.

-

Does airSlate SignNow integrate with other business tools for managing AT T W 9 forms?

Yes, airSlate SignNow integrates seamlessly with numerous business applications, including CRM and accounting software, enhancing your ability to manage AT T W 9 forms. This integration helps streamline your workflow and reduce administrative burdens.

-

What is the benefit of using airSlate SignNow for electronic signatures on AT T W 9 forms?

Using airSlate SignNow for electronic signatures on AT T W 9 forms offers numerous benefits, including faster turnaround times, enhanced security, and reduced paper waste. It simplifies the signing process, ensuring that your documents are signed and returned promptly.

Get more for At T W 9

Find out other At T W 9

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT