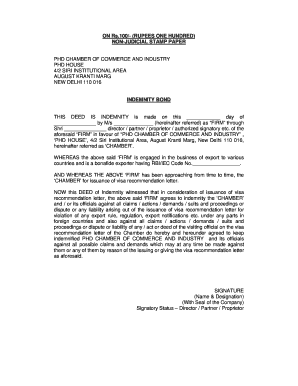

Indemnity Bond PHD Chamber Form

What is the indemnity bond?

An indemnity bond is a legally binding agreement that protects one party from potential losses or damages incurred by another party. It serves as a guarantee that the bonded party will compensate for any financial loss that may arise from specific actions or failures to act. In the context of the PHD Chamber, this bond is often required to ensure compliance with various regulations and obligations, providing a layer of security for both parties involved.

Key elements of the indemnity bond

Understanding the key elements of an indemnity bond is essential for its proper execution. The primary components include:

- Principal: The individual or entity that is required to obtain the bond.

- Obligee: The party that requires the bond as a form of protection against potential losses.

- Surety: The entity that issues the bond and guarantees the principal's obligations will be met.

- Conditions: Specific terms and conditions under which the bond is valid, outlining the circumstances that may trigger a claim.

These elements work together to create a comprehensive framework that ensures all parties understand their roles and responsibilities.

Steps to complete the indemnity bond

Completing an indemnity bond involves several critical steps to ensure its validity:

- Gather necessary information: Collect all relevant details about the parties involved, including names, addresses, and any pertinent identification numbers.

- Draft the bond: Use a standard indemnity bond template or create a custom document that includes all required elements.

- Review legal requirements: Ensure compliance with local and state regulations that may affect the bond's validity.

- Sign the bond: All parties must sign the document, often in the presence of a notary public to enhance its legal standing.

- Submit the bond: Deliver the completed bond to the obligee or relevant authority as specified in the agreement.

Following these steps carefully can help avoid complications and ensure that the bond serves its intended purpose.

Legal use of the indemnity bond

The legal use of an indemnity bond is governed by specific regulations that vary by state. Generally, the bond must be executed in compliance with local laws to be enforceable. This includes adhering to any requirements related to notarization, witness signatures, and submission deadlines. Understanding these legal frameworks is crucial for both the principal and obligee to ensure that the bond is recognized in a court of law.

How to obtain the indemnity bond

Obtaining an indemnity bond typically involves a straightforward process:

- Identify the need: Determine the specific requirements for the indemnity bond based on the obligations you need to fulfill.

- Contact a surety company: Reach out to a reputable surety provider who specializes in indemnity bonds.

- Complete the application: Fill out the necessary application forms, providing all required information about your financial status and the purpose of the bond.

- Pay the premium: Once approved, you will need to pay a premium, which is typically a percentage of the bond amount.

This process ensures that you have the necessary coverage to meet your obligations while protecting all parties involved.

Examples of using the indemnity bond

Indemnity bonds are utilized in various scenarios, including:

- Construction projects: Contractors may be required to secure an indemnity bond to protect against potential claims arising from project delays or defects.

- Licensing requirements: Certain professions, such as insurance agents or real estate brokers, may need to obtain an indemnity bond to comply with state licensing regulations.

- Financial transactions: Businesses may use indemnity bonds to safeguard against losses related to loans or credit agreements.

These examples highlight the versatility of indemnity bonds in providing security across different industries and situations.

Quick guide on how to complete indemnity bond phd chamber

Complete Indemnity Bond PHD Chamber effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-conscious alternative to traditional printed and signed forms, as you can obtain the correct template and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without holdups. Manage Indemnity Bond PHD Chamber on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to alter and eSign Indemnity Bond PHD Chamber with ease

- Obtain Indemnity Bond PHD Chamber and select Get Form to begin.

- Use the tools we offer to complete your form.

- Mark important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, text message (SMS), an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow addresses all your needs in document management in just a few clicks from a device of your choice. Modify and eSign Indemnity Bond PHD Chamber to ensure excellent communication at all stages of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the indemnity bond phd chamber

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an indemnity bond?

An indemnity bond is a legally binding contract that provides a guarantee of compensation for potential losses or damages. In the context of our services, it ensures that both parties are protected during transactions involving signed documents. This bond is crucial for businesses looking to safeguard their interests.

-

How does an indemnity bond work in airSlate SignNow?

In airSlate SignNow, an indemnity bond serves as a protective measure for users when executing electronic signatures on documents. By using our platform, parties can confidently sign contracts knowing that an indemnity bond is backed by legal protections. This enhances trust and reduces the risk of disputes.

-

Are there costs associated with obtaining an indemnity bond through airSlate SignNow?

While the airSlate SignNow platform itself is cost-effective, the price of an indemnity bond may vary based on the specifics of the agreement. Generally, fees are determined by the amount of coverage needed and the risk assessment associated with the contract. We recommend checking with your bond provider for the most accurate pricing.

-

What benefits does an indemnity bond offer for businesses?

An indemnity bond provides businesses with peace of mind, as it minimizes potential financial losses from miscommunication or contract bsignNowes. Furthermore, it enhances credibility when dealing with clients and partners. Using an indemnity bond promotes a transparent and secure business environment.

-

Can I integrate indemnity bonds with other services on airSlate SignNow?

Yes, airSlate SignNow allows for seamless integration of indemnity bonds with other document management services. This capability ensures that you can streamline your workflow by combining eSigning functionality with necessary legal protections. Our integrations are designed to enhance user experience and operational efficiency.

-

What types of transactions typically require an indemnity bond?

Transactions that involve signNow monetary exchanges or contractual obligations often necessitate an indemnity bond. This includes real estate deals, construction contracts, and various business agreements. Utilizing an indemnity bond in these transactions protects all parties involved from potential risks.

-

Is an indemnity bond mandatory for electronic signatures?

An indemnity bond is not universally mandatory for electronic signatures; however, it is highly recommended for certain transactions that are more sensitive or higher risk. Using an indemnity bond can provide additional layers of protection and assurance, making it a wise choice for many businesses. It's best to assess each transaction's needs individually.

Get more for Indemnity Bond PHD Chamber

- Kentucky name change form

- Name change notification form kentucky

- Commercial building or space lease kentucky form

- Ky legal documents form

- Kentucky standby temporary guardian legal documents package kentucky form

- Attorney fee election kentucky kentucky form

- Kentucky bankruptcy forms

- Ky bankruptcy form

Find out other Indemnity Bond PHD Chamber

- How To eSign Illinois Business Operations Stock Certificate

- Can I eSign Louisiana Car Dealer Quitclaim Deed

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later