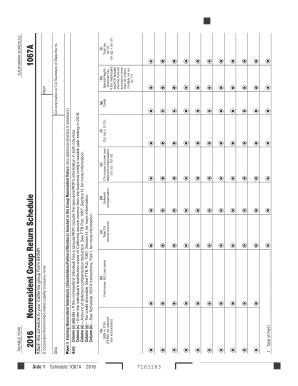

Form 1067A Nonresident Group Return Schedule Ftb Ca

What is the Form 1067A Nonresident Group Return Schedule Ftb Ca

The Form 1067A Nonresident Group Return Schedule, issued by the California Franchise Tax Board (FTB), is a tax document specifically designed for nonresident groups. This form allows nonresident individuals to collectively report their income earned in California. By using this schedule, nonresidents can simplify their tax obligations and ensure compliance with state tax laws. It is essential for groups such as partnerships or joint ventures where members have income sourced from California but do not reside in the state.

How to use the Form 1067A Nonresident Group Return Schedule Ftb Ca

Utilizing the Form 1067A involves several steps. First, gather all necessary financial information for each member of the group. This includes income earned in California, deductions, and credits applicable to nonresidents. Next, complete the form by entering the required details accurately. Each member's share of income and deductions must be calculated and reported on the form. Finally, submit the completed form to the California FTB by the specified deadline. It is advisable to keep copies of all documents for your records.

Steps to complete the Form 1067A Nonresident Group Return Schedule Ftb Ca

Completing the Form 1067A requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents for each group member.

- Calculate each member's California-source income.

- Determine allowable deductions and credits for nonresidents.

- Fill out the form, ensuring that all calculations are accurate.

- Review the completed form for any errors or omissions.

- Submit the form to the California FTB by the due date.

Legal use of the Form 1067A Nonresident Group Return Schedule Ftb Ca

The Form 1067A is legally binding when completed and submitted according to California tax laws. It is crucial for nonresident groups to ensure that the information provided is accurate and truthful, as any discrepancies can lead to penalties or legal consequences. The form must be signed by an authorized representative of the group, affirming that the information is correct. Compliance with the relevant tax regulations protects the group from potential audits and ensures that all members fulfill their tax obligations.

Filing Deadlines / Important Dates

Timely filing of the Form 1067A is essential to avoid penalties. The due date for submission typically aligns with the individual income tax filing deadline, which is usually April 15th of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes to tax deadlines, as these can vary from year to year. Ensure that the form is submitted on or before the deadline to maintain compliance.

Form Submission Methods (Online / Mail / In-Person)

The Form 1067A can be submitted through various methods to accommodate different preferences. Nonresidents may choose to file the form online through the California FTB's e-filing system, which offers a secure and efficient way to submit documents. Alternatively, the form can be mailed to the appropriate FTB address, ensuring that it is sent with sufficient time to meet the filing deadline. In-person submissions may also be possible at designated FTB offices, although this option may vary based on location and current regulations.

Quick guide on how to complete form 1067a nonresident group return schedule ftb ca

Complete Form 1067A Nonresident Group Return Schedule Ftb Ca effortlessly on any device

Managing documents online has gained popularity among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without any hold-ups. Manage Form 1067A Nonresident Group Return Schedule Ftb Ca on any device using the airSlate SignNow apps for Android or iOS and enhance your document-related processes today.

How to alter and eSign Form 1067A Nonresident Group Return Schedule Ftb Ca with ease

- Locate Form 1067A Nonresident Group Return Schedule Ftb Ca and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools provided specifically for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

No more concerns over lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Revise and eSign Form 1067A Nonresident Group Return Schedule Ftb Ca and ensure seamless communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1067a nonresident group return schedule ftb ca

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 1067A Nonresident Group Return Schedule Ftb Ca?

The Form 1067A Nonresident Group Return Schedule Ftb Ca is a document required by the California Franchise Tax Board for nonresident taxpayers who want to file a group return. This schedule allows multiple nonresidents to file their taxes collectively, simplifying the process and ensuring compliance with California tax laws.

-

How does airSlate SignNow assist with the Form 1067A Nonresident Group Return Schedule Ftb Ca?

airSlate SignNow provides a streamlined process for submitting the Form 1067A Nonresident Group Return Schedule Ftb Ca. Our platform enables users to easily eSign and send documents, ensuring all necessary signatures are obtained quickly and efficiently, thereby reducing turnaround time and enhancing accuracy.

-

What features does airSlate SignNow offer for completing tax forms like the Form 1067A Nonresident Group Return Schedule Ftb Ca?

airSlate SignNow offers features such as customizable templates, document tracking, and automated reminders that help streamline the process of completing tax forms like the Form 1067A Nonresident Group Return Schedule Ftb Ca. These tools ensure that users can complete their returns accurately and on time without any hassle.

-

Is airSlate SignNow a cost-effective solution for businesses filing the Form 1067A Nonresident Group Return Schedule Ftb Ca?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses needing to file the Form 1067A Nonresident Group Return Schedule Ftb Ca. Our competitive pricing ensures that you receive high-quality eSignature solutions without breaking your budget, making it ideal for businesses of all sizes.

-

Can I integrate airSlate SignNow with other applications for managing the Form 1067A Nonresident Group Return Schedule Ftb Ca?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as Google Drive, Salesforce, and Microsoft Office. This allows you to manage your documents and the Form 1067A Nonresident Group Return Schedule Ftb Ca in a centralized location, enhancing efficiency and collaboration.

-

What are the benefits of using airSlate SignNow for tax document management, including the Form 1067A Nonresident Group Return Schedule Ftb Ca?

Using airSlate SignNow for document management, including the Form 1067A Nonresident Group Return Schedule Ftb Ca, offers multiple benefits. These include enhanced security, compliance with legal regulations, and the ability to easily track the status of your documents, which can save time and reduce the risk of errors.

-

How can airSlate SignNow help ensure compliance when submitting the Form 1067A Nonresident Group Return Schedule Ftb Ca?

airSlate SignNow helps ensure compliance with tax regulations when submitting the Form 1067A Nonresident Group Return Schedule Ftb Ca by providing secure eSigning options and audit trails. This ensures that all signatures are verified and documented, minimizing the risk of compliance issues during tax season.

Get more for Form 1067A Nonresident Group Return Schedule Ftb Ca

- Il dor il 941 x 2019 form

- Ar ar1099pt 2017 form

- Canada imm 0008 2019 form

- Attorney registration connecticut judicial branch ctgov form

- Legal separation complaint form

- Gv 115 request to continue court hearing judicial council forms

- Cr132 cr 132 notice of appealmisdemeanor clerk stamps form

- Domestic violence plea form

Find out other Form 1067A Nonresident Group Return Schedule Ftb Ca

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed